France: Pensions and Investment News and Analysis

Latest news and analysis of pensions, asset management, regulation and trends in France from our award-winning journalists.

Pension Funds in France - Country Report

Pensions in France - IPE Country Report

Fierce opposition from trade unions and a large part of the political spectrum did not manage to stop Emmanuel Macron’s plan to reform the French pension system. The new framework kicks in this month, and the long-term sustainability of public pensions is secure. However, French workers will have to work longer into their lives, and their standard of living will decline.

TOP FRENCH PENSION FUNDS 2023

Pension fund/entity | Assets (€’000)

- Agirc-Arrco | 67,700,000

- ERAFP | 38,200,000

- La Mondiale Retraite Supplémentaire | 31,180,000

- Fonds de Réserve pour les Retraites (FRR) | 21,300,000

- Ircantec |13,980,000

©IPE Research; See IPE’s Top 1000 Pension Funds for the full ranking

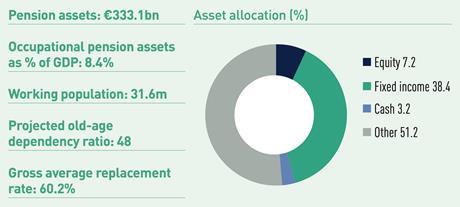

Key fund data for France

Sources: Pension assets - IPE research; Occupational pension assets as % of GDP - OECD June 2022; Working population, data as of end 2021 - World Bank; Projected old-age dependency ratio 2050 per 100 people - Eurostat 2021; gross average replacement rate - OECD Pensions at a Glance, 2021; Asset Allocation - OECD Pension Funds in Fugures, June 2022

FRR nets 9.68% in 2023 as return asset boost brings H2 benefits

Reserve fund also announces that CIO Salwa Boussoukaya-Nasr has been appointed to executive board

Olivier Rousseau exits French pension reserve fund

Executive director decides not to seek a third term, but does not plan to retire

French regulator publishes transition plan guide for companies

AMF says transition plans under the CSRD ‘hold great significance for investors and stakeholders’

France’s ERAFP includes debt refusal in tighter fossil fuel policy

Pension fund also tightens thresholds for thermal coal, unconventional oil & gas

France strengthens SRI fund label to ‘give investors more confidence’

The label can now only be secured by funds that have no exposure to companies developing new fossil fuel assets

TOP MANAGERS: FRENCH INSTITUTIONAL ASSETS

Company | Assets (€m)

- Amundi | 744.476*

- Natixis Investment Managers | 472,009

- Ostrum Asset Management | 359,578

- AXA Investment Managers | 234,198**

- BNP Paribas Asset Management | 190,052*

- Ofi Invest | 154,800**

- Generali Investments | 72,986***

- Groupama Asset Management | 64,701

- Allianz Global Investors | 57,366

- Swiss Life Asset Management | 30,652**

As at 30.6.23, *31.3.23, **31.12.22, ***30.6.22

©IPE Research; Sign up to IPE Profesional to see all the data in the latest country report

IPE BEST PENSION FUND IN FRANCE AWARD WINNERS

- 2023 - ERAFP

- 2022 - AG2R La Mondiale

- 2021 - ERAFP

- 2020 - AG2R La Mondiale

- 2019 - AG2R La Mondiale

Interviews

- Previous

- Next

Viewpoint: Macron’s reform paves way for development of French second- and third-pillar pension

The rationale of the reform is simple: the rising life expectancies combined with decreasing birth-rate have accelerated the aging of the French population

FRR nets 9.68% in 2023 as return asset boost brings H2 benefits

Reserve fund also announces that CIO Salwa Boussoukaya-Nasr has been appointed to executive board

French institutional investors team up in biodiversity fund drive

The investors will launch a call for proposals by the end of July

ERAFP: France’s public sector pension scheme and its key priorities

Susanna Rust talks to Catherine Vialonga, CIO of ERAFP, France’s mandatory additional pension scheme for civil servants, and CEO Régis Pelissier about the fund’s priorities and tactical asset allocation adjustments

Olivier Rousseau exits French pension reserve fund

Executive director decides not to seek a third term, but does not plan to retire

French regulator publishes transition plan guide for companies

AMF says transition plans under the CSRD ‘hold great significance for investors and stakeholders’

France’s ERAFP includes debt refusal in tighter fossil fuel policy

Pension fund also tightens thresholds for thermal coal, unconventional oil & gas

France strengthens SRI fund label to ‘give investors more confidence’

The label can now only be secured by funds that have no exposure to companies developing new fossil fuel assets

France is first country to transpose CSRD into national law

The Directive will replace the Non-Financial Reporting Directive, laying out much stricter expectations for companies reporting on environmental and social impacts

French dashboard to join European pension tracking service

The dashboard in France covers all pillars of the country’s pension system, with 42 pay-as-you go service providers and 100 private pension organisations on board

ERAFP names 11 winners in multi-billion equities hiring spree

Amundi and BlackRock were among 11 winners in a European and Japanese equities hiring process by the French civil service pension scheme