All central banks articles

-

Features

FeaturesCentral banks and cryptocurrency reserve: set for a breakthrough?

After courting the crypto community during his presidential campaign, Donald Trump issued an executive order in early March to create a US strategic bitcoin reserve, as well as a national digital assets stockpile of tokens other than bitcoin.

-

Features

FeaturesGold’s lustre turns heads as precious metals regain investment safe haven status

Gold, and to a lesser extent silver, have regained their lustre as favoured precious metal safe havens, although there are now new structural drivers.

-

News

NewsCentral banks and actuaries both publish climate risk proposals

Analysis looks at how physical and transition risks can be transmitted and exacerbated, and offers tools to help monitor vulnerabilities

-

Opinion Pieces

Opinion PiecesThe size of Australia’s super funds could threaten the financial system

Australia’s central bank has warned that rapid growth of the nation’s superannuation system could “amplify” shocks to the country’s financial stability.

-

Features

FeaturesCan central banks retain their independence?

Over the last few decades, following central bank behaviour has been a rewarding investment strategy. That is why there is now a community of people employed to analyse every word central bank officials utter.

-

Asset Class Reports

Asset Class ReportsLocal currency debt markets now more compelling

Bond yields are now more attractive because local central banks hiked interest rates sooner than their developed market counterparts

-

Opinion Pieces

Opinion PiecesViewpoint: A challenging period for emerging market debt or a golden opportunity?

Despite the challenges posed by rising interest rates and the steep rise of the US dollar, none of the bigger emerging markets seem to be in debt distress

-

Special Report

Special ReportProspects special report 2024: CIOs on what awaits investors

Asset management CIOs and strategists answer key questions about investment for the 12 months and beyond

-

Opinion Pieces

Opinion PiecesInvestors should focus on debt sustainability

The good news for institutional investors as 2024 approaches is that central banks seem to have accomplished something remarkable. Inflation is falling in the US and Europe after rising to levels not seen for decades, thanks to what have been among the fastest and sharpest rate hikes. Economic growth has held up, at least in the US. Many economists expect a soft landing there, and a mild recession in Europe.

-

Interviews

InterviewsPension funds ride out the macro uncertainty

European institutions reflect on their priorities for 2024, as the fundamental questions about inflation and the impact of higher interest rates remain unanswered

-

News

NewsSampension sticks to cautious equity tactics, with central banks in a bind

Danish labour-market pensions firm regrets early roll-back of equities exposure

-

Opinion Pieces

Opinion PiecesViewpoint: Breaking the banks

Pension funds should ally themselves with activist investors to break up the hegemony of large banks

-

Features

FeaturesResearch: Pension investing in an inflation fuelled world

Monica Defend and Amin Rajan highlight the big upheavals facing pension investors

-

Features

FeaturesUS dollar strength and the issues facing institutional investors

Most central banks across the world are raising interest rates – some more aggressively than others – but it is proving hard for any of them to out-hike the US Federal Reserve. The resulting widening interest rate differentials have been an important factor in the appreciation of the US currency.

-

News

NewsCapital markets having to get to grips with new status quo, says Keva CIO

Finland’s biggest pension fund reports 6.4% investment loss for year so far

-

Special Report

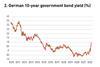

Special ReportOutlook: Good riddance to negative interest rates

The net effect of setting interest rates below zero is negative, and central banks may be wary of such policies in the future

-

News

NewsGreen central bankers group to mainstream consideration of nature risks

Nature-related financial risks should be considered by central bankers for fulfilment of their mandates, says NGFS

-

News

Danish pension funds invest more in unlisted equities than listed

Central bank analyses sector’s average allocations in three years up to 2021

-

News

NewsIcelandic pension funds nearing foreign allocation goals, says central bank

Foreign currency purchases dipped in November to March to a quarter of the level seen previously

-

News

Derivatives drive DKK251bn total 2020 return for Denmark’s pension funds

Returns for individual pension providers varied from averages of 7.8% to -1.4%, central bank reports