IPE's Germany Coverage – Page 10

-

Features

FeaturesBriefing: The challenge of investing in Europe’s energy transition

The way the European economy powers itself is undergoing a fundamental shift, driven by market forces and policymakers. But while the direction of travel is clear, the path to a different energy mix is tortuous and the shift may be much slower than required to meet Europe’s target to be net zero by 2050.

-

Analysis

AnalysisIPE DACH Briefing: Germany mulls over increasing security/defence spending

Plus: Bundesrat recommends reviewing second pillar pension system; Swiss Federal Supreme Court rejects complaints on pension reform

-

News

NewsAmundi builds on multi-layer private markets strategy for DACH region

The next steps in Amundi’s private markets strategy in Germany are to promote ‘healthy growth’ among institutional investors and double AUM to €5bn in the next 3 years

-

News

NewsGerman parties relaunch pensions policies as election campaign starts

The Union plans to introduce mandatory pension schemes for the self-employed, while SPD will continue to support stable pensions at 48% of an early retirement for people with 45 years of contributions

-

News

NewsGermany pushes EU Commission to scale back sustainability reporting rules

Germany asks EU Commission to postpone the CSRD application deadline by two years

-

News

NewsGerman associations relax exclusion criteria for investments in defence sector

BVI and others publish a new version of ESG target market concept (Zielmarkt Konzept), scrapping revenues threshold to invest sustainably in the defence sector

-

News

NewsVerka takes over operational business of German Red Cross pension scheme

Verka will manage close to €4bn by adding the €780m under the Deutschen Roten Kreuz scheme

-

News

NewsGerman funds for professionals to apply new asset allocation stress test

Pension funds will pass the test if they have sufficient risk capital to cover stressed assets, and if the funding ratio is at least 100%

-

News

NewsGerman government backs sustainable investing in defence sector

Sustainable investments association FNG says weapons are ‘not compatible with the principles of sustainable investing’

-

News

NewsGerman Spezialfonds record worse capital inflows since 2008/09 financial crisis

Spezialfonds received net cash inflows of €1.7bn in July, but in August and September stood at almost the same amount, so ‘net new business’ came to only €45m

-

News

NewsWTW to set up shop in Germany for pension buyout deals

German buyout market is worth potentially €600bn, according to consultancy Lurse

-

Analysis

AnalysisGerman occupational pension schemes gear up for 2025

Pensionsfonds continue to be one of the most preferred vehicles for companies to outsource direct pension promises

-

News

NewsGerman parties slam FDP’s attempt to reform third pillar pension system

BVI says Germany’s political parties are already in election campaign mode and are using the opportunity to set their own agenda

-

News

Germany’s Bundesrat recommends review of second pillar reform

The Bunderat recommends reviewing whether a significant increase in the maximum possible amount of funding beyond a wage adjustment is possible

-

News

NewsSustainable Finance-Beirat expects next government to continue transition finance plans

Chair Silke Stremlau says

-

Asset Class Reports

Asset Class ReportsEquities: US equity markets expected to gain from Trump’s victory

As the political dust settles following Donald Trump’s victory in the US presidential elections, global equity funds are eagerly eyeing the incoming administration and the opportunities it may offer

-

Features

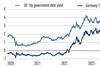

FeaturesFixed income, rates, currencies: All eyes on Trump’s return

With the Republican Party now in control of both Senate and House, the leeway that President-elect Donald Trump will have to enact his pre-election policies could be considerable.

-

Interviews

InterviewsHypoVereinsbank pension funds: Searching for sustainability in private markets

Markus Schmidt, director of asset management for the pension funds of Germany’s HVB, talks to Carlo Svaluto Moreolo about the schemes’ combination of strict liability and risk management with a broad growth portfolio and sustainability focus

-

Opinion Pieces

Opinion PiecesGerman pension reforms in limbo after coalition government collapse

The collapse of Germany’s three-way ‘traffic light’ coalition in November opens questions about the fate of the pension reforms it had drafted over the past couple of years. The government, led by Olaf Scholz, started in 2021 with a mission to reinforce the capital-funded component of the pension system.

-

News

NewsBVI warns of new law for venture capital, infra investments being politicised

The new rules create a legal framework that removes obstacles for investment in infrastructure and renewable energy projects