In Depth – Page 3

-

Features

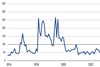

FeaturesIPE Quest Expectations Indicator - May 2025: US markets lose their wings

Markets have been gyrating wildly with Trump’s on-again-off-again trade wars, but resistance is building

-

Interviews

InterviewsSystematica Investments CEO Leda Braga on the hedge fund's strategy

‘Ten years ago, we were the nerds, the geeks, and nobody was interested’

-

Features

FeaturesIPE Quest Expectations Indicator - June 2025

At last, we have some clarity about the nature of ‘Trump risk’ – it is about uncertainty and growth. Markets are signalling that the US president’s on-again-off-again policies are a threat to growth and stoking inflation even if his threats are not implemented.

-

Features

FeaturesCould white hydrogen solve the renewable energy challenge?

Discovery of a reserve of ‘white’ hydrogen could alter the dynamics of energy transition Hydrogen-focused ETFs have fared badly The gas can also serve as a hedge against geopolitical and energy security risks Production costs are higher than fossil fuel alternatives

-

Features

Fixed income, rates, currencies: Fickle US policy shakes global investor confidence

The hugely unpredictable policy announcements from those in charge of the world’s largest developed economy are market events more usually associated with goings-on in a newer EM economy

-

Features

FeaturesChart watch: Uncertainty ripples across markets

The trade war unleashed by Trump’s tariffs and the knock-on effects for business confidence and commodities demand are reflected in our latest chart overview

-

Features

FeaturesIPE Quest Expectations Indicator - April 2025

Since 1900, the US has waged numerous wars but has won only three without allies. This is the sobering background for recent US geopolitical policy moves: changing sides from Ukraine to Russia, interfering in German elections and behaviour at the NATO ministerial meeting.

-

Features

FeaturesCentral banks and cryptocurrency reserve: set for a breakthrough?

After courting the crypto community during his presidential campaign, Donald Trump issued an executive order in early March to create a US strategic bitcoin reserve, as well as a national digital assets stockpile of tokens other than bitcoin.

-

Features

FeaturesFixed income, rates, currencies: Trump’s tariff announcements weigh on sentiment

As tariff announcements garner huge amounts of media attention, financial market reactions have been muted. Participants are trying to beat off tariff fatigue and assess the best path through all the smoke and mirrors.

-

Features

FeaturesIPE Quest Expectations Indicator - March 2025

Political risk has risen to boiling point. Donald Trump’s talks with Russia to end the war in Ukraine, without as much as a Ukrainian presence, left the US without allies or credibility, especially in Europe.

-

Features

FeaturesCan emerging market equities offset US headwinds with domestic growth?

Emerging market (EM) equities have been an unloved asset class over the past few years. China’s economic woes, a stronger US dollar and the country’s prolonged tech bull run cast a long shadow. However, there are some bright spots in 2025, despite US president Donald Trump’s tariffs.

-

Features

FeaturesGold’s lustre turns heads as precious metals regain investment safe haven status

Gold, and to a lesser extent silver, have regained their lustre as favoured precious metal safe havens, although there are now new structural drivers.

-

Interviews

InterviewsDaniel Gamba, NTAM: Scaling the heights of asset management

Daniel Gamba, president of Northern Trust Asset Management (NTAM), is sketching out a future for his business involving the mass customisation of products for clients and leveraging important client relationships to act as a key partner.

-

Features

FeaturesFixed income, rates, currencies: Markets rocked by Trump’s sweeping tariffs plan

The world’s economy enters a new phase as the US administration escalates towards a global trade war, raising the prospect of a US recession and crashing global financial markets

-

Features

FeaturesAnother strong year ahead for green bond market as EU regulations set to drive demand

Against all the odds, the green bond market had a good 2024. In a year when inflows into global sustainability funds were slashed in half, green bonds recorded their second-highest annual issuance levels ever, with more than $560bn (€536bn) of labelled paper sold

-

Features

Cross-border investment barriers: issues for institutional investors

Protectionist trade policies are back in vogue, fuelled by the rise of China’s economy and, more recently, by the escalation of geopolitical tensions.

-

Interviews

InterviewsECP Asset Management: An Australian approach to concentrated equity portfolios

The 2020s will likely be remembered as a period of high stock market concentration, similar to the decade of ‘nifty fifty’ stocks, which propelled the US market in the years before the 1973 crash.

-

Features

FeaturesIPE Quest Expectations Indicator - February 2025

The erosion in trust in the US is promoted by its refusal to participate in a proposed trigger force in Ukraine. In response, European defence expenses are rising, in particular in Poland, the Baltics and Scandinavia.

-

Features

FeaturesFixed income, rates, currencies: Uncertainty reigns as Trump 2.0 takes office

Now that Donald Trump has been installed as US president, there should be more clarity around some of the timings of his probable new policies.

-

Features

FeaturesFixed income, rates, currencies: Trump 2.0 sends global markets out of sync

Trump’s re-election prompted a rally in US assets, but elsewhere in global markets investors did not react positively