All Asset Class Reports articles – Page 3

-

Asset Class Reports

Asset Class ReportsEquities: Active investors keep their eye on the prize

As equity markets enter a new phase after the August 2024 sell-off, institutions are sticking to their long-term active equity approaches

-

Asset Class Reports

Asset Class ReportsInvestors look to smaller companies

Following the rout of the Magnificent Seven, small and mid-caps stepped into the breach

-

Asset Class Reports

Asset Class ReportsDenmark’s Lærernes ups its appetite for private credit risk

Lærernes Pension (LP), the pension fund for teachers in Denmark, started investing in private credit in 2018, in small amounts. In 2021 it made a more sizeable strategic allocation to the asset class.

-

Asset Class Reports

Asset Class ReportsPrivate credit: How banks are joining forces with managers

As the private credit market grows, banks are looking to partner with private credit managers rather than compete with them

-

Asset Class Reports

Asset Class ReportsPublic-to-private borrowing is a two-way street

The private credit boom seems to be drawing to a halt as public funding becomes cheaper

-

Asset Class Reports

Asset Class ReportsMulti-asset private credit comes to the fore

Investors are increasingly looking at multi-asset private credit mandates for diversification and stable risk-adjusted returns

-

Asset Class Reports

Asset Class ReportsCompenswiss: a newcomer to private credit

Four European pension schemes outline their activity in the private credit market

-

Asset Class Reports

Asset Class ReportsPenSam focuses on funds

Four European pension schemes outline their activity in the private credit market

-

Asset Class Reports

Asset Class ReportsRegulators shine a light on non-bank lenders

Although private market activity is slowing down, there are fears of systemic risk

-

Asset Class Reports

Asset Class ReportsNEST’s outsourcing strategy

When NEST was weighing up whether to outsource some of its private markets allocations, the decision was not straightforward.

-

Asset Class Reports

Asset Class ReportsSmall-cap equities struggle as giants surge ahead

Small caps are finding it difficult to make inroads in a world dominated by the Magnificent Seven

-

Asset Class Reports

Asset Class ReportsMagnificent seven stocks suck up capital from other sectors

Concentration of US equity markets around a handful of names remains an intractable issue

-

Asset Class Reports

Asset Class ReportsEquities: a return to passive safe havens

In an effort to counterbalance an uncertain economic outlook and geopolitical tensions, many institutional investors are avoiding active management

-

Asset Class Reports

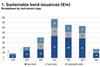

Asset Class ReportsClosing the data gap in green, social and sustainability-linked bonds

Luxembourg’s bourse has capitalised on its experience as a green bond hub

-

Asset Class Reports

Asset Class ReportsGreen bonds reach escape velocity

The green bond market looks set to grow further, despite pressure from many sides and key questions over their function

-

Asset Class Reports

Asset Class ReportsFixed income: European high yield stands its ground

Investors flocked to the European junk bond market last year and despite a strong US economy, there is still appetite for European issuers

-

Asset Class Reports

Asset Class ReportsThe quest for innovation in sustainable fixed income

Japan’s climate transition bond is the latest in a string of innovative developments in sustainable fixed income

-

Asset Class Reports

Asset Class ReportsA changing Saudi Arabia proves attractive for investors

Equity market is starting to open to investors as the country liberalises strict rules

-

Asset Class Reports

Asset Class ReportsIs India’s equity market now the new China in investors’ eyes?

Better governance and a clear economic path may put India in the lead

-

Asset Class Reports

Asset Class ReportsEmerging market equities: investors grapple with peak political risk

As billions of people head to the polls in 2024, how will politics influence flows to emerging market equities?