IPE's EU Coverage – Page 16

-

News

EC advisers adjust proposed social taxonomy structure given feedback

Social taxonomy would help by clearly defining what constitutes a social investment

-

Special Report

Special ReportSpecial Report - Regulation

Europe’s flagship SFDR regime for ESG was never intended to become a fund-labelling framework. So as Susanna Rust also writes in this issue, it is a relief that the EU is now consulting on minimum requirements for Article 8 funds. In this Special Report, we look in some depth at how asset managers have embraced SFDR, taking in the broad reclassification exercise that has taken place to relabel existing funds, and the short-term risks of greenwashing. In the longer term, the hope is for much more standardisation and there are signs that this is already happening.

-

Special Report

Special ReportCSDR’s settlement penalties kick in

New regulations attempt to clarify and standardise securities settlement procedures

-

Opinion Pieces

Opinion PiecesViewpoint: Greenwashing needs to be pinned down

On 10 March 2022, the EU’s Sustainable Finance Disclosure Regulation (SFDR) turns one. In terms of how it was drafted and how it has been implemented, it hasn’t exactly covered itself in glory, although it was high time regulators got involved to try to bring some order into ESG-land.

-

Features

FeaturesAccounting: DB sponsors at a crossroads

If a decade ago the talk was of defined-benefit (DB) scheme sponsors locked in an infernal struggle against the dizzying gravity of spiralling accounting deficits, thoughts now are turning to the end game.

-

News

NewsESG roundup: EU Council agrees position on CSRD

Plus: FCA writes to credit rating agencies; New framework classifies climate risks at firm level

-

News

Greenwashing fight a priority for ESMA in new roadmap

EU watchdog emphasises need for shared understanding of greenwashing and identifying it under the SFDR

-

News

Natural gas doesn’t need EU green taxonomy inclusion – EDHECinfra

And including it could harm renewable energy investment

-

News

Commission taxonomy decision lamented as political, creating confusion

The Dutch Pension Federation is calling on the European Parliament to reject the Commission’s proposal to include natural gas and nuclear energy in the taxonomy

-

News

SFDR Article 8 fund label questionable in 20% of cases, analysis suggests

Advisory and portfolio analytics firm delivers ’clinical assessment of the state of ESG integration in the European fund management industry’

-

News

ESMA launches call for evidence on ESG ratings market

To be complemented by separate consultation from European Commission

-

News

ESMA recommends final one-year clearing exemption for pension funds

PensionsEurope welcomes announcement, calls for European Commission to start rule-making process early

-

Special Report

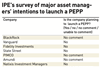

Special ReportSpecial Report – Pan-European Personal Pensions

From March, the European Commission’s vision of a simple, cross-border savings product becomes a reality with the launch of the Pan-European Personal Pension Product (PEPP). EU citizens will for the first time be able to channel savings into a long-term third-pillar product that is cost effective, simple and portable across borders.

-

Special Report

Special ReportPEPP: Few players on the starting line

In March, the European Union’s Pan-European Personal Pension Product (PEPP) framework comes into effect, amid doubts about the take-up by providers

-

Special Report

Special ReportFrancesco Briganti: All’s well that ends well for PEPP?

Despite the remaining questions, the impact of the PEPP on European pensions could be positive

-

Special Report

Special ReportCase study: Readying PEPP for launch

The EU’s PEPP is like a shuttle aircraft, with the potential to carry individual savers across Europe. But its flight plan is detailed and complex, and admin providers play a key role in preparing PEPP for launch

-

Opinion Pieces

Opinion PiecesThe EU taxonomy needs rescuing

The EU taxonomy, a system for identifying what economic activities count as sustainable, has been in the spotlight since the news broke on new year’s eve about a proposal from the European Commission to extend it to cover nuclear energy and natural gas. It is unclear how long the controversy will last.

-

Opinion Pieces

Opinion PiecesGuest Viewpoint: Is Europe on track to become sovereign?

The Next Generation EU (NGEU) programme is designed to speed up the EU recovery and spur growth over the medium and long term. More importantly, it represents a unique opportunity to lay the foundations of a deep and liquid European safe asset.

-

News

Proposed EU green bond regulation amendments worry ICMA

Capital markets body says changes put forward ’reflect fundamental shift’ from EC’s proposal