Investment – Page 18

-

Features

FeaturesAhead of the curve: Crypto assets

It is no longer prudent to ignore the potential of crypto assets

-

-

-

Features

FeaturesIPE Quest Expectations Indicator - June 2021

The UK experience with vaccination suggests that COVID-19 case numbers start falling when about half the population is immunised. The US will soon reach that level. The EU is over the 30% mark while Japan is at 3%. Taking the BRIC countries as a proxy for emerging markets, Brazil scores 16%, while Russia and India have reached about 10%. China has not published its vaccination figures. Meanwhile, new strains remain a source of concern.

-

Interviews

InterviewsStrategically Speaking: Cardano

The central argument of the 2015 documentary ‘Boom, bust, boom’, which features several high-profile experts including Nobel laureates Paul Krugman, Robert Shiller and Daniel Kahneman, is that financial crises are natural events caused by human nature.

-

Features

FeaturesAhead of the curve: Occupation could trump sex

There remains a great deal of popular debate about such things as the sex-linked glass ceiling, cliff, escalator and the ‘sticky’ floor, all of which imply that career opportunities are different for men and women.

-

Features

FeaturesActive management: More than just a stopped clock

When most active managers underperform, how can investors identify the few who are likely to consistently outperform?

-

Features

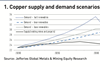

FeaturesNet-zero opportunities: Global green momentum boosts prospect of a mining super cycle

The Covid-19 pandemic has given everyone pause for thought. It has also been a catalyst for action. For some, global warming seemed like a nebulous, distant concern. But the fragility of life on earth has been laid bare.

-

Features

FeaturesFixed Income, Rates, Currencies: A false start

While we may be approaching that ‘exit from pandemic’ moment, the exceptional monetary and fiscal responses from policymakers ensure COVID-19’s economic legacy will be felt globally for years to come.

-

-

-

Features

FeaturesIPE Quest Expectations Indicator - May 2021

COVID-19 infection rates are still rising in the US and Japan, hopefully on the verge of decreasing in the EU and low in the UK. The positive trend in global infection rates is more than undone by a strong rise in infections in parts of Asia. With the exception of the UK and Israel, vaccination has not progressed to the stage where it has a discernible influence on infection rates.

-

Features

FeaturesInflation strategy: Conditions look ripe for a new commodities supercycle

The media briefly got excited when the followers of Reddit – a social news website often used by political activists – ineffectually attempted to ramp up silver prices in February. But news about commodity prices other than oil and gold rarely make headlines. For most institutional investors, commodities are a Cinderella asset class. A fleeting moment in fashion before the 2008 global financial crisis (GFC) has been superseded by widespread indifference.

-

Features

FeaturesSelectivity is key in SPAC market

The vogue for special purpose acquisition companies (SPACs) has something in common with many other fashions, whether in investment or in the shops. Just when you think the trend cannot get even hotter, the temperature rises yet further.

-

Features

FeaturesLong term assets: Proposed vehicle aims to help DC funds access private asset classes

The UK’s chancellor of the exchequer, Rishi Sunak, has set an ambitious timetable for the launch of a new UK-authorised fund vehicle, the Long-Term Asset Fund (LTAF), by the end of 2021. The LTAF is envisaged to simultaneously help achieve several policy goals by directing pension savings into alternative investments.

-

Interviews

InterviewsStrategically speaking: Allianz Global Investors

Allianz Global Investors (AGI) has long invested in green infrastructure. The market, and the perception of renewable energy for investors in particular, has changed during this time. Investors are ready to engage with renewable energy or cleantech if the underlying technology has a proven track record.

-

Features

FeaturesFixed Income, Rates, Currencies: Rising yields signal reflation

The Federal Reserve has not hinted at its future plans to unwind quantitative easing (QE). However, markets are looking to 2013’s ‘taper tantrum’ for an explanation of the dramatic US-led bond market sell-offs.

-

Features

FeaturesAhead of the curve: Modelling the unmodellable

In January 2020, the world was on the verge of a pandemic. It would empower the state, increase the might of technology firms, speed up technological adaptation, upend cities and accelerate China’s rise.

-

-