Latest analysis – Page 30

-

Features

Editor's Notes: A radical ambition

Last month’s three doorstop reports from the EU’s 35-strong technical expert group (TEG) on sustainable finance have the potential to radically repurpose capital markets.

-

Features

FeaturesEC’s expert group releases landmark climate taxonomy

The European Commission’s expert group on sustainable finance last month published its long-awaited final recommendations for a taxonomy of environmentally sustainable activities, which is at the heart of the EU executive’s plan to harness the finance sector for its fight against climate change.

-

Features

FeaturesDutch pensions agreement dodges the real issues

Social partners have agreed compromises relating to the state pension age and early retirement Many crucial aspects are yet to be confirmed and could still derail efforts to reform the system

-

Book Review

Book ReviewBook review: Achieving Investment Excellence

Fix asset allocation and the numbers will follow. This rule of thumb originated from an influential study published in 1986, which showed that 93.6% of variations in a portfolio’s returns are due to asset allocation policy.

-

Features

IAS 19: How did they do it?

Two academics have analysed key amendments to IAS 19 and how they came about

-

Features

FeaturesPerspective: Growing buzz around cannabis

Legalisation of cannabis raises ethical questions for some investors, while presenting an investment opportunity for others

-

Features

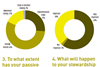

FeaturesResearch: Passive investors, active owners

The rise of index investing raises important question about ownership rights and governance

-

Opinion Pieces

Opinion PiecesLetter from the US: On a secure retirement path

The most significant changes to US retirement plans in more than a decade look set to be approved by Congress. On 23 May, the House of Representatives passed the Secure Act – Setting Every Community Up for Retirement Enhancement – by 417-3, and the Senate is also likely to approve it, with President Donald Trump unopposed.

-

Features

FeaturesNo going back

There is no going back to the days when the key political divide was between mainstream left and right

-

Features

FeaturesEurope belatedly turns eastwards

The EU’s lack of a common strategy to respond to the rise of China as an economic superpower suddenly came to the fore earlier this year, as Italy joined China’s Belt and Road Initiative (BRI).

-

Features

FeaturesDC’s collective voice could be decisive

Australian pension funds could soon become the biggest shareholders in their country’s equity market (see page 5), with researchers at Rainmaker Information forecasting their combined domestic stock holdings to hit 60% by 2033.

-

Book Review

Book ReviewBook review: The Rise of the Working-Class Shareholder

David Webber is well placed to rehearse the legal and political arguments around public pension funds’ power to change companies

-

Features

FeaturesInterview: Sharon Bowles – A forensic assessment

The former chair of the European Parliament’s Economic Affairs Committee talks to Stephen Bouvier

-

Features

FeaturesInterview: Haukur Hafsteinsson, LSR

The government pensions veteran bids farewell to LSR, Iceland’s largest pension, after 34 years as its chief executive

-

Opinion Pieces

Opinion PiecesLetter from the US: Practitioners defend ESG from executive threat

The proxy season was different in the US this time around. Environmental, social and governance (ESG) resolutions – as well as the use of those criteria for investing – are under scrutiny by the Trump administration and the Securities and Exchange Commission (SEC).

-

Analysis

AnalysisAnalysis: Experts warn of bank stress test impact on covered bonds

ECB’s banking sector stress tests have caused concern among covered bond analysts over the potential impact on the attractiveness of the asset class

-

Features

FeaturesCultivating judgement

One of the big challenges we face, both in the financial world and in everyday life, is how to overcome our biases

-

Features

FeaturesPension funds act as Nordic drama engulfs Swedbank

Sweden’s largest pension funds have been thrust into leading roles in a money-laundering scandal over the past few weeks, as Swedbank was raided by fraud investigators and forced to fire its CEO.

-

Features

UK pools slam ‘simplistic’ guidance

UK local authority funds have accused the government of imposing higher costs through changes in its stance towards asset pooling.

-

Features

Handelsblatt Conference: De-risking comes to the fore as past costs loom large

German pension schemes reveal ambitious overhauls to reduce sponsor burdens; Generali moves to reassure over sale of insurance business to Viridium