All IPE articles in July/August 2024 (Magazine) – Page 2

-

Opinion Pieces

Opinion PiecesWhy the green transition throws up workforce and pension challenges

Pensions are a hot topic in corporate Germany, where skills shortages and an ageing workforce have led to a war for talent, as well as a renaissance in occupational retirement provision in the fight for workforce skills.

-

Opinion Pieces

Opinion PiecesA mid-year stock take on ESG: talk is no longer cheap

It’s halftime for 2024, which offers a convenient reason to reflect on where we are with respect to ESG investing. I’d say the outlook is pretty good. That’s because, as global equity impact investor WHEB Asset Management says, the “ESG tourists – asset managers that stampeded into the sustainability market just a few years ago – are now packing their bags” as the depth and breadth of anti-greenwashing regulation bite.

-

Asset Class Reports

Asset Class ReportsMulti-asset private credit comes to the fore

Investors are increasingly looking at multi-asset private credit mandates for diversification and stable risk-adjusted returns

-

Asset Class Reports

Asset Class ReportsCompenswiss: a newcomer to private credit

Four European pension schemes outline their activity in the private credit market

-

Interviews

InterviewsPreparation is key to countering pensions cyber risk

Pension funds face very real cyber security risks and must prepare for regulatory changes, such as the EU’s Digital Operational Resilience Act. IPE asked European pension funds about their strategies to deal with cyber crime

-

Features

FeaturesReforms are needed to improve pensions in emerging markets

The emerging world is ageing the fastest. Despite having the advantage of a young population, emerging countries are expected to transition to older age groups within 25 years, a change that took over 150 years in some developed nations.

-

Analysis

AnalysisLove it or hate it, ESG is here to stay

The latest wave of regulatory and policy measures will benefit different aspects of ESG investing

-

Asset Class Reports

Asset Class ReportsPenSam focuses on funds

Four European pension schemes outline their activity in the private credit market

-

Country Report

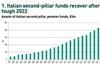

Country ReportSlow growth for Italy's second-pillar pensions

Despite the urgency of increasing second-pillar coverage, policymakers continue to focus reform efforts on public pensions

-

Analysis

AnalysisTowards harmonisation on shareholder rights

Could amendments to the EU’s Shareholder Rights Directive help fix Europe’s splintered voting rules?

-

Features

FeaturesThe next Magnificent Sevens are hiding in plain sight

Like the so-called FANGs that preceded them, one could argue that the Magnificent Seven group of US tech mega-caps that accounted for a large portion of market performance in 2023 are now a part of Wall Street’s history books. Besides two names that have continued to pull away from the pack, the group is no longer commanding investors’ undivided attention.

-

Asset Class Reports

Asset Class ReportsRegulators shine a light on non-bank lenders

Although private market activity is slowing down, there are fears of systemic risk

-

Opinion Pieces

Opinion PiecesThe US perspective on a mixed proxy season

Opinion is divided on whether opposition to environmental and social considerations are increasing following the 2024 annual general meeting season in the US.

-

Asset Class Reports

Asset Class ReportsNEST’s outsourcing strategy

When NEST was weighing up whether to outsource some of its private markets allocations, the decision was not straightforward.

- Previous Page

- Page1

- Page2

- Next Page