Top 500 Asset Managers 2025

IPE’s annual Top 500 Asset Managers Report offers vital market data and intelligence for those in and around the institutional investment industry. Access the report to benefit from:

- Comprehensive analysis

- Leading viewpoints

- Key data

IPE Top 500 Asset Managers 2025: Record growth in a winners-take-all asset management market

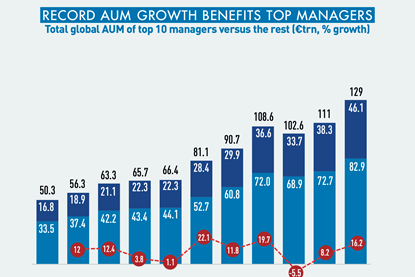

The world’s asset managers have enjoyed three straight years of robust growth, but a transformative trend is gaining momentum – AUM growth is increasingly concentrated at the top.

Access the Top 500 Asset Managers Data. Support data-driven decision-making.

Gain access to the complete 2025 survey dataset providing detailed information on 500 global asset management firms. Whether you are looking for data on competitors, clients or prospects in the asset management sector, this data will provide comprehensive insight into opportunities, challenges and market trends.

Generation of change: asset managers grapple with AI on both sides of the P&L

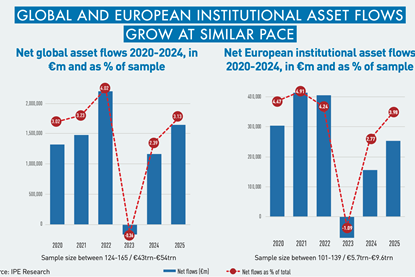

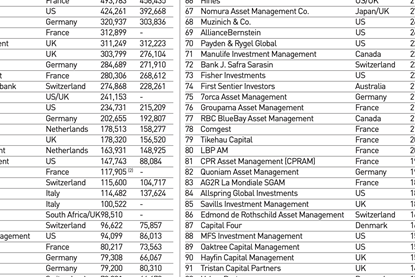

Data highlights from IPE Top 500 Asset Managers 2024: Global asset management AUM: €111.4trn ($120trn) | Year-on-year increase of 8.6% on the 2023 total of €102.6trn | Global institutional assets: €36trn (2023: €35.1trn) | European institutional assets €11.9trn (2023: €11.5trn)

IPE Top 500 Asset Managers 2023: Asset management at a pivotal point

Data highlights from IPE Top 500 Asset Managers 2023: 2022 global asset management AUM is €102.6trn | 5.5% reduction on the 2022 total of €108.6trn | Global institutional AUM: €35.1trn | European institutional assets: €11.5trn

Top 500 Asset Managers 2022

The emergence of persistent higher inflation, China’s zero-COVID policy, stress on global supply chains, and Russia’s Ukraine war all suggest that the asset total of this year’s IPE Top 500 Asset Managers Guide represents a high water mark.

Top 500 Asset Managers 2021

IPE’s annual study of the global asset management industry compiles data from more than 500 companies globally, with insights into key business segments and overall AUM in excess of €90trn.

Top 500 Asset Managers 2020

Asset managers in our listing are ranked by global assets under management and by the country of the main headquarters. Assets managed by these groups total €81.1trn

Top 400: Cultures change

Is asset management a tech business, a people business, or both? As the sector pushes new frontiers, much of the attention has been on vast sums the sector needs to invest in technology. This, combined with the burden of new regulation, is making investment management a more cost intensive business and driving M&A