All Asset Class Reports articles – Page 5

-

Asset Class Reports

Asset Class ReportsFixed income & credit – Sustainability-linked bonds

Sovereigns and other issuers are yet to embrace sustainability-linked bonds but issuance is growing

-

Asset Class Reports

Asset Class ReportsPortfolio strategy – Fixed income & credit

Factors including rising inflation and interest rates, the war in Ukraine, and the uncertainty surrounding the global economy might have significantly slowed down the growth of an alternative asset class like private debt. But this has not been the case, and while fundraising by private debt managers for 2022 and 2023 might be challenging, investors are making new long-term commitments.

-

Asset Class Reports

Asset Class ReportsEquities – Does location matter in the corporate listings debate?

The number of listed companies have fallen dramatically, but London remains a preferred global financial centre

-

Asset Class Reports

Asset Class ReportsEquities – Testing times for high-conviction equity strategies

Today’s environment may favour stock picking, but investors continue to face pressures to justify the added risks

-

Asset Class Reports

Asset Class ReportsPortfolio strategy – Equities

Our report shines a light on investors’ thought processes when it comes to choosing active, passive or a combination of the two. We surveyed CIOs and senior portfolio managers to get an insight into how they construct their equity portfolios. Our report also features an investigation into the fall in listings on the UK equity market, at a time when listing domicile is increasingly consequential aspect of portfolio construction.

-

Asset Class Reports

Asset Class ReportsFixed income – New beginning for bond investors

A painful 2022 for fixed income means attractive opportunities and a possible normalisation in risk and return

-

Asset Class Reports

Asset Class ReportsFixed income – Convertible bonds return to favour

After a long period in the wilderness, convertible bond issuance is coming back to life

-

Asset Class Reports

Asset Class ReportsFixed income – Europe's investment-grade market makes a comeback

Investors are showing tentative signs of interest as spreads tighten

-

Asset Class Reports

Asset Class ReportsPortfolio strategy – Fixed income

Last year ushered in a new era for global fixed income and credit markets. It was the worst, in terms of returns, for bond investors in years, but it signalled a regime change. Investors need to be prepared for structurally higher inflation and rates, as well as higher volatility. But for fixed income managers, this is an environment where value is easier to find. Our report looks at this new beginning for fixed income investors, and at how selectivity has become key in the high yield and loan markets.

-

Asset Class Reports

Asset Class ReportsFixed income – A year for selectivity in high yield and loans

Patience might prove the be the watchword for the rest of 2023 in high yield

-

Asset Class Reports

Asset Class ReportsEmerging market equities – Investors watch as China corrects course

The Chinese government has managed to restart the economy post-COVID, but investors are cautious

-

Asset Class Reports

Asset Class ReportsEmerging market equities – Slow progress on corporate governance

Equity investors see improvements in corporate governance in emerging markets, but alignment between shareholders, management and owners remains critical

-

Asset Class Reports

Asset Class ReportsEmerging market equities – India’s dancing elephant in the room

Despite challenges with corporate governance and corruption, the prospects for India are too bright to ignore for investors

-

Asset Class Reports

Asset Class ReportsPortfolio Strategy – Emerging market equities

The Adani corporate scandal in India brought the issue of corporate governance in emerging markets back to the fore. As Lynn Strongin Dodds finds, however, emerging market corporates are slowly adapting to the requirements of institutional investors in terms of governance.

-

Asset Class Reports

Asset Class ReportsEmerging market equities – Rise of the Gulf equity markets

The Gulf region is changing dramatically and provides growing opportunities for emerging market investors

-

Asset Class Reports

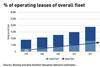

Asset Class ReportsPrivate debt: Leases make plane sense after COVID

With plenty of pent-up demand for air travel, aeroplane operating leases may be an attractive investment option

-

Asset Class Reports

Private debt: European markets try to power ahead

Private debt in Europe is still feeling the impact of the war in Ukraine and the surge in inflation, but there are reasons for optimism

-

Asset Class Reports

Asset Class ReportsPrivate debt: Managers take back control

Steady demand for private credit puts lenders in a strong position to negotiate beneficial terms, but discipline in lending remains crucial

-

Asset Class Reports

Asset Class ReportsPrivate debt: Sustainable lending set for comeback

Issuance of sustainability-linked paper took a hit in 2022, but managers are now introducing ESG KPIs to incentivise borrowers

-

Asset Class Reports

Asset Class ReportsPortfolio strategy – Private debt

The rise in interest rates and inflation throughout 2022 brought traditional fixed-income assets back into focus for investors. The threat of a recession, the pressure on investors to maintain liquidity in portfolios and the ‘denominator effect’, which sees investors over-allocated to unlisted assets after a torrid 2022 for listed equities and bonds, are all facts that would suggest that private debt markets will suffer. However, investors are still backing experienced private debt managers and allocations to the asset class are forecast to grow further in the medium term.