All IPE articles in July/August 2025 (Magazine) – Page 2

-

Asset Class Reports

Asset Class ReportsTrade finance: From ‘just in time’ to ‘just in case’

A new joint venture tradeco between Pemberton and Santander aims to give investors access to working capital strategies, and to add a new tech-driven dimension to the age-old business of inventory financing

-

Country Report

Country ReportCasse di previdenza put under the spotlight

First-pillar pension funds have faced parliamentary scrutiny over their investments, returns and relationships with advisers

-

Opinion Pieces

Opinion PiecesEurope must forge its own trade relations policy with China – without relying on the US

Iran has recently been in the headlines, but while its relations with the US have ramifications across the Middle East, the more profound longer-term issue may be America’s relationship with China, as Washington beats the drum of a new cold war with Beijing.

-

Opinion Pieces

Opinion PiecesRethinking diversity: the overlooked value of cognitive differences

Over recent years, the term ‘diversity’ has been stretched in so many directions that its meaning risks becoming lost. The original common-sense goals – improving decision making, widening access to talent and ensuring equal opportunity – have become lost amidst a politicised battle.

-

Features

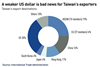

FeaturesFixed income, rates, currencies: Questions over US economic policy dominate global concerns

As ever, the US dominates the global economic landscape. While there is still considerable uncertainty around possible tariffs emanating from the US – despite deals struck by the UK, China and Vietnam – the levels are still expected to be markedly lower than those trumpeted on 2 April.

-

Country Report

Country ReportItalian pension funds consolidation grinds to a halt

Mergers between pension funds have been too few to have an impact on the Italian pension industry

-

Asset Class Reports

Asset Class ReportsFive trends to watch in private credit

From the rise of secondaries and capital solutions funds to the trend of concentration among scale players, private credit is experiencing an intense and rapid phase of development

-

Asset Class Reports

Asset Class ReportsUS versus Europe: will private credit investors shift focus?

As market volatility persists, private credit investors are starting to rethink their allocations to the US in favour of Europe

-

Interviews

InterviewsPension funds eye higher private credit exposure in search of yield

Lured by its high returns and continued strong outlook, pension funds are considering increasing their exposure to private credit amid a fast-evolving landscape

-

Opinion Pieces

Opinion PiecesEurope’s nasty pension tax dilemma

The Nobel Prize-winning economist Bill Sharpe famously once said that retirement drawdown is the “hardest, nastiest problem in finance”. In EU politics, the same thing could pretty much be said about taxation.

-

Opinion Pieces

Opinion PiecesTime for some straight talking on ESG matters

Catherine Howarth, chief executive of campaign group ShareAction, expects more of asset owners.

-

Interviews

InterviewsFondoposte: New investment strategy, same values for Italian postal workers' pension fund

Antonio Nardacci, chairman of Fondoposte, the pension fund for Italian postal workers, speaks to Luigi Serenelli about the fund’s revamped offering, its domestic investments and ESG

- Previous Page

- Page1

- Page2

- Next Page