In Depth – Page 9

-

Interviews

InterviewsHow we run our money: CPEG

Grégoire Haenni, CIO of CPEG, the public pension fund for the Swiss canton of Geneva, explains the fund’s multidimensional approach to asset allocation

-

Interviews

On the Record: The volatility question

We asked two European pension funds how they view, and invest in, the hedge fund sector at a time when volatility is structurally low

-

Interviews

InterviewsHow we run our money: Railpen

Andrea Ash (pictured), investment director at RPMI Railpen, tells Carlo Svaluto Moreolo about the UK pension fund’s private markets strategy

-

Features

FeaturesForeign pension funds set for tax refunds on UK property income

A recent ruling by the UK Tax Tribunal decided that the imposition of UK income tax on the property income of a German pension scheme was unlawful under EU law

-

Features

PEPP: no straightforward route

Some entities will not be eligible to offer PEPP products in Bulgaria, which looks like a recipe for market confusion

-

Interviews

InterviewsHow we run our money: APK Pensionskasse

Christian Böhm, CEO of Austria’s APK Pensionskasse, talks about the organisation’s blend of dynamic and long-term investment strategy

-

Interviews

On the record: Delivering on our promise

Dmytro Sheludchenko of Sweden’s AP1 buffer fund explains how it constructs and manages its factor-investing portfolios

-

Interviews

On the Record: Looking beyond Brexit

We asked European pension funds whether they see value in investing in UK assets. Despite the uncertainty regarding Brexit, most still see opportunities in the long term

-

Features

Annuity innovation: A new decumulation solution

With the decline of DB pension funds, individuals are seeking alternatives for longevity protection

-

Interviews

InterviewsHow we run our money: Bank of Ireland

Paul Droop (pictured), CIO of the Bank of Ireland’s staff pension scheme, tells Carlo Svaluto Moreolo about his approach to building a shockproof portfolio

-

Interviews

On the record: Asset management fees

We asked two European pension funds about their attitude to asset management fees and costs

-

Features

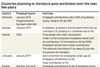

FeaturesAuto-enrolment grows globally

A growing number of countries are planning to reduce the strain placed on public finances of providing pensions to ever more retirees by encouraging individuals to make more adequate provision for their own retirement

-

Interviews

InterviewsHow we run our money: Laborfonds

Ivonne Forno (pictured), the CEO of Laborfonds, the Trentino-Alto Adige/Südtirol regional pension fund, talks to Carlo Svaluto Moreolo shortly after the fund’s 20th birthday

-

Interviews

On the Record: Adapting to change

As the equity markets begin 2019 in worse shape than last year, we asked three European pension funds how they conceive and execute their equity strategy, in order protect the portfolio

-

Interviews

InterviewsHow we run our money: PWRI

Xander den Uyl, chairman of PWRI, the Dutch fund for disabled workers, tells Carlo Svaluto Moreolo about its particular approach to ESG

-

Interviews

On the Record: The question of hedging

We asked two European pension funds how they hedge against interest rate risk, as the probability that interest rates will rise over the few next years grows

-

Features

Collective DC in the Netherlands

How Dutch collective defined contribution schemes came about and how they differ from other schemes

-

Interviews

InterviewsHow we run our money: Första AP-fonden (AP1)

Mikael Angberg, CIO of Första AP-fonden (AP1), one of Sweden’s buffer funds, outlines the fund’s investment philosophy to Carlo Svaluto Moreolo

-

Interviews

On the Record: Manager Due Diligence

The suspension of a GAM fund manager has revived the discussion about due diligence. We asked three pension funds how they deal with it

-

Interviews

InterviewsHow we run our money: ÄVWL

Christian Mosel, CEO of Ärzteversorgung Westfalen-Lippe, the pension fund for doctors in Germany’s Westphalia-Lippe region, talks about his old-fashioned approach to investment