All IPE articles in January 2015 (Magazine) – Page 3

-

Special Report

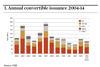

Special ReportSpecial Report, The M&A Cycle: Turning the ratchet

Convertible bonds are not only a good way for fixed-income investors to protect themselves against the ravages of M&A. Martin Steward and Anthony Harrington find that they are a great risk-managed way to exploit the cycle, too

-

Opinion Pieces

Letter from the US: Data managers

Technological tools, data management, attention to governance and transparency are the most important issues for pension fund CIOs right now.

-

Features

Supply, demand and the Juncker plan

A plan to meet the EU’s infrastructure needs was announced as 2014 drew to a close, with new European Commission president Jean-Claude Juncker launching an investment fund that will be leveraged up to €300bn with institutional capital and guarantees aimed at reducing risk.

-

Features

A divergent opinion

If there is one big idea running markets around the world at the moment, it’s the ‘great policy divergence’. I’ve articulated the idea more than once: just last month I suggested it would take a “brave, brave soul to bet against the dollar”.

-

Asset Class Reports

Investing In Small & Mid-Cap Equities: Focus from diversity

Rummaging through successful small-caps portfolios reveals a diversity of opportunity, finds Martin Steward. This diversity enables portfolio managers to express very well-defined styles in their portfolio risk

-

Asset Class Reports

Investing In Small & Mid-Cap Equities: The M&A effect

The M&A theme tends to be big in small-caps: these companies are growing, often via their own acquisitions; and becoming assets coveted by both LBO from below and large-caps from above. Our featured strategies feel its effects as both a blessing and a curse.

-

Asset Class Reports

Investing In Small & Mid-Cap Equities: Keeping it in the family

Germany’s Mittelstand shows why mom-and-pop shops, despite the risks, can create superior success from local networks and a longer-term view of their businesses. Joseph Mariathasan investigates

-

Asset Class Reports

Investing In Small & Mid-Cap Equities: Taking small-caps global

Brandes Investment Partners has been managing global small caps since 1997. “It’s a big pond with a lot of fish but very few anglers,” as director of investments Luiz Sauerbronn puts it.

-

Asset Class Reports

Investing In Small & Mid-Cap Equities: Northern exposure

While the Swedish stock market in general can be rather volatile, this goes to an even greater extent for Swedish small-caps. But as Caroline Liinanki finds, for those able to handle the short-term market movements investing in smaller Swedish companies has been a very profitable move

-

Features

Selfish EU governments put future of union at risk

Selfish EU governments are putting the continued survival of the European Union at risk, Ireland’s former taoiseach John Bruton has warned, as he told IPE the UK was likely to be the only outlier in a two-speed Europe.

-

Features

Focus on pension funds’ social purpose

One of the most important victories during the recent bargaining process over the revised IORP Directive is related to the fundamental nature of pension institutions.

-

Country Report

When the trend is not your friend

The convergence between asset management and consultancy was a topic for discussion at a conference on fiduciary management organised by the German Federation of Financial Analysts and Asset Management (DVFA) in Frankfurt last November.

-

Features

How we run our money: KZVK-VKPB

The two schemes are separate legal entities but are managed through a single fund and investment team, led by CIO Wolfram Gerdes

-

Features

FeaturesInterview: Yngve Slyngstad, NBIM, Master of the universe

Yngve Slyngstad is one of the most influential asset owners in the world. As chief executive of Norges Bank Investment Management (NBIM), he oversees the day-to-day affairs of the Government Pension Fund Global, the sovereign wealth fund that claims ownership of 1% of all equities worldwide – and 2.5% of those listed on European exchanges.

-

Features

Some Kodak moments

At the recent IPE Conference and Awards event, the audience voted on many questions but two really were extraordinary moments worth capturing.

-

Features

Markets and pensions

Do financial markets reward countries that have a fully funded and mandatory second-pillar pension system? It is hard to say. But it’s clear they do not penalise countries that dismantle theirs.

-

Features

New ways to talk to your members

As European social welfare budgets come under pressure, persuading stakeholders of the need both to make retirement provision and to save towards it is becoming more crucial. Yet planning and funding a communications strategy to achieve this will be wasted if members neglect to read or simply ignore the literature. ...

- Previous Page

- Page1

- Page2

- Page3

- Next Page