A new study conducted in the US has shown that when given the enabling information, consumers much prefer to put their money into sustainable investments and are willing to accept give up returns of up to 2-3% to do so.

The University of Cambridge Institute for Sustainability Leadership (CISL), in conjunction with the Investment Leaders Group (ILG), carried out a “virtual investment experiment” to analyse the extent to which the investing public valued sustainability.

CISL and ILG said the experiment was different because rather than asking people for their opinion, the researchers observed how they behaved in practice when making fund choices.

The experiment – which used “a unique, science-based rating formula” developed by CISL to communicate the social and environmental impact of funds – revealed a strong preference for sustainable investing even when returns of up to 2-3% points were sacrificed.

Jake Reynolds, executive director, sustainable economy, at CISL, said: “The study shows that people want more from their capital than returns. Given the right information they will avoid investments which harm people or the environment.”

In the real world, he said, most savers were not given that information so they were unable to make positive choices.

“Given what we know about climate change, destruction of nature and high levels of inequality, that needs to change,” said Reynolds.

‘No significant effect’ from income, gender and education

Participants in the study – a sample of 2,000 US citizens – were asked to choose between pairs of differently-specified funds. CISL said that in order to simulate real investing behaviour, they knew they had a chance of receiving a $1,000 investment in a fund of their choice.

The results were analysed to show how decision-making was affected by the presence of environmental and social information on fund fact sheets alongside traditional financial data.

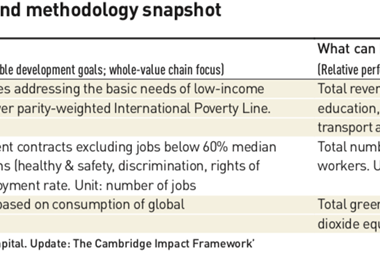

The Investment Impact Framework, developed by CISL and the ILG, was used as the model to present the social and environmental information.

The study also found under-35s to have a stronger preference for sustainable investment than other age groups, while income, gender and education had no significant effect on choices.

It also showed people had a stronger preference for avoiding funds rated poorly for sustainability than for actively choosing funds with high sustainability.

The study report can be found here.