Latest analysis – Page 24

-

Opinion Pieces

Opinion PiecesLetter from Australia: Coalition mulls super hike

There are arguments both for and against a rise in compulsory superannuation contribution rate as Australia emerges from the COVID-19 pandemic .

-

Opinion Pieces

Opinion PiecesLetter from US: The rise of the new alternatives

Pension funds and other institutional investors used to invest in hedge funds aspiring to outperform public stock and bond benchmarks. Now, after years of disappointing performances, they have changed their attitude. They still invest in hedge funds, but the new expectation is simply to get a few percentage points above the return on zero risk investments.

-

Features

Accounting: Getting there eventually

You could be forgiven for thinking that audit reform has a lot in common with online shopping: knowing what you want is the easy part – it is fulfilment that is the let-down.

-

Features

FeaturesPerspective: Nicolai Tangen & NBIM

Less than a year after his controversial appointment, criticism of Nicolai Tangen’s leadership of Norges Bank Investment Management is building

-

Analysis

AnalysisBridgewater: Fluent in risk, return… and impact

Bridgewater Associates, one of the most prominent macro hedge funds, is reflecting the integration of sustainability in its research process with two senior appointments.

-

Opinion Pieces

Opinion PiecesLetter from Australia: A question of gender imbalance

Statistics offer a snapshot into the real world and they reveal a depressing picture of gender inequality in Australia’s superannuation system.

-

Opinion Pieces

Opinion PiecesLetter from US: Aid without reform set to resolve the multi-employer pension plan crisis

Until March, The prospective collapse of multi-employer pension plans meant that over one million retired truck drivers, shop assistants, builders and other members of 186 schemes were at risk of losing their retirement benefits.

-

Features

Reporting: Yours sustainably…

You know how one thing can lead to another? Well, that is what happened with the International Financial Reporting Standards Foundation’s steps into sustainability reporting.

-

Features

FeaturesPerspective: APG & E Fund in China

APG’s partnership with E Fund Management has produced tangible results

-

Analysis

AnalysisAnalysis: EC gets to issuer side of sustainable finance measures

Major corporate sustainability reporting proposal delivered alongside final draft climate taxonomy criteria

-

Analysis

AnalysisAnalysis: Pension funds embark on SFDR implementation journey

IPE analysis across four key EU pension jurisdictions finds uncertainty about the final detailed rules underpinning the anti-greenwashing regulation

-

Opinion Pieces

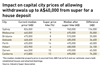

Opinion PiecesLetter from Australia: Should super savings fund homes?

A post-COVID-19 housing boom has made the future of Australia’s A$3trn (€2trn) superannuation savings pool a hot topic.

-

Opinion Pieces

Opinion PiecesLetter from US: Pension bonds raise concerns

The resurgence of interest in pension obligation bonds (POBs) is one of the effects of the pandemic on the US pension funds industry. Indeed in 2020 POB issuance reached its highest level in a decade, exceeding $6bn (€5bn), according to Municipal Market Analytics (MMA), an independent research firm focusing on the US municipal bonds.

-

Features

FeaturesDB accounting: Lump-sum benefits

Service-defined lump-sum payments are causing accounting attribution problems

-

Features

FeaturesPerspective: UK actuaries and COVID-19 – Exceeding expectations

COVID-19 has brought few positive outcomes but the response from UK actuaries could become a template for bringing other strategic challenges to the fore

-

Opinion Pieces

Opinion PiecesLetter from US: COVID and racial justice to the fore

The 2021 proxy season’s hot issues are human capital management related to COVID-19 and social justice. Several large US public pension funds are at the forefront of these campaigns together with non-profit shareholder advocacy organisations like the Interfaith Center on Corporate Responsibility (ICCR) and As You Sow, a non-profit foundation that promotes corporate accountability.

-

Features

FeaturesPerspective: Pooled investors gain a vote

A disruptive new service allows institutional investors in pooled funds to express their stewardship preferences. Will others follow suit?

-

Opinion Pieces

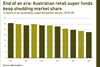

Opinion PiecesLetter from Australia: Retail super funds in distress

Australia’s once-dominant retail super funds are witnessing the end of an era as they wrestle with loss of consumer confidence in their brands. Hastening change has been the rise of industry supers, which benefitted from damaging evidence provided to the Hayne Royal Commission in 2018.

-

Opinion Pieces

Opinion PiecesThe world is approaching an inflection point

Domestic challenges and US political developments have proved such a preoccupation recently that it has been all too easy to miss a key global shift. China’s rise to global prominence has accelerated markedly as a result of the past year’s events.

-

Opinion Pieces

Opinion PiecesCOVID-19 barely tested the financial system

The financial system seems to have coped well with COVID-19. This is despite the repeated recent warnings about a build-up of systemic risk. In turn this has been linked to the abundance of cheap debt and the growth of the asset management industry.