IPE's Germany Coverage – Page 26

-

News

NewsBVI develops index for Spezialfonds to track funds’ share performance

The index showed that, because of larger allocations to bonds, the shares held in Spezialfonds by German investors are less volatile than equities

-

Opinion Pieces

Opinion PiecesGermany's first-pillar pension reform plans: tough to meet expectations

How would you design your asset allocation if you were building a portfolio from scratch? This is the question facing the governors of Germany’s new state pension buffer fund, the grandly titled ‘Generationenkapital’ (Generational Capital) fund. The expectations are high.

-

News

NewsGerman insurance association proposes Bürgerrente for third-pillar reform

The provision of private pensions ‘needs a fresh start’, says GDV president

-

News

City of Berlin to issue €750m in sustainable bonds

The city’s first sustainable bond is being issued in line with the internationally recognised market standards of the International Capital Market Association

-

News

NewsBaFin warns of sinking reserves for Pensionskassen with higher interest rates

The regulator has identified six main risks for 2023 in its latest risk report

-

News

NewsGerman Green Party defies idea of growing first pillar equity pension funds

Green MP Frank Bsirke warned against diverting contributions for investment in the equity market ‘at the expense of millions of pensioners’

-

News

NewsGerman government to start discussions on third pillar pensions reform

A focus group, under the leadership of the Ministry of Finance and including academics, associations and social partners, are to meet on 24 January

-

News

NewsDACH roundup: DAX companies’ pension assets drop

Plus: WTW Switzerland buys GiTeC, Swiss parliamentary committee consults on second pillar reform

-

News

NewsGerman government to set up foundation with up to €150bn for first-pillar pension reform

Nuclear waste management fund KENFO to help Stiftung Generationenkapital on asset management

-

News

NewsGerman coalition parties fire back at proposals to change pensions

Chair of the Council of Economic Experts called to increase retirement age, contribution rates, and cut high pensions

-

News

NewsVBL names Angelika Stein-Homberg as new chair

Stein-Homberg succeeds Richard Peters, who retired at the end of last year after serving on the board of VBL for 25 years

-

News

NewsDACH roundup: BaFin orders Eurex Clearing to act on risk management

Plus: Swiss APK applies minimum interest rate on pension assets

-

News

NewsGerman employers’ associations call on government to act on pension reforms

The German labour market continues to have structural problems, and one solution is to create the right conditions for people to work longer, says BDA

-

Opinion Pieces

Opinion PiecesGermany’s equity pension plan raises questions

The current legislative period could bring substantial changes to Germany’s pension system. The government is pursuing reforms to fund first-pillar pensions through a buffer fund invested in equities, although there is little consensus on its feasibility.

-

Features

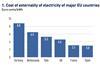

FeaturesESG: Germany’s energy options

The country’s reliance on Russian gas means its change of energy sources will carry a larger environmental cost

-

News

NewsGerman, Austrian pension fund assets could drop by up to 14% in value

Pension funds predominantly favour external ESG ratings/indices to review sustainability factors in investments

-

News

NewsDACH roundup: German pension schemes’ assets in Spezialfonds shrink

Plus: Austrian fund industry hit by war in Ukraine; Swiss cabinet sets date for first pillar reform

-

News

Chancellor Scholz opens up discussions on early retirement

A flexible retirement age would give individuals options for a transition to retirement and in turn making the possibility to work longer more attractive

-

News

NewsAktienrente fund needs ‘three-digit billion’ sum for impact, says German finance minister

The funds the government plans to allocate in the initial phase for the statutory equity pension are not sufficient, says Christian Lindner

-

News

NewsBVI proposes fund saving accounts to reform third pillar pensions

German government tasked group of experts to examine the introduction of private products with higher returns than Riester-Rente for pensions