In Depth – Page 24

-

Interviews

Strategically speaking: Old Mutual Alternative Investments

Africa looks set to account for over half of the world’s population growth between now and 2050, according to the UN. Thanks to a young population and a high fertility rate, Africa’s population could exceed 2bn, making it the fastest-growing continent in that respect.

-

Features

FeaturesAhead of the Curve: The trade war and Asia

The rivalry between the US and China looks set to dominate Asian affairs in the future and cannot be ignored by responsible investors. The escalation of tensions at the start of Donald Trump’s presidency led to an increase in trade barriers and impacted growth; now a temporary truce has been agreed but uncertainty remains, as do tariffs on Chinese exports to the US. The new bilateral agreement is a positive step, but investors should take a long-term view; the economic and strategic rivalry looks set to continue and some sectors are better placed than others to adapt to this landscape.

-

-

-

-

Features

FeaturesBriefing: Central bank about-turn bolsters gold

Gold is unlike any other commodity. It has few industrial applications of any note. It is widely used in jewellery partly because of its aesthetic appeal but also in many cases as a form of investment. Central banks distance themselves from acknowledging the precious metal as a kind of universal currency yet still keep thousands of tonnes of it locked away in their vaults.

-

Features

FeaturesAre cryptocurrencies an asset class for institutional investors?

Cryptocurrencies are sweeping the world in terms of news headlines but how should institutional investors react?

-

Features

FeaturesWhere insurers are placing their money

Insurers’ investment decisions can influence economic growth and developments in capital markets

-

Features

FeaturesThe proof of the Brexit pudding is in the eating

Brexit “got done”, to paraphrase the British prime minister, at the end of January. But the exact form it will take is still to be determined

-

Interviews

InterviewsStrategically Speaking: Aspect Capital

Over the last few years, Aspect’s diversification strategy has involved generating alternative income streams from new programmes and reducing the cost base

-

Features

FeaturesFixed income, rates, currencies: A confident start to the year

Undoubtedly a good year for financial assets, 2019 ended on a bright note with the broad, and relieved, consensus that the China/US trade conflict might be de-escalating

-

Features

FeaturesAhead of the Curve: Avoid the crowds in EMs

Emerging markets (EMs) look set to be the most important growth engine of the 2020s as their consumption levels rise and China follows a saw-toothed growth path towards the economic top spot. However, asset-allocators need to remove themselves from the malign legacy of the 2010s if they are to tap this growth.

-

-

-

Features

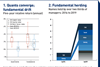

FeaturesIPE Quest Expectations Indicator: February 2020

Net bond sentiment is trending down, yet remains stable in Japan

-

Features

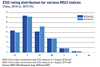

FeaturesChina: On a long climb up the ESG ladder

China is the world’s biggest emitter of greenhouse gases, compels imprisoned Muslims in Xinjiang to toil in factories, and has Communist Party committees embedded in companies, exercising a shadowy influence over management. It is, in other words, not exactly a poster child for good ESG performance.

-

Interviews

InterviewsStrategically speaking: QMA

QMA’s CEO Andrew Dyson explains why current market dislocations arguably represent the biggest investment opportunities of the last decade – if not of the last 25 years – for value investors

-

Features

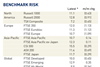

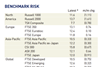

FeaturesAsset management faces systemic risk questions

When will the next financial crisis hit? Over 80% of respondents among a sample of 500 institutional investors surveyed by Natixis Investment Managers expect a crisis to take place within the next five years.

-

Features

FeaturesWhen safe haven assets aren’t safe

In the current environment, investors look set to lose money on European government bonds – a quintessential safe-haven asset

-

Features

FeaturesFixed income, rates, currencies: Better than expected

Although packed with geopolitical surprises 2019 turned out to be better than expected for financial assets. Equities and bonds rallied together reversing last year’s ‘unusual occurrence’ of both performing badly.