All interest rates articles – Page 4

-

News

NewsPensionDanmark reins in equities exposure despite positive scenario

Danish labour-market pension fund blames 2023 underperformance on higher weighting of non-cyclical stocks

-

Opinion Pieces

Opinion PiecesViewpoint: A challenging period for emerging market debt or a golden opportunity?

Despite the challenges posed by rising interest rates and the steep rise of the US dollar, none of the bigger emerging markets seem to be in debt distress

-

News

NewsLower rates overshadow further €500m transfer to Siemens Pensionsfonds

Liabilities increase to €1.5bn despite good returns due to lower rates

-

News

NewsDutch pension funds well prepared for liquidity crunch, say regulators

The switch to obligatory central clearing will increase liquidity needs while the transition to DC will likely have the reverse effect, according to regulators DNB and AFM

-

News

NewsSwiss schemes face higher national debt in medium to longer term, says Complementa

Plus: Pensionskasssen Monitor published by Swisscanto saw funding ratios of private pension funds increase from 110.1% in 2022 to 114.9% in 2023

-

News

NewsGerman corporate pension funds see increased liabilities

Corporate pension obligations have already increased by around 17% at the end of 2023 compared with the previous year

-

News

NewsAegon compensates customers for inappropriate interest rate hedge hike

The insurer had increased the interest rate hedge of a pension product with an offensive risk profile from 45% to 85% in the summer of 2021

-

News

NewsSwiss APK applies minimum interest rate on members’ pension savings

The scheme expects its funding ratio to hit 100% after a ‘very volatile’ year

-

News

NewsSwiss pension funds increase interest rates on pension savings

The pension fund for the city of Zurich, Migros Pensionskasse, PK SBB and Publica, among others, have made changes to their interst rates on pensions

-

News

NewsGerman actuaries propose maximum interest rate increase on pension products

The increase, of 1% from 2025 from 0.25% currently, is the fist increase in three decades

-

Opinion Pieces

Opinion PiecesInvestors should focus on debt sustainability

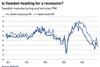

The good news for institutional investors as 2024 approaches is that central banks seem to have accomplished something remarkable. Inflation is falling in the US and Europe after rising to levels not seen for decades, thanks to what have been among the fastest and sharpest rate hikes. Economic growth has held up, at least in the US. Many economists expect a soft landing there, and a mild recession in Europe.

-

Interviews

InterviewsPension funds ride out the macro uncertainty

European institutions reflect on their priorities for 2024, as the fundamental questions about inflation and the impact of higher interest rates remain unanswered

-

News

NewsSwiss groups slam government’s decision to increase minimum interest rate

The Swiss Employers’ Association considers the increase unjustified and says minimum interest rate should have been well below the limit of 1%

-

Features

FeaturesFixed income, rates & currency: interest rates the big question

In August, when Fitch Ratings downgraded US debt from AAA to AA+, it cited an “erosion of governance” as one of the key reasons for its decision. September’s US government shutdown chaos will probably not have improved perceptions of US lawmakers’ proficiency to govern.

-

News

NewsSampension sticks to cautious equity tactics, with central banks in a bind

Danish labour-market pensions firm regrets early roll-back of equities exposure

-

News

NewsAustrian VBV increases fixed income exposure

The group’s Pensionskasse and Vorsorgekasse will also expand private markets investments

-

News

NewsWTW expects Swiss corporate pension funds to lift technical interest rates

Discount rates increased during the third quarter of this year, pushing down liabilities by 0.5%, according to the consultancy

-

News

NewsSwiss pension fund industry slams regulator’s new definition of improved benefits

The Swiss Chamber of Pension Fund Experts (SKPE) has firmly rejected the proposed change because it is ‘too restrictive’

-

News

NewsPFA’s chief strategist sees market upturn despite mood-driven summer dip

Denmark’s largest commercial pensions firm ‘glass half full’ on late 2023 market outlook, said Choi Danielsen

-

News

NewsSwiss pension funds over invested in real estate, alternatives

PPCmetrics recorded for the first time rise in average technical interest rate