Investment – Page 23

-

Features

FeaturesIPE Quest Expectations Indicator June 2020

In the EU, statistics for both contagion and death by COVID-19 are still diminishing. Relaxing restrictions typically causes a short recurrence. The UK and Sweden are behind the curve.

-

Interviews

InterviewsStrategically speaking: GQG Partners

As an employee-owned boutique asset manager, GQG Partners is inherently more resilient than many other investment firms, according to chairman and CIO Rajiv Jain

-

Features

FeaturesAhead of the curve: Can the system win in EMs?

Systematic investment models have been commonplace in equity markets. Can they generate returns in emerging market debt?

-

Features

FeaturesBriefing: COVID-19 crisis shines light on private equity tech

It was five years ago that Partners Group’s disaster-recovery team began preparing for a crisis like the one that would shut down all but four of its 20 offices by the end of March.

-

Features

Briefing: A close look at active credit

Research suggests credit mutual funds and hedge funds are not delivering outperformance

-

-

-

Features

FeaturesIPE Quest Expectations Indicator May 2020

Using last month’s model of the statistics on daily new cases as an early indicator and daily case mortality as evidence of policy change, the 21 April situation looks like:

-

Features

FeaturesBriefing: Europe turns Japanese

Despite the more immediate concerns of the COVID-19 pandemic, the spectre of ‘Japanisation ’ casts a dark shadow over euro-zone investment markets. It is possible that the current crisis will supercharge the pre-existing trend for Europe to follow Japan’s economic and financial experiences.

-

Features

FeaturesBriefing: A safe haven

Treasuries, the yen, and gold all traditionally serve to harbour investors in times of stress. A closer look at the current demand for Treasuries, however, paints a complex world view with implications for financial markets. Yields suggest it might remain ugly for another decade.

-

Special Report

Special ReportStrategically Speaking: HSBC Global Asset Management

As the financial markets enter uncharted territory, HSBC GAM could be well placed to take advantage of the dislocations in Asian and emerging markets. Its aim, though, is to offer investors the full spectrum of fixed-income solutions, says Xavier Baraton, global CIO for fixed-income private debt and alternatives.

-

Features

FeaturesAhead of the Curve: The mega-cap conundrum

Last year was challenging for quantitative equity strategies with a large proportion of them underperforming their benchmark on a rolling one-year basis. There has, therefore, been a great deal of interest in understanding the shortcomings of quantitative portfolios over the same calendar year.

-

-

-

Features

FeaturesIPE Quest Expectations Indicator: April 2020

This months’ figures were collected before the successive stock-market slumps.

-

Features

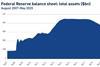

FeaturesFixed income, rates, currencies: Global economy under pressure

At the end of February, after a week that saw stock markets around the world plummet, US Federal Reserve chair Jerome Powell sought to calm fears, saying that the Fed would “act as appropriate” to support growth.

-

Features

FeaturesEmerging market outlook

Emerging markets have a knack for being in the headlines for the wrong reasons. They also stand out as sources of growth for investors who face low interest rates and muted economic performance in the developed world

-

Features

FeaturesDollar/sterling: The road ahead for cable

The twisting path of the dollar/sterling relationship over 2020 will provide ongoing theatre, punctuated by moments of intensity

-

Features

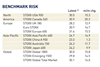

FeaturesGeopolitical risk: The new norm

Geopolitical risk is now the norm and not the exception, and brings with it a rise in volatility,” says Joyce Chang, chair of global research at JP Morgan, adding: “This volatility has tended to create more noise than trend.”

-

Features

FeaturesESG: What drives ATP to divest?

Short of flying someone to Mexico City to knock on the door of the mining and transport company’s headquarters, the Danish pension fund had done all it could. Selling off its DKK13m (€1.7m) block of shares in Grupo México was not what ATP really wanted to do at the end of last year.