Impact investing – Page 17

-

News

NewsAllianz toughens investment policy on oil and gas

From 2025 Allianz will only insure and invest in oil and gas companies committing to net-zero greenhouse gas emissions by 2050

-

Analysis

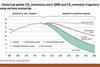

AnalysisPortfolio analysis: to net or not to net?

Portfolio alignment tools can help build a clearer picture of overall portfolio impact but accounting for negative externalities is problematic

-

Special Report

Special ReportDriving change as the debate on impact evolves

It’s hard to believe, but this is IPE’s fifth annual special report dedicated to investing for impact: our first impact investing report was in 2018. What has changed since then? In some ways not much. We still have a debate about the credibility of claiming impact in public markets, where the narrative is all about stewardship in the form of engagement and voting, and we discuss the effectiveness of engagement versus divestment.

-

Special Report

UK Stewardship Code: a platform for impact

Investors and specialist managers could use the UK’s revised Stewardship Code to showcase intentionality and impact

-

Special Report

Special ReportCorporate lobbying comes under the spotlight

Companies are starting to respond to investors’ demands for transparent and consistent lobbying.

-

Special Report

Special ReportConsigning fossil fuels to the past

How are asset managers supporting the shift away from fossil fuels in energy intensive sectors?

-

Interviews

InterviewsOn the record: Impact through corporate engagement

Investors are aiming to maximise the impact of their investment strategies by engaging with investee companies

-

Special Report

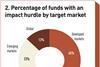

Special ReportData: focus on impact hurdles

An increasing number of impact funds link carried interest to impact goals. Asset owners can help by encouraging this trend

-

Special Report

Special ReportStrategy: The search for integrity and effectiveness

Investors are increasingly seeking real-world impact, but understanding of what that means and how it can best be achieved is still evolving.

-

Features

FeaturesMeasuring health impacts could expand ESG metrics

All companies have an impact on the world beyond just the profits for shareholders. Acknowledging and measuring these impacts in a quantitative manner enables them to be managed for the benefit of all and contributes to the creation of a fairer and more just society. The environment, social and governance (ESG) movement has raised the importance of such sentiments.

-

Special Report

Special ReportTowards a sustainable portfolio theory

Applying monetary values to impacts would allow investors to direct capital better and assess opportunities for improved long-term returns

-

Opinion Pieces

Opinion PiecesViewpoint: Why the UK Investment Bank must nurture nature

By Gavin Templeton, partner at Pollination

-

News

‘Quality impact performance reports are transparent about lessons learned’

BlueMark proposes key elements of quality impact reports based on market analysis, consultation

-

News

ESG roundup: Insurer reappoints Lombard Odier for sustainable investment brief

Plus: Bfinance adopts Impact Investing Principles; Finnish investor bets in sustainable cashew production

-

Special Report

Special ReportManager selection: Market trends

Manager selection consultants are helping investors navigate the next stages of ESG integration

-

News

GIIN launches beta version of first IRIS+ impact performance benchmark

Goal is for impact performance benchmarks to play same role as financial benchmarks in investing

-

News

UK pension funds increasingly look into impact investing

Social infrastructure and social and affordable housing are the most popular social impact investments

-

News

KLP, Nordic banks, launch transition financing code for shipping

‘Guidelines for Transition-linked Financing’ for the shipping industry aimed at increasing transparency around firms seeking rate discounts on loan/bond financing

-

News

Pensioenfonds Detailhandel invests €100m in circular economy fund

The €31bn pension fund for the Dutch retail industry is the seed investor in the Polestar Capital Circular Debt Fund

-

News

M&G acquires Swiss impact firm responsAbility Investments

Emerging market-focussed firm was founded in 2003 and is seen as one of the leading impact investment asset managers