Investment – Page 10

-

Features

FeaturesJapan: New hand on the tiller

Kazuo Ueda, is the first new governor of the Bank of Japan (BoJ) in 10 years. One of outgoing governor Haruhiko Kuroda’s last moves was to widen the yield curve control (YCC) band on 10-year bonds from +/-25bps to +/-50bps. The reaction from the bond market over the following few days was to trade to the new upper limit.

-

Features

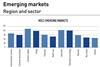

FeaturesEmerging markets decarbonisation

The International Energy Agency estimates that developing economies and emerging markets are responsible for more than two-thirds of global carbon emissions.

-

Features

FeaturesAhead of the curve: Introducing the concept of a carbon risk-free curve

As global investors and companies progress towards their net-zero emissions targets, the concept of a carbon risk-free curve becomes increasingly relevant within the fixed-income market. In our view, this curve should provide a reference for evaluating the risk levels of bonds in relation to their issuers’ CO₂-equivalent (CO₂e) emissions and can therefore help investors to assess the impact of changes in CO₂e emissions on the yield spread of fixed-income bonds.

-

Interviews

InterviewsNikko Asset Management: Complex, creative thinking

Stefanie Drews is at home with complexity. She speaks several languages fluently, including Japanese, and tells us she still does her maths in Italian.

-

Features

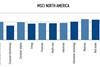

FeaturesIPE Quest Expectations Indicator April 2023

With new, superior equipment, the Ukrainian military is set to start an offensive soon. Meanwhile, Yevgeny Prigozhin, leader of the Wagner Group, is jockeying to become Russia’s next kleptocrat on the back of the Russian army. Donald Trump’s candidacy is increasingly beleaguered by defeats in court. The trade agreement on Northern Ireland between the EU and the UK is a significant boon for both as well as for Prime Minister Rishi Sunak, not because the trade flows are so important but because the issue blocked co-operation in many other fields. While the winter has been mild and beneficial, there are early signs of a dry spring, quite possible in view of climate change setting in. If that materialises, harvests, therefore food prices, will be affected in autumn.

-

Features

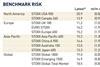

FeaturesQontigo Riskwatch – April 2023

*Data as of 28 February 2023. Forecast risk estimate for each index measured by the respective US, World and Emerging Markets Qontigo model variants

-

-

Features

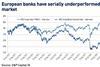

FeaturesFear and loathing in European banks

Any CEO would recognise there is a problem when investors do not want to put their money to work with you. That is the situation that European banks find themselves in. The MSCI Europe bank index has considerably underperformed its MSCI Europe parent over the last 10 years.

-

Features

FeaturesPrivate equity fundamentals resilient in headwinds

The economy and markets are beset with headwinds, and private equity assets are unlikely to be impervious. The concerns with the asset class are wide-ranging, from difficult financing conditions to rising interest rates, squeezed corporate margins and closed exit routes.

-

Interviews

InterviewsBain Capital: Vintage private equity

“In our world, it is quite easy to describe what we do, but it is very hard to do it,” says Robin Marshall, partner at Bain Capital. That statement encapsulates the concept of private equity and is also an effective introduction to his firm. Private equity may be a straightforward idea, but in reality it is an incredibly complex undertaking, which is why the asset class remains a non-core allocation within institutional portfolios.

-

Features

FeaturesAhead of the curve: The missing elements in the digital currencies debate

The recent contraction of the cryptocurrency markets poses questions about the viability of digital currency as an asset class for institutional investors. However, these developments have not undermined the efforts of central banks to pursue their own digital currency initiatives.

-

Features

FeaturesQontigo Riskwatch – March 2023

*Data as of 31 January 2023. Forecast risk estimate for each index measured by the respective US, World and Emerging Markets Qontigo model variants

-

-

Features

FeaturesIPE Quest Expectations Indicator March 2023

The next Ukrainian offensive will be in April at the earliest, as modern tanks will have arrived by then. US Republican pushback of ESG and climate-related investments are a new bone of contention in relations with the EU, already strained by the Trump presidency, and a bad sign for US-EU co-operation on China policy, an issue Japan seems to be ducking successfully. Aided by a soft winter, EU energy concerns have become quite manageable.

-

Features

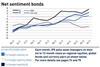

FeaturesHigh yield bonds: do your homework

Last year, European bond markets were struck by a toxic a combination of geopolitical, economic and market tensions. The picture has improved with the dawning of 2023, although the markets will continue to experience bouts of volatility and uncertainty will persist. High yield is back on the agenda, but selectivity and careful analysis will be key in identifying the right opportunities.

-

Features

FeaturesDid smart beta go ‘horribly wrong’?

In 2016, we published a paper titled ‘How can ‘smart beta’ go horribly wrong?’, the first in a series on the future of factor investing and other forms of so-called smart beta. Did smart beta go horribly wrong? Yes and no.

-

Interviews

InterviewsImpax rides the sustainability wave

One investment analyst sums up Impax Asset Management as a “pure sustainability play”. And certainly, according to founder and CEO Ian Simm, the core thesis of Impax is to “make the most of the investment opportunities offered by the transition to a more sustainable economy”. These are “on the scale of the Industrial Revolution”, Simm believes.

-

Features

FeaturesAhead of the curve: Time to automate collateral management

The resilience of financial markets has been tested several times in recent years, from the so-called ‘dash for cash’ at the start of the coronavirus pandemic in March 2020 to the spike in UK Gilt yields in September 2022.

-

Features

FeaturesIPE Quest Expectations Indicator: February 2023

Russian attacks against Ukrainian civilians are hampered by efficient air defence. With weapons for the Ukrainian military on the way, a new offensive seems imminent. US President Joe Biden’s troubles over classified documents are a relief for Republicans. The threat of a US-EU trade conflict over China is growing as both sides retreat into nationalistic behaviour. In the UK, Conservatives are under threat of predicted historic losses, while Prime Minister Rishi Sunak so far has done nothing to repair relations with the EU.

-