In Depth – Page 2

-

Interviews

InterviewsHow pension funds manage derivatives and liquidity needs

The use of derivatives, for hedging and other purposes, is common among pension funds, but it can be a drain on liquidity. We asked three pension funds how they ensure adequate levels of liquidity when interest rates are volatile

-

Interviews

InterviewsHypoVereinsbank pension funds: Searching for sustainability in private markets

Markus Schmidt, director of asset management for the pension funds of Germany’s HVB, talks to Carlo Svaluto Moreolo about the schemes’ combination of strict liability and risk management with a broad growth portfolio and sustainability focus

-

Interviews

InterviewsVeritas: Finnish pension insurer seeks in-house efficiency

Veritas CIO Laura Wickström talks to Pirkko Juntunen about the challenges and opportunities of running a lean but efficient internal investment team

-

Interviews

InterviewsPrivate equity remains a key building block for pension schemes

While allocations vary, pension funds value solid returns and private equity’s role as a diversifier. Funds use PE to gain both domestic and international exposure.

-

Interviews

InterviewsHow two pension funds are already using AI

PGGM is using large language models in ESG, generic AI in forecasting to improve on quant models and ChatGPT to improve coding.

-

Interviews

InterviewsCassa Nazionale del Notariato: Megatrend investor

Stella Giovannoli, CIO and CFO at Italy’s Cassa Nazionale del Notariato, talks to Carlo Svaluto Moreolo about the efforts to modernise the fund

-

Interviews

InterviewsKPN Pensioenfonds: Active investors by conviction

Caspar Vlaar and Jaap van Dam of KPN Pensioenfonds talk to Tjibbe Hoekstra about the Dutch fund’s belief in active investing, its venture into private markets and its impact strategy

-

Interviews

InterviewsPension funds on euro fixed income: navigating the rate cycle

We asked pension funds in Spain, Germany and Finland about their current views on European fixed income and credit as the ECB looks carefully at the timing and sequence of its rate cuts

-

Features

FeaturesHow the EU's pay transparency directive affects pension sponsors

Pay transparency is looking set to be the employment hot topic of at least the next few years and reflects an ongoing global conversation around addressing equal pay. The latest figures in the EU put the gender pay gap at around 12.7% and the gender pension gap at in excess of 30%, with very little movement over the last few years. Greater transparency over pay is the route being adopted in a growing number of countries as the silver bullet to accelerate progress.

-

Features

FeaturesReforms are needed to improve pensions in emerging markets

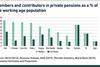

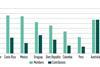

The emerging world is ageing the fastest. Despite having the advantage of a young population, emerging countries are expected to transition to older age groups within 25 years, a change that took over 150 years in some developed nations.

-

Interviews

InterviewsPreparation is key to countering pensions cyber risk

Pension funds face very real cyber security risks and must prepare for regulatory changes, such as the EU’s Digital Operational Resilience Act. IPE asked European pension funds about their strategies to deal with cyber crime

-

Interviews

InterviewsATP's long game in investment strategy

Christian Kjaer, head of liquid markets at Denmark’s ATP, talks to Carlo Svaluto Moreolo about the institution’s liquid assets portfolio and his knack for game theory.

-

Interviews

InterviewsPension funds on the record: stewardship and engagement

IPE asked European pension funds to outline their strategy at this year’s shareholder meetings

-

Interviews

InterviewsFinland’s Elo doubles down on sustainability

Jonna Ryhänen, CIO of Finland’s €31bn Elo, tells Pirkko Juntunen about strategic asset allocation, investing for change and in-house expertise

-

Interviews

InterviewsMerseyside pension fund dials down domestic bias

Scheme’s strategic ambition is to move closer to the MSCI World index weightings

-

Interviews

InterviewsSweden’s AP3 pension fund and its quest for alpha

Jonas Thulin, recently appointed CIO of Sweden’s Tredje AP-Fonden (AP3), talks to Carlo Svaluto Moreolo about his approach to asset allocation and portfolio management

-

Interviews

InterviewsPension funds revisit allocations to China

European pension funds have reduced their allocations to China as the outlook for the country’s economy becomes more uncertain

-

Interviews

InterviewsAhold Delhaize pension fund on climate transition and system change

Eric Huizing, chief investment officer at Ahold Delhaize Pensioen, explains to Tjibbe Hoekstra how the pension fund is progressing not only with its climate-focused investments but also the change in the Dutch pension system

-

Interviews

InterviewsERAFP: France’s public sector pension scheme and its key priorities

Susanna Rust talks to Catherine Vialonga, CIO of ERAFP, France’s mandatory additional pension scheme for civil servants, and CEO Régis Pelissier about the fund’s priorities and tactical asset allocation adjustments

-

Interviews

InterviewsBiodiversity, the next responsible investment frontier

European pension funds are ramping up their efforts to consider the impact of their portfolios on the loss of biodiversity related to climate change