Germany Investment and Pensions

The Christian Democrat-led grand coalition has reactivated the process to reform a pension system hit by high costs and an ageing population. The process will follow two main paths: on one side reinforcing statutory pensions, which remain the central and most important pillar, and on the other side nudging people towards occupational and private pension savings.

Pension Funds in Germany - Country Report

Germany country report 2025: New government faces choices on pensions reform

The collapse of Germany’s three-party coalition last year left behind a backlog of laws and proposals on pensions. What happens now?

TOP GERMAN PENSION FUNDS 2025

Pension fund/entity | Assets (€’000)

- Bayersiche Versorgungskamer (BVK) | 117,000,000

- VBL | 65,000,000

- BVV | 34,789,396

- Siemens AG | 29,063,000

- Daimler AG | 22,550,000

©IPE Research; View the Top 1000 European Pensions Funds 2025 for a comprehensive market overview

Mubadala ruling offers roadmap as lawyers target BVK’s US property losses

Lawyers cite Mubadala precedent as they seek damages and deeper scrutiny over BVK’s troubled US property investments

Germany’s BVV sacks CIO after five months

Reports suggest disagreements emerged within the management board over BVV’s investment strategy, which Axel-Rainer Hoffmann reportedly considered too risk-averse

Former German dentists’ fund director ‘abused his position’, court rules

According to the court, Ralf Wohltmann ‘deliberately placed himself in a conflict of interest’ by holding dual positions

Germany, France target European venture capital platform funded by pension capital

An expert panel led by former French central bank governor, Christian Noyer, and former German finance minister, Jörg Kukies, has delivered recommendations to scale up European venture capital market

IPE DACH Briefing: German professional pension funds wrestle with losses

Plus: VdW Pensionsfonds struggles to appoint internal team; PKBS continues US equity strategy

TOP MANAGERS: GERMAN INSTITUTIONAL ASSETS

Company | Assets (€m)

- MEAG | 284,642*

- Union Investement | 229,910**

- Allianz Global Investors | 175,140

- DWS Group | 157,286

- DekaBank | 155,906***

- Generali | 103,665****

- BayernInvest 91,761

- Amundi | 69,027

- BlackRock | 61,408

- AXA Investment Managers | 60,101*

As at 31.12.24, *30.9.24, **29.11.24, ***30.12.24, ****31.12.23

©IPE Research; Sign up to IPE Profesional to see all the data in the latest country report

Interviews

- Previous

- Next

German pension funds need to step up in fight to boost economic growth

Germany’s Christian Democratic Union (CDU) and Christian Social Union (CSU) parties, together with the Social Democratic Party (SPD), have now entered negotiations to form a new ‘grand coalition’ government

Mubadala ruling offers roadmap as lawyers target BVK’s US property losses

Lawyers cite Mubadala precedent as they seek damages and deeper scrutiny over BVK’s troubled US property investments

Germany’s BVV sacks CIO after five months

Reports suggest disagreements emerged within the management board over BVV’s investment strategy, which Axel-Rainer Hoffmann reportedly considered too risk-averse

Former German dentists’ fund director ‘abused his position’, court rules

According to the court, Ralf Wohltmann ‘deliberately placed himself in a conflict of interest’ by holding dual positions

Germany, France target European venture capital platform funded by pension capital

An expert panel led by former French central bank governor, Christian Noyer, and former German finance minister, Jörg Kukies, has delivered recommendations to scale up European venture capital market

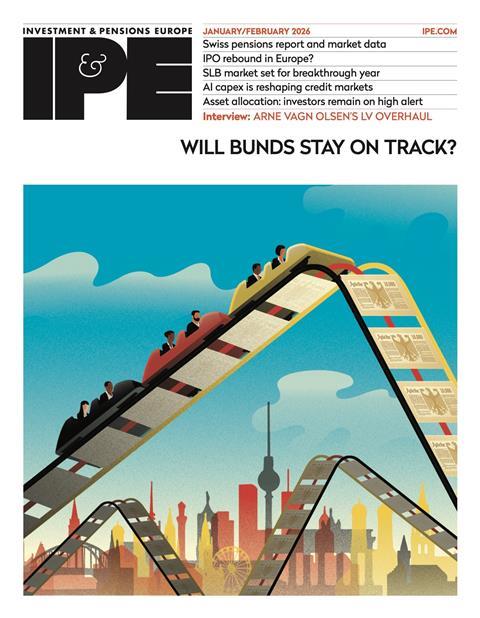

Fixed income report 2026 - Germany’s spending spree: safe bet or bumpy ride for Bund investors?

The German government’s landmark decision to increase public spending beyond its traditionally strict limits meant that Bunds had a volatile ride last year. This scenario has already become a familiar one for investors, as shown by the 2.5 basis points (bps) jump in the 10-year bond yield that kickstarted 2026.

Fiduciary assets plateau as UK market matures

UK pension schemes are de-risking through insurance in growing numbers, while many are choosing run-on strategies – and fiduciary managers must adapt

IPE DACH Briefing: German professional pension funds wrestle with losses

Plus: VdW Pensionsfonds struggles to appoint internal team; PKBS continues US equity strategy

Market fragmentation exposes German pension funds to losses

German pension market fragmentation, weak oversight, and risky strategies leave funds exposed to huge investment losses

German companies curb support fund contributions

New occupational pensions in support funds fall sharply as employers conserve cash

Germany misses auto-enrolment momentum, experts say

Lawyers and consultants say Germany’s pension reform curbs opt-out models and blocks wider take-up of occupational pensions

IPE BEST PENSION FUND IN GERMANY AWARD WINNERS

- 2024 - Bosch Pensionsfonds

- 2023 - Bosch Pensionsfonds

- 2022 - Bosch Pensionsfonds

- 2021 - Bosch Pensionsfonds

- 2020 - Bosch Pensionsfonds