In Depth – Page 17

-

Features

FeaturesPrivate credit: Floating to safety

Despite inflationary headwinds, the outlook for private credit remains strong

-

Features

FeaturesBriefing: New benchmark to reduce cost of FX transactions

Among the areas of focus for a pension fund looking to cut costs are the fees charged by its asset managers, usually as an annual percentage of assets under management, plus costs for other services. As part of a cost-cutting exercise, however, foreign exchange (FX) is often neglected. But as funds increasingly invest outside their home country, FX transactions are acquiring more significance because of the need to hedge foreign currency fluctuations. And these deals can carry hidden costs.

-

Features

FeaturesPrivate credit fundraising: A record year for private-debt funds

Record amounts of capital were raised by private-debt funds in 2020 but the outlook may be less strong in the short term

-

Features

FeaturesESG & private markets: Crying out for standards

Growing awareness of ESG is fuelling pressure for definitive metrics to assess company performance

-

Features

FeaturesDigital transformation: Take advantage of the digital reset

Covid has accelerated the digital transformation across all industries. How has it contributed to new trends and opportunities in private debt and how can investors benefit?

-

Features

FeaturesAhead of the curve - Green assets: An alternative to green bonds

Policy performance bonds, in which returns are linked to ESG outcomes, would be a positive alternative to green bonds

-

Features

FeaturesStrategically speaking: Lyxor & Amundi

Lyxor has made a mark over the 20-plus years of its existence, pioneering managed accounts for hedge funds, including the first dedicated institutional managed account platform, that it created for PGGM in 2010.

-

Features

FeaturesBriefing - Growth private equity: From margin to multiple

Private equity may have a reputation for buying cheap, levering up and selling high. But with a record $30bn (€25bn) sitting in European growth vehicles, true business growth is expected to play a greater role in coming years.

-

Features

FeaturesBriefing - Energy: IEA sets net-zero target

The energy sector is the source of about three-quarters of greenhouse gas emissions at present and yet until only recently, the influential International Energy Agency (IEA), an inter-governmental group, had not produced a fully-fledged aligned pathway with the goal of limiting the rise in global temperatures to 1.5°C above pre-industrial levels.

-

Features

FeaturesBriefing: Central bank digital currencies take shape

Central bank digital currencies (CBDCs), also sometimes called govcoins, have suddenly become a subject of public discussion. Until recently the topic was mainly the preserve of a coterie of technical experts working for central banks and niche technology firms. But now there seems to be immense excitement about their potential to transform finance. There are even some who suggest the new technology could allow the renminbi to overtake the dollar as the world’s leading cross-border currency.

-

Features

FeaturesBriefing: Bonds on the blockchain

Bitcoin’s wild ride has been hard to ignore this past year. However, it has mainly attracted its stalwart audience of retail investors, family offices and hedge funds. Institutional investors mostly sat on the sidelines, although interest has been piqued. Digital assets, most notably bonds and not cryptocurrencies, are likely to garner the inflows owing to the comfort of regulation and established market infrastructure.

-

Features

FeaturesFixed Income, Rates, Currencies: Trickier than usual

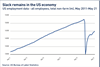

Amongst the myriad of investment conundrums facing investors, one of the more pressing today is whether – or not – the US economy will overheat. Though the Federal Reserve has done a good job assuring the markets that while (US) inflation data may indeed print higher than “target”, Chair Jerome Powell will be “looking through” any rises. They have argued that these should be temporary and a dovish outlook will remain.

-

-

-

Features

FeaturesIPE Quest Expectations Indicator - July 2021

At the time of writing, over half of the US population was vaccinated against COVID-19 with the EU at 40%. UK figures give a positive picture but the threat of new strains remains. The G7 have announced plans to supply vaccines to developing countries.

-

Features

FeaturesIPE Quest Expectations Indicator - August 2021

The next wave of COVID-19 has come to pass earlier than expected, largely due to new variants. The UK is hard hit, being sensitive to variants Alpha, Beta and Delta. The EU is next in line, with the Netherlands, Spain and Denmark in the forefront and Delta playing a leading role, but other member states are right behind. There is no sign of the next wave in the US yet, but it is sensitive to the variants Gamma and possibly Alpha, which plays a role in Canada.

-

Features

FeaturesStrategically speaking: Hayfin – no hayseed

Europe’s abortive football super league didn’t collapse from want of loan capital this April. It collapsed, instead, because of a catastrophic lack of cultural fit with the ethos of the sport.

-

Features

Briefing: Credit-risk niche gains interest

In a world of prolonged low interest rates, institutional investors are scouring different pockets of the investment landscape to generate additional returns. One area is capital regulatory transactions, which are far from new but are being put under the microscope for their potential as part of an alternative credit portfolio. However, these transactions can be more complex than other alternative credit asset classes and require specialist expertise, skills and understanding.

-

Features

FeaturesBriefing: China bonding with the world

It is tantalising to imagine the concept – that the standard global fixed-income portfolio, which has stood the test of time for so long, may be about to unravel. The standard bearers – US Treasuries, the UK Gilts, German Bunds and Japanese government bonds (JGBs) – may soon have to share the stage with a brash newcomer: Chinese government bonds (CGBs).

-

Features

FeaturesFixed income, rates, currencies: Still missing the target

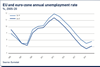

Most would agree that one data release from an important but volatile dataset – employment figures – should be read with caveats. However, the scale of the forecasting ‘miss’ for April’s US job numbers was hard to dismiss as just noise.