All Asset Class Reports articles – Page 2

-

Asset Class Reports

Asset Class ReportsViewpoints: Asset managers prepare for global credit slump

Leading asset managers speak out on the contingency plans needed to ensure resilience in the next credit downturn

-

Asset Class Reports

Asset Class ReportsTrade finance: From ‘just in time’ to ‘just in case’

A new joint venture tradeco between Pemberton and Santander aims to give investors access to working capital strategies, and to add a new tech-driven dimension to the age-old business of inventory financing

-

Asset Class Reports

Asset Class ReportsFive trends to watch in private credit

From the rise of secondaries and capital solutions funds to the trend of concentration among scale players, private credit is experiencing an intense and rapid phase of development

-

Asset Class Reports

Asset Class ReportsUS versus Europe: will private credit investors shift focus?

As market volatility persists, private credit investors are starting to rethink their allocations to the US in favour of Europe

-

Asset Class Reports

Asset Class ReportsIs it time for private credit to step up on investing in artificial intelligence?

Besides digital and power infrastructure, investors are beginning to shift their focus to other areas of the burgeoning AI market

-

Asset Class Reports

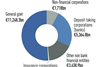

Asset Class ReportsConsolidation in the private credit space points to a maturing phase

Recent M&A activity in private credit follows hot on the heels of a decade-long boom. Is there more to come?

-

Asset Class Reports

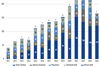

Asset Class ReportsPrivate credit turns evergreen as funds grow in number

As managers compete for scale and expand their footprint, the role of evergreen private credit funds is expected to grow

-

Asset Class Reports

Asset Class ReportsLP perspectives: European pension funds on private credit strategies

Two European pension funds detail how they are tapping into the private credit market at a time of exponential growth and heightened volatility

-

Asset Class Reports

Asset Class ReportsViews from the top: Leading general partners on the evolution of private credit

We polled leading GPs on the evolution of private credit. They detect the growing strength of institutional investor interest but as competition increases and the market comes under greater scrutiny, could increased regulation be on the way?

-

Asset Class Reports

Asset Class ReportsEurope investment outlook: Search for opportunities amid the gloom

We asked fixed-income managers for their views on Europe’s outlook as Germany and France grapple with structural challenges and political uncertainty.

-

Asset Class Reports

Asset Class ReportsEuropean equities: Bargains or bear traps amid global headwinds?

Despite record valuation gaps with the US, investors remain cautious about European equities. Political turmoil, geopolitical risks, and fears of tariffs under Trump’s presidency cast a shadow, while fund managers pivot toward stock-specific opportunities

-

Asset Class Reports

Asset Class ReportsTrade and economy weigh on European credit

Despite trade worries and a challenging economic outlook, appetite for European credit remains robust, bolstered by refinancing activity and a supportive ECB stance

-

Asset Class Reports

Asset Class ReportsInvestors eye return to European small cap equities

Largely dependent on domestic investors, interest has been growing in the opportunities offered by Europe’s smaller companies

-

Asset Class Reports

Asset Class ReportsEquities: US equity markets expected to gain from Trump’s victory

As the political dust settles following Donald Trump’s victory in the US presidential elections, global equity funds are eagerly eyeing the incoming administration and the opportunities it may offer

-

Asset Class Reports

Asset Class ReportsInvestor body aims to fill reporting gap

ILPA issues reporting guidance and templates after US court overturns SEC’s private funds rule

-

Asset Class Reports

Asset Class ReportsValuations for AI-related firms are starting to heat up

There are concerns that the market for acquiring artificial intelligence-related companies is showing signs of overheating

-

Asset Class Reports

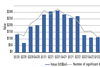

Asset Class ReportsPrivate equity industry starts to show signs of recovery

Private equity has a bounce in its step once again, but it could be years before the industry recovers fully

-

Asset Class Reports

Asset Class ReportsEmerging markets private credit steps into the breach

Institutional investors are increasingly providing the funding that emerging market companies cannot get from banks

-

Asset Class Reports

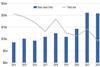

Asset Class ReportsLocal currency debt markets now more compelling

Bond yields are now more attractive because local central banks hiked interest rates sooner than their developed market counterparts

-

Asset Class Reports

Asset Class ReportsWhy emerging market debt deserves more scrutiny

Investors are becoming more sophisticated in how they approach emerging market debt