Latest analysis – Page 20

-

Opinion Pieces

Opinion PiecesGermany's gamble with sweeping pension reforms

This is without a doubt an interesting time for pension reforms in Germany, given the inevitable associated risks of failure.

-

Features

FeaturesTCFD reporting for pension funds in the UK: a progress report

Some 18 months from the introduction of mandatory reporting of climate data by large UK pension funds, evidence shows that the policy has not brought about greater orientation towards green investments

-

Opinion Pieces

Opinion PiecesUS: Sponsors back pension buyouts

In 2022, pension risk transfer (PRT) deals in the US reached a record of over $50bn (€46.5bn), according to estimates. And many industry observers expect demand from plan sponsors for PRT solutions to remain strong in 2023.

-

Opinion Pieces

Opinion PiecesAustralia: Super funds face the future of fossil fuels

After a year when fossil fuel stocks outperformed all other shares, Australian super funds face a conundrum – to buy, hold or sell?

-

Opinion Pieces

Opinion PiecesUS: Republican House will not divert from SECURE 2.0

The new Republican majority in the US House of Representatives is not large enough to have a significant impact on the retirement industry.

-

Opinion Pieces

Opinion PiecesTime to rethink defined contribution pensions design

This year is shaping up to be the worst for investment returns since before the great financial crisis, according to IPE’s latest performance analysis of the leading European pension funds.

-

Features

FeaturesEuropean pension dashboard in the starting blocks

The European Tracking Service for pensions has been years in the making but is now set for a rollout, to be completed by 2027

-

Opinion Pieces

Opinion PiecesAustralia: Supers face A$500m tax hit

In the lead-up to the first budget by a Labor government in 12 years, speculation was rife about what the new Australian government might have in store for the superannuation sector.

-

Opinion Pieces

Opinion PiecesUS: Pension plans face up to a tough 2022

After the terrible returns of the fiscal year that ended in June, what will US public pension funds do? Will they increase their risky investments to try to reach their target returns? Or will they lower their target returns?

-

Features

FeaturesUK LDI woes raise wider European questions

Turmoil in UK Gilt markets has forced continental European pension industries to review their risk management strategies

-

Opinion Pieces

Opinion PiecesAustralia: Super funds shift focus to private credit

An ambition of the architects of Australia’s universal superannuation system, when it was set up in 1992, was to create what would become a fifth pillar of the nation’s banking system.

-

Analysis

AnalysisAnalysis: Outperformance brings factor investing back in favour

64% of investors say confidence in factor investing has improved over the past year, according to Invesco

-

Opinion Pieces

Opinion PiecesLetter from Berlin: The German way to supervise the EU Taxonomy

The German financial supervisory authority, BaFin, has chosen its own path to deal with the EU taxonomy – in particular when it comes to nuclear and gas.

-

Opinion Pieces

Opinion PiecesAustralia: Role for superannuation in nation-building

A new Labor government has set the scene for change in Australia’s growing superannuation industry to ensure that some of the country’s A$3.3trn (€2,3trn) savings pool is directed toward social housing and the energy transition.

-

Opinion Pieces

Opinion PiecesUS: Transparency concerns over SEC private market disclosure rules

Will the US Securities and Exchange Commission’s (SEC’s) new climate risk reporting rules bring more transparency to private markets? Or will they have the unintended consequences of increasing the opacity of the markets?

-

Analysis

AnalysisAnalysis: Goodbye, LDI? Too early to say

The sudden and unprecedented rise in Gilt yields, caused by the UK government massive fiscal stimulus announcement, tested the risk management strategies of UK DB schemes

-

Analysis

AnalysisAnalysis: How Swiss pension funds tackle governance in asset management

‘A professional investment process requires a separation of powers between the investment decision, implementation and monitoring of the investment activity,’ says PPCmetrics

-

Features

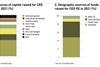

FeaturesCEE private equity: in search of capital

War in Ukraine is just one factor deterring investment in private equity and growth capital in Central and Eastern Europe

-

Opinion Pieces

Opinion PiecesAustralia: Downturn casts a shadow over super anniversary

Australia’s superannuation industry enters its fourth decade under the darkening clouds of a global economic slowdown that is already having a dramatic impact on returns.

-

Opinion Pieces

Opinion PiecesUS: The great unfreeze - does it make sense to reopen DB plans?

US defined benefit (DB) public and corporate pension funds are responding differently to inflationary pressures. Public schemes are more concerned about the negative impact of financial market turmoil on their returns, while corporates are enjoying the rising discount rates that are lowering their liabilities and improving their funded status.