All IPE articles in July/August 2021 (Magazine)

View all stories from this issue.

-

-

-

Features

FeaturesIPE Quest Expectations Indicator - July 2021

At the time of writing, over half of the US population was vaccinated against COVID-19 with the EU at 40%. UK figures give a positive picture but the threat of new strains remains. The G7 have announced plans to supply vaccines to developing countries.

-

Features

FeaturesIPE Quest Expectations Indicator - August 2021

The next wave of COVID-19 has come to pass earlier than expected, largely due to new variants. The UK is hard hit, being sensitive to variants Alpha, Beta and Delta. The EU is next in line, with the Netherlands, Spain and Denmark in the forefront and Delta playing a leading role, but other member states are right behind. There is no sign of the next wave in the US yet, but it is sensitive to the variants Gamma and possibly Alpha, which plays a role in Canada.

-

Features

Accounting: The Friedman conundrum

The world, or rather capitalism, has come a long way since Milton Friedman’s 1970 New York Times opinion piece The Social Responsibility of Business is to Increase Its Profits. Corporations, he argued, have no responsibility beyond the duty they hold to shareholders.

-

Features

FeaturesEuropean venture capitalists finally adopting ESG

Many would argue that venture capital (VC), at its core, has a positive impact on the world as it is driven fundamentally by the desire to solve society’s problems. But there is a contradiction between that driving mission, and the reality of the slow adoption of ESG into the consciousness and the investment processes of VCs and their assets.

-

Features

FeaturesDigital transformation: Take advantage of the digital reset

Covid has accelerated the digital transformation across all industries. How has it contributed to new trends and opportunities in private debt and how can investors benefit?

-

Features

FeaturesAhead of the curve - Green assets: An alternative to green bonds

Policy performance bonds, in which returns are linked to ESG outcomes, would be a positive alternative to green bonds

-

Country Report

Country ReportPrivate markets: Seeking post-COVID alternatives

Italian pension funds continue to invest in private markets ahead of a potentially promising post-Covid recovery phase

-

Features

FeaturesStrategically speaking: Lyxor & Amundi

Lyxor has made a mark over the 20-plus years of its existence, pioneering managed accounts for hedge funds, including the first dedicated institutional managed account platform, that it created for PGGM in 2010.

-

Features

Pensions insider: A DIY approach could harm large transactions

In the second in a series of articles aimed at empowering trustees, our expert contributor describes how to diplomatically sidestep problems when your good in-house team isn’t right for a complex task

-

Opinion Pieces

Opinion PiecesLetter from Australia: When the ‘kill switch’ misfires

The Australian government is attempting to push through Parliament legislation that would selectively benchmark the performance of superannuation funds – but has given up its intention to override investment decisions made by super funds.

-

Features

FeaturesBriefing: Central bank digital currencies take shape

Central bank digital currencies (CBDCs), also sometimes called govcoins, have suddenly become a subject of public discussion. Until recently the topic was mainly the preserve of a coterie of technical experts working for central banks and niche technology firms. But now there seems to be immense excitement about their potential to transform finance. There are even some who suggest the new technology could allow the renminbi to overtake the dollar as the world’s leading cross-border currency.

-

Interviews

InterviewsHow we run our money: Fondo Pensione Nazionale BCC CRA

Sergio Carfizzi (pictured), CEO of Italy’s Fondo Pensione Nazionale BCC CRA, tells Carlo Svaluto Moreolo about the fund’s ambitious alternative-investment programme

-

Features

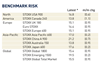

FeaturesBriefing: New benchmark to reduce cost of FX transactions

Among the areas of focus for a pension fund looking to cut costs are the fees charged by its asset managers, usually as an annual percentage of assets under management, plus costs for other services. As part of a cost-cutting exercise, however, foreign exchange (FX) is often neglected. But as funds increasingly invest outside their home country, FX transactions are acquiring more significance because of the need to hedge foreign currency fluctuations. And these deals can carry hidden costs.

-

Features

FeaturesBriefing: Bonds on the blockchain

Bitcoin’s wild ride has been hard to ignore this past year. However, it has mainly attracted its stalwart audience of retail investors, family offices and hedge funds. Institutional investors mostly sat on the sidelines, although interest has been piqued. Digital assets, most notably bonds and not cryptocurrencies, are likely to garner the inflows owing to the comfort of regulation and established market infrastructure.

-

Features

FeaturesBriefing - Growth private equity: From margin to multiple

Private equity may have a reputation for buying cheap, levering up and selling high. But with a record $30bn (€25bn) sitting in European growth vehicles, true business growth is expected to play a greater role in coming years.

-

Features

FeaturesBriefing - Energy: IEA sets net-zero target

The energy sector is the source of about three-quarters of greenhouse gas emissions at present and yet until only recently, the influential International Energy Agency (IEA), an inter-governmental group, had not produced a fully-fledged aligned pathway with the goal of limiting the rise in global temperatures to 1.5°C above pre-industrial levels.

-

Country Report

Country ReportSecond-pillar pensions: The virtuous circle that will not start

Italy’s second-pillar pension system is developing but the industry awaits more decisive policymaking

-

Features

FeaturesLong term matters: It’s corporate tax, stupid

Bill Clinton used the slogan “It’s the economy, stupid” to help him win the 1992 US presidential election. The same now applies to corporate tax in 2021.