In Depth – Page 4

-

Features

FeaturesBriefing: The challenge of investing in Europe’s energy transition

The way the European economy powers itself is undergoing a fundamental shift, driven by market forces and policymakers. But while the direction of travel is clear, the path to a different energy mix is tortuous and the shift may be much slower than required to meet Europe’s target to be net zero by 2050.

-

Features

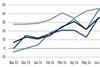

FeaturesIPE Quest Expectations Indicator - January 2025: hard to pick short-term winners

IPE’s latest manager expectations survey finds high net sentiment across most main asset classes as allocators weigh the Trump trade

-

Interviews

InterviewsLeapFrog eyes global impact investment opportunities

Impact investing was once a niche concept. “We were seen as the weird people in the corner of the room,” recalls Andy Kuper, the South African founder and CEO of LeapFrog Investments

-

Features

FeaturesThe effect of behavioural biases on active investment portfolios

It has been become apparent in recent years that behavioural finance has important things to say about how investors make decisions.

-

Features

FeaturesFixed income, rates, currencies: All eyes on Trump’s return

With the Republican Party now in control of both Senate and House, the leeway that President-elect Donald Trump will have to enact his pre-election policies could be considerable.

-

Features

FeaturesIPE Quest Expectations Indicator - December 2024

Bond expectations falling, equity mostly flat

-

Features

FeaturesInsurance-linked securities bank a stellar year for returns

Insurance-linked securities (ILS) may be complicated, but they are gaining an institutional following especially among pension and sovereign wealth funds, multi-asset investment firms and endowments.

-

Analysis

AnalysisPan-European personal pension product requires improvement

Funded pensions can provide both a retirement income for EU citizens and capital for long-term investments by financial institutions.

-

Features

FeaturesA new perspective on credit for climate transition

Sustainable finance has turned out to be a much dirtier and grittier battlefield than early adopters and advocates projected it to be.

-

Features

FeaturesSoft landing likely again for US economy

It has been more than a year since the attacks by Hamas in Israel and tensions in the Middle East remain high, with a rising impact on financial market sentiment.

-

Features

FeaturesMarket looks to Xi Jinping for a plan to boost China’s economy

When the Chinese government announced a package of measures designed to revitalise the domestic economy in late September, the country’s stock markets responded positively, and many breathed a sigh of relief.

-

Features

FeaturesIPE Quest Expectations Indicator - November 2024

Donald Trump has profited from climate change, which he believes unimportant, as this year’s hurricane season has so far seen more storms over a wider area.

-

Interviews

InterviewsBNY Investments: More than the sum of the parts?

The world’s top asset managers are a diverse bunch. From pure-play managers to investment bank-owned firms and those with an asset servicing heritage, the different flavours also reflect the changing nature of the sector.

-

Interviews

InterviewsSEI Investments seeks new partnership approach

SEI Investments, the Pennsylvania-based technology and investment firm, was a vocal advocate for independent fiduciary management in the UK pension industry.

-

Features

FeaturesFixed income, rates, currencies: All eyes are on US elections

With so many important elections taking place this year, politics were likely to have an outsized influence on financial markets.

-

Features

FeaturesCan central banks retain their independence?

Over the last few decades, following central bank behaviour has been a rewarding investment strategy. That is why there is now a community of people employed to analyse every word central bank officials utter.

-

Features

FeaturesIPE Quest Expectations Indicator - October 2024

In generic US polls, Democrats beat Republicans, with a small but increasing margin, signalling an opportunity for reforms if Kamala Harris wins and a continuation of a divided and blocked Congress if Donald Trump wins.

-

Features

FeaturesUS high yield bonds punch out of a corner

US high yield has come a long way from its murky beginnings with the very high yielding bonds of so called ‘fallen angels’, and Drexel Burnham Lambert’s Michael Milken offering bonds newly issued by corporates with sub-investment grade ratings for the first time in the 1980s, properly introducing the world to high yield bond investing.

-

Interviews

InterviewsHSBC Asset Management puts team culture at the fore in growth strategy

It’s often said that timing is everything. Nicolas Moreau sees an element of luck in the timing of his appointment to the helm of HSBC Asset Management in September 2019. This gave him a six-month head start in his role as CEO by the time the COVID pandemic arrived in early 2020.

-

Features

FeaturesSecondary markets and innovation boost private equity liquidity

Liquidity has reduced significantly in global private capital markets. Whilst private equity-backed IPOs are up this year, overall exit value is down by 66% and there is currently a large backlog of unsold assets, of which 40% are four years or older. The cumulative sum of unsold assets sits at $3.2trn (€2.9trn), according to Bain. Recent data from Preqin shows that capital called has exceeded capital distributed by $1.57trn since 2018, highlighting the lack of free capital in private markets.