All superfunds articles – Page 3

-

Opinion Pieces

Opinion PiecesAustralia: Supers face A$500m tax hit

In the lead-up to the first budget by a Labor government in 12 years, speculation was rife about what the new Australian government might have in store for the superannuation sector.

-

Opinion Pieces

Opinion PiecesAustralia: Super funds shift focus to private credit

An ambition of the architects of Australia’s universal superannuation system, when it was set up in 1992, was to create what would become a fifth pillar of the nation’s banking system.

-

Opinion Pieces

Opinion PiecesViewpoint: Consolidation in UK pensions market – what are the options?

Will there be an increase in pension scheme consolidation in the UK market and will it lead to increased investment in alternative ESG assets? Consolidation could provide the collateral to invest in greater ESG assets.

-

Opinion Pieces

Opinion PiecesAustralia: Superannuation funds on a consolidation path

Australians are beginning to get used to super funds with names like Australian Retirement Trust, Aware Super and Spirit Super.

-

Opinion Pieces

Opinion PiecesAustralia: Political risk on the agenda for super funds

Australia’s cash-rich super funds allocate more to international equities than to their domestic counterparts. International equities are the largest single allocation.

-

News

NewsClara-Pensions completes first TPR assessment

Several schemes will look at superfunds as a viable endgame solution for their membership

-

Opinion Pieces

Opinion PiecesLetter from Australia: In need of a broader asset pool

With a market cap of just A$2.7trn (€1.75tn), Australia’s ASX stock market is increasingly overshadowed by a rapidly growing pool of super savings which now exceed A$3trn.

-

News

NewsLawyers back superfunds as strong ‘Plan B’ for DB plans

But legal experts split over best sequencing of action for schemes with insolvent sponsors

-

Opinion Pieces

Opinion PiecesLetter from Australia: Super funds: shame in a name

Named and shamed! Thirteen Australian superannuation funds have been forced to inform their million-plus members that they have failed an inaugural superannuation performance test mandated by the financial regulator, the Australian Prudential Regulation Authority (APRA).

-

Opinion Pieces

Opinion PiecesLetter from Australia: When the ‘kill switch’ misfires

The Australian government is attempting to push through Parliament legislation that would selectively benchmark the performance of superannuation funds – but has given up its intention to override investment decisions made by super funds.

-

Opinion Pieces

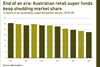

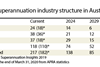

Opinion PiecesLetter from Australia: Retail super funds in distress

Australia’s once-dominant retail super funds are witnessing the end of an era as they wrestle with loss of consumer confidence in their brands. Hastening change has been the rise of industry supers, which benefitted from damaging evidence provided to the Hayne Royal Commission in 2018.

-

News

NewsAon adds to outlooks for active 2021 pension risk transfer market

Bulk annuity market capacity seen at £30bn-£40bn, busy longevity market on top of that

-

News

Regulator called to ‘fight the corner’ of Arcadia pension scheme members

Sir Philip Green’s high street retail company reportedly on the brink of collapse

-

Opinion Pieces

Opinion PiecesLetter from Australia: Funding the future world

A handful of Australian superannuation funds are committing their members’ savings to the future world in terms of energy, water, technology and ideas. There will be successes and failures as ideas are developed and marketed.

-

News

NewsUK regulator delivers superfund guidance for trustees, sponsors

Guidance follows the announcement of an interim regime for superfunds in the summer

-

News

NewsClara-Pensions gains CPPIB-owned Wilton Re as capital partner

US life reinsurance company joins Sixth Street as investor in superfund

-

News

Superfund sees ‘train hard to fight easy’ value in tough TPR process

Rigorous regulatory assessment important for confidence

-

News

LCP calls sponsors to work closely with trustees to consider superfunds

The buyout demand may outstrip market capacity, forcing schemes to remain in the funding regime for significantly longer than anticipated

-

Opinion Pieces

Opinion PiecesLetter from Australia: Pooling for savings and strength

The government, the regulator and economic fallout from COVID-19 have combined to pressure Australia’s large and unwieldy pool of super funds towards consolidation.

-

Special Report

Special ReportUK: Consolidation remains controversial

Guidance on the long-awaited legislation setting out a regulatory framework for superfunds is finally released

- Previous Page

- Page1

- Page2

- Page3

- Page4

- Next Page