All articles by Joseph Mariathasan – Page 3

-

Opinion Pieces

Opinion PiecesBond markets look set to become the new stewardship powerbroking arena

Investors in bond markets are starting to assume a more powerful position than equity investors to influence companies and countries. Innovation is sweeping through bond markets with the introduction of specific ‘use of proceeds’ bonds and sustainability-linked bonds.

-

Asset Class Reports

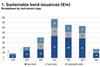

Asset Class ReportsClosing the data gap in green, social and sustainability-linked bonds

Luxembourg’s bourse has capitalised on its experience as a green bond hub

-

Asset Class Reports

Asset Class ReportsGreen bonds reach escape velocity

The green bond market looks set to grow further, despite pressure from many sides and key questions over their function

-

Asset Class Reports

Asset Class ReportsThe quest for innovation in sustainable fixed income

Japan’s climate transition bond is the latest in a string of innovative developments in sustainable fixed income

-

Opinion Pieces

Opinion PiecesSmall island states turn to institutional investors to protect oceans

Small island developing states may have a total population of only around 65 million, but through their exclusive economic zones they control about 30% of oceans and seas, according to the International Institute for Sustainable Development (IISD).

-

Asset Class Reports

Asset Class ReportsA changing Saudi Arabia proves attractive for investors

Equity market is starting to open to investors as the country liberalises strict rules

-

Asset Class Reports

Asset Class ReportsIs India’s equity market now the new China in investors’ eyes?

Better governance and a clear economic path may put India in the lead

-

Opinion Pieces

Opinion PiecesA template for innovation and investment opportunity in health services

Introducing innovations into entrenched organisations is always a challenge. No more so than in the UK’s much loved, much criticised and, many would argue, barely functioning National Health Service (NHS). Yet revolutions in AI and technology should be able to transform the NHS for the better in a cost-effective manner.

-

Asset Class Reports

Asset Class ReportsLegal systems key in emerging market private credit

In the legally complex world of emerging markets, private credit investors naturally favour those with cleaner legal systems

-

Opinion Pieces

Opinion PiecesDemocracy: a missing ingredient in ESG?

Nearly half the world’s population is facing elections to change governments in 2024, yet democracy appears to be in decline across the globe. How should investors respond?

-

Opinion Pieces

Opinion PiecesA thematic focus on sustainability

The evidence for global temperatures rises caused by human emissions of greenhouse gasses (GHGs) has become overwhelming. That means there will have to be a huge adaptation by human societies across the globe to the reality of significant climate changes in the next few decades.

-

Opinion Pieces

Opinion PiecesInterview: Elizabeth Fernando on NEST’s new thematic strategy

Sustainability focus underlines NEST’s growing importance as a UK institutional investor

-

Opinion Pieces

Opinion PiecesMansion House reforms: UK government should embrace long-term thinking to boost the economy

Other countries have been far better than the UK at creating long-term strategies that have been maintained way beyond the five-year or shorter electoral timescales on which UK politicians focus

-

Asset Class Reports

Asset Class ReportsUK equities fail to regain their shine

UK pension funds are abandoning domestic equities, and the country’s global weighting in indices has also declined significantly

-

Opinion Pieces

Opinion PiecesUK equities: stop tinkering and focus on the long term

As the UK heads for a general election this year, both major parties (Labour and Conservative) will be proclaiming their solutions to the UK’s perennial problems of chronically low levels of investment, a dearth of new innovative companies and disappointing growth.

-

Asset Class Reports

Asset Class ReportsDebt investors face European uncertainty

High interest rates and inflation are the biggest concerns as recession looms

-

Opinion Pieces

Opinion PiecesLabour market evolution: the macro trend that investors cannot ignore

Macroeconomic factors can overwhelm micro ones for investors. The impact of COVID is a good example. But the short-term impact of COVID on labour markets can mask structural trends in the evolution of labour markets that have much more profound long-term impacts, according to a paper by PGIM

-

Opinion Pieces

Opinion PiecesLondon’s new Lord Mayor sets out his stall for the City as a centre for global problem solving

The newly elected Lord Mayor of the City of London Michael Mainelli is keen to position the City as a global problem solving hub and not just a financial services centre

-

Asset Class Reports

Asset Class ReportsAI: Moving from innovation to early adoption

Generative artificial intelligence (AI) capable of generating text, images and even music has stepped into the limelight after decades in the making. It will eventually have an impact across most industries, comparable to the impact of the internet. But while the world may have reached an inflection point in the usage of generative AI, a lot needs to happen before companies are positioned to take full advantage of the developments in large language models (LLMs) such as ChatGPT.

-

Asset Class Reports

Asset Class ReportsPrivate equity managers reflect on AI’s power to transform healthcare

There are plenty of opportunities for investors, but the regulatory obstacles must be understood