All Emerging Market Equity articles – Page 2

-

Analysis

AnalysisInvestors look to isolate China from EM equity portfolios, says bfinance

Several of bfinance’s institutional clients are reportedly on the verge of cutting out China from their main emerging market equity exposure

-

Asset Class Reports

Asset Class ReportsEmerging market equities – Investors watch as China corrects course

The Chinese government has managed to restart the economy post-COVID, but investors are cautious

-

Asset Class Reports

Asset Class ReportsEmerging market equities – India’s dancing elephant in the room

Despite challenges with corporate governance and corruption, the prospects for India are too bright to ignore for investors

-

Asset Class Reports

Asset Class ReportsPortfolio Strategy – Emerging market equities

The Adani corporate scandal in India brought the issue of corporate governance in emerging markets back to the fore. As Lynn Strongin Dodds finds, however, emerging market corporates are slowly adapting to the requirements of institutional investors in terms of governance.

-

Asset Class Reports

Asset Class ReportsEmerging market equities – Rise of the Gulf equity markets

The Gulf region is changing dramatically and provides growing opportunities for emerging market investors

-

Special Report

Special ReportAsia investment: Focus shift brings turmoil to emerging Asia equities

Enthusiasm about Asian equities has cooled on the back of global recession risk, geopolitics and inflation

-

Features

FeaturesChina calls the tune for emerging markets

If President Xi Jinping mismanages China, the careers of many emerging market asset managers could be over. It would also mean emerging markets as an asset class would become irrelevant, at least according to Xavier Hovasse, head of emerging markets at the French fund management house Carmignac, who has devoted his career to seeking opportunities in emerging markets.

-

Asset Class Reports

Asset Class ReportsEmerging markets: Investors stay positive on Chinese investments

Many Western investors are staying put in China. But Russia’s invasion of Ukraine has given them pause over what might change their stance

-

Asset Class Reports

Asset Class ReportsEmerging markets: Global or local?

For emerging market strategies, it is difficult to establish a clear link between performance and local presence

-

Asset Class Reports

Asset Class ReportsPortfolio strategy – Emerging markets

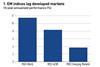

It is no secret that while investments in emerging markets promise to deliver superior returns, thanks to their exposure to faster-growing economies, actual performance has been volatile and, at times, disappointing. Over the past decade, emerging market indices have outperformed, as have fund strategies.

-

Asset Class Reports

Asset Class ReportsBrazil’s allure defies negative signals

Latin America’s largest economy continues to hold the interest of investors despite its poor showing on COVID, the economy and politics

-

Asset Class Reports

Asset Class ReportsEM outlook: Opportunities amid uncertainties

The pandemic has greatly affected emerging markets but while some are in a bad state others are showing great resilience

-

Asset Class Reports

Asset Class ReportsAsset class report – Emerging market equities

The pandemic has substantially altered the landscape for emerging markets. While some countries have contained its effect better than any developed market, others have been devastated. How should investors regard the impact of COVID-19 in their decision-making on future increases on allocations to emerging markets? In this report, we analyse the outlook for the asset class in general, and find out why Brazil continues to hold the interest of investors.

-

Asset Class Reports

Asset Class ReportsEM equity outlook resilient despite gloom

There is less difference between apparently conflicting expert views on the prospects for emerging markets than first appears

-

Asset Class Reports

Emerging market equities: ESG in Latin America

An anti-corruption drive by Latin American companies is creating opportunities for responsible investors

-

Asset Class Reports

Trade war: The silver lining in the clouds of trade war

Smaller emerging market players could benefit from the US-China trade war

-

Asset Class Reports

Defining the EM universe

A rising number of wealthy developed countries are still considered emerging market economies. Does this make sense?

-

Asset Class Reports

Argentina’s dramatic change of fortunes

Argentina has had to seek a $50bn rescue package from the IMF in its latest crisis after just two years of a boom period

-

Asset Class Reports

Equity Markets: Behind the latest sell-off

The recent rash of selling of EM assets has been triggered by a combination of factors

-

Asset Class Reports

Emerging Market Equities: Resisting a tantrum

Most emerging markets are regarded as reasonably placed to handle the impact of the winding up of quantitative easing in the West

- Previous Page

- Page1

- Page2

- Page3

- Page4

- Next Page