All Briefing articles – Page 5

-

Features

FeaturesBriefing: Is equity duration risk about to step into the limelight?

In his memoirs, Sir Laurence Olivier tells how, in 1967, he was suddenly taken ill during a National Theatre production of August Strindberg’s Dance of Death. His understudy stepped into the role for just four nights, but in that short time, “.…walked away with the part of Edgar like a cat with a mouse between its teeth”. A star was born. Fifty-five years later, Sir Anthony Hopkins, with a career just as stellar as his one-time mentor, was the oldest-ever recipient of an Oscar for best actor.

-

Features

FeaturesBriefing: Private market fees

In today’s low-interest-rate and low-return environment, investing in private markets has become a requirement for virtually every institutional investor. Private markets are where investors can obtain the extra returns they need and can no longer earn from listed assets, thanks to the liquidity premium and higher risk/return profile of non-listed assets.

-

Features

FeaturesBriefing: Germany’s Spezialfonds are weathering the crisis well

Institutional investors in Germany continue to invest in funds despite the challenging conditions. In the middle of 2021, the volume of Spezialfonds – Germany’s vehicle for professional investors – on the Universal-Investment platform stood at almost €474bn. This represents an increase of 36% over the past 12 months. According to most observers, it has been one of the most exceptional periods in a long time.

-

Features

FeaturesBriefing: The sustainability missing link

Love him or loathe him, no one can doubt that Tesla CEO Elon Musk has a penchant for self-publicity and a talent for disruption in industries from automobiles to space. He has lately taken an interest in the metals and mining sector. In June, he tweeted that he would provide a “giant contract for a long period of time if you mine nickel efficiently and in an environmentally sensitive way”.

-

Features

FeaturesBriefing: Why gold is different

Why does gold behave so differently from industrial metals and, indeed, most commodities in general? Despite the obvious contrasts – such as its shininess and its use in jewellery – it is not immediately clear why this should be the case.

-

Features

FeaturesBriefing: Central bank digital currencies take shape

Central bank digital currencies (CBDCs), also sometimes called govcoins, have suddenly become a subject of public discussion. Until recently the topic was mainly the preserve of a coterie of technical experts working for central banks and niche technology firms. But now there seems to be immense excitement about their potential to transform finance. There are even some who suggest the new technology could allow the renminbi to overtake the dollar as the world’s leading cross-border currency.

-

Features

FeaturesBriefing: New benchmark to reduce cost of FX transactions

Among the areas of focus for a pension fund looking to cut costs are the fees charged by its asset managers, usually as an annual percentage of assets under management, plus costs for other services. As part of a cost-cutting exercise, however, foreign exchange (FX) is often neglected. But as funds increasingly invest outside their home country, FX transactions are acquiring more significance because of the need to hedge foreign currency fluctuations. And these deals can carry hidden costs.

-

Features

FeaturesBriefing: Bonds on the blockchain

Bitcoin’s wild ride has been hard to ignore this past year. However, it has mainly attracted its stalwart audience of retail investors, family offices and hedge funds. Institutional investors mostly sat on the sidelines, although interest has been piqued. Digital assets, most notably bonds and not cryptocurrencies, are likely to garner the inflows owing to the comfort of regulation and established market infrastructure.

-

Features

FeaturesBriefing - Growth private equity: From margin to multiple

Private equity may have a reputation for buying cheap, levering up and selling high. But with a record $30bn (€25bn) sitting in European growth vehicles, true business growth is expected to play a greater role in coming years.

-

Features

FeaturesBriefing - Energy: IEA sets net-zero target

The energy sector is the source of about three-quarters of greenhouse gas emissions at present and yet until only recently, the influential International Energy Agency (IEA), an inter-governmental group, had not produced a fully-fledged aligned pathway with the goal of limiting the rise in global temperatures to 1.5°C above pre-industrial levels.

-

Features

FeaturesBriefing: China bonding with the world

It is tantalising to imagine the concept – that the standard global fixed-income portfolio, which has stood the test of time for so long, may be about to unravel. The standard bearers – US Treasuries, the UK Gilts, German Bunds and Japanese government bonds (JGBs) – may soon have to share the stage with a brash newcomer: Chinese government bonds (CGBs).

-

Features

Briefing: Credit-risk niche gains interest

In a world of prolonged low interest rates, institutional investors are scouring different pockets of the investment landscape to generate additional returns. One area is capital regulatory transactions, which are far from new but are being put under the microscope for their potential as part of an alternative credit portfolio. However, these transactions can be more complex than other alternative credit asset classes and require specialist expertise, skills and understanding.

-

Features

FeaturesActive management: More than just a stopped clock

When most active managers underperform, how can investors identify the few who are likely to consistently outperform?

-

Features

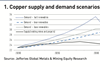

FeaturesNet-zero opportunities: Global green momentum boosts prospect of a mining super cycle

The Covid-19 pandemic has given everyone pause for thought. It has also been a catalyst for action. For some, global warming seemed like a nebulous, distant concern. But the fragility of life on earth has been laid bare.

-

Features

FeaturesLong term assets: Proposed vehicle aims to help DC funds access private asset classes

The UK’s chancellor of the exchequer, Rishi Sunak, has set an ambitious timetable for the launch of a new UK-authorised fund vehicle, the Long-Term Asset Fund (LTAF), by the end of 2021. The LTAF is envisaged to simultaneously help achieve several policy goals by directing pension savings into alternative investments.

-

Features

FeaturesInflation strategy: Conditions look ripe for a new commodities supercycle

The media briefly got excited when the followers of Reddit – a social news website often used by political activists – ineffectually attempted to ramp up silver prices in February. But news about commodity prices other than oil and gold rarely make headlines. For most institutional investors, commodities are a Cinderella asset class. A fleeting moment in fashion before the 2008 global financial crisis (GFC) has been superseded by widespread indifference.

-

Features

FeaturesSelectivity is key in SPAC market

The vogue for special purpose acquisition companies (SPACs) has something in common with many other fashions, whether in investment or in the shops. Just when you think the trend cannot get even hotter, the temperature rises yet further.

-

Features

FeaturesChina: Caught in the crossfire

The investment world is at risk of being caught in the midst of a ‘geoeconomic’ conflict between the world’s main economic blocs

-

Features

FeaturesHedge funds: Coping with low interest rates

Historical analysis suggests portfolios of certain quant hedge fund strategies may offset some of the risk of rising interest rates

-

Features

Rising interest in EM debt

The weak dollar and low US interest rates are pushing governments and companies in emerging markets (EMs) to issue growing volumes of dollar-denominated debt.