Investment – Page 22

-

Features

FeaturesIPE Quest Expectations Indicator September 2020

US COVID-19 figures are receding, to the extent that Brazil has taken over as the world’s worst managed country. A number of western European countries are experiencing a minor rebound, likely because of holiday travel. India has suffered a high death toll but this is partly a reflect of its huge population.

-

-

Special Report

Special ReportSWFs: Never waste a good crisis

Despite pressure on revenues from oil and gas, Arab sovereign wealth funds are taking opportunistic bets in foreign markets in the face of global economic turmoil

-

Features

Briefing: The unbearable lightness of investing

Open the newspaper. Any newspaper. Read the front page and then the money pages. Absorb, assimilate, repeat. After half a dozen goes, a pattern is clear.

-

Features

FeaturesThe Renminbi: A matter of trust

Only a few years ago, there was much hype about the renminbi becoming the next significant reserve currency and potentially even threatening the dominance of the dollar.

-

Features

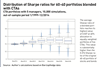

FeaturesHedge funds: ‘Real life’ portfolio evaluation

Outlining an equal volatility-adjusted approach to hedge fund management

-

Features

FeaturesStrategically Speaking: Asoka Woehrmann, DWS

DWS has just unveiled a new, simplified global structure. CEO Asoka Woehrmann explains how the reorganisation will allow the firm to focus on its key business lines

-

Features

FeaturesAhead of the curve: Liquidity has been the litmus test for China’s bond market

It is no safe haven, but China has provided bond investors with important shelter through the storm

-

Features

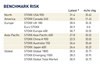

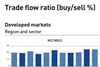

FeaturesFixed income, rates, currencies: Dismay sets in

As lockdowns ease, particularly in the northern hemisphere and the Antipodes, economic recoveries get underway. Given the exceptional circumstances, economic forecasts and predictions may show little consensus, or potentially be wrong, the puzzling US payroll announcements for May being a vivid example.

-

-

-

Features

FeaturesIPE Quest Expectations Indicator July 2020

Global statistics indicate that while new cases of COVID-19 are rising, case mortality is stable at about 4,000 per day. The situation is in hand, but the danger is not over. First, the Americas, dominated by the US and Brazil, are confronted by rising case statistics. Second, there are signals of a rebound in autumn, both in theory as medical experts embrace the thought and in practice, as the figures in Iran show. Third, the equality protests increase the chances of a second wave.

-

Features

FeaturesAhead of the curve: Media, markets and investing in a better world

Hans-Jörg Naumer, director global capital markets and thematic research at AllianzGI, and B. Burcin Yurtoglu, chair of corporate finance at WHU Otto Beisheim School of Management Through our analysis of the impact of media coverage, we not only demonstrate that news can lower or raise financing costs; the results also ...

-

Features

FeaturesBriefing: Hybrids come into their own

Back in the days when sailors relied on sails, they used to dread the doldrums – that zone near the equator where trade winds converge, generating windless weather.

-

Features

Briefing: Six insights on PE

Considerations for private equity investors in light of the coronavirus pandemic

-

Features

FeaturesAhead of the curve: Value investing – bruised, but not broken

The COVID-19-induced market crash of 2020 has battered investors, and in particular the fans of value investing. In the first quarter, value lagged growth by nearly 14% in the US and 13% globally, exceeding quarterly shortfalls at the trough of the global financial crisis. These losses are second-worst among all quarterly outcomes in over four decades, eclipsed only by the runaway tech bubble in the fourth quarter of 1999, as growth soared and value stalled.

-

Interviews

InterviewsStrategically speaking: Dimensional Fund Advisors

“Implementing the great ideas in finance for clients” is the stated mantra of Dimensional Fund Advisors’ founder and executive chairman David Booth. But at times of market stress and volatility, such as this year and in March in particular, even the most sophisticated and long-term-focused investors can question the validity of great ideas.

-

Features

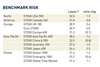

FeaturesFixed income, rates, currencies: Unprecedented times

According to a Wall Street Journal blog, the word “unprecedented” was used in 395 of the publication’s articles in the past three months. Also popular were massive, enormous, staggering and eye-popping

-

-