Latest analysis – Page 32

-

Features

FeaturesBeyond green bonds

Green finance is booming. Interest in green finance is booming even more.

-

Features

FeaturesRegulatory capacity crunch?

This year could turn out to be a lucrative one for lawyers in the pension and investment sectors. Deciphering Brexit implications, ensuring compliance with IORP II and localised rulebook changes will keep the legal profession busy

-

Opinion Pieces

Opinion PiecesBanking on life after politics

At 49, Brian Hayes is young man by political standards. Having started in Irish politics early with his appointment to the Irish Senate in the mid 1990s, Hayes was elected to the Dáil, the lower house, before he was 30, taking a seat for the Fine Gail party.

-

Opinion Pieces

Opinion PiecesIs BlackRock set to revive annuities?

What can happen if the largest global asset manager teams up with the largest software company, which also happen to be the first and second largest companies in the world by market cap?

-

Analysis

AnalysisAnalysis: First estimates of UK equality ruling costs emerge

Equalising guaranteed minimum pensions estimated to cost between 0.2% and 1.7% of liabilities, according to early company estimates

-

Features

FeaturesDouble standards on trade

No wonder the discussion of trade is in such a tangle. The terminology around the subject is almost designed to cause confusion.

-

Features

FeaturesInvesting is not a zero-sum game

The rampant bull market of the past decade could already be a thing of the past and institutional investors are understandably nervous about the future

-

Features

FeaturesHow far should auto-enrolment go?

Some are contemplating whether auto-enrolment into pension funds could be expanded to help savers in other areas of their financial lives

-

Features

Accounting Matters: Full agenda for 2019

German DB plan sponsors might be busily acquainting themselves with new longevity tables, while in the UK there is really only one question on some accountants’ minds – GMP equalisation

-

Features

FeaturesExit Interview: Peter Hansson

Peter Hansson, former CEO of Sparinstitutens Pensionskassa, decided to retire after 25 years with the pension fund for savings institutions in Sweden as new regulatory changes loom

-

Features

FeaturesResearch - Europe: Investors braced for an era of lower returns and higher volatility

In the second of three articles on a new survey, Pascal Blanque and Amin Rajan argue that pension investors are adapting to challenges that go beyond the realms of a maturing business cycle

-

-

Opinion Pieces

Opinion PiecesBrussels People – Lieve Wierinck: Building on Europe’s scientific base

Lieve Wierinck’s main political passion is ensuring the EU takes full practical advantage of Europe’s excellent scientific base

-

Features

FeaturesLiabilities remain in focus

Given overall pressure on funding rates and falling asset markets, 2019 looks set to be a year where good governance and adaptability to external events will be crucial

-

Features

FeaturesThe right tool for the job

Applying economics models to understand politics is like trying to use a trowel to saw a piece of wood in half

-

Features

FeaturesInterest rates are not a one-sided risk

Pension funds should always act as long-term investors whenever possible

-

Features

FeaturesChecking back on 2018

In January, in this column, I highlighted areas to watch for 2018. In the spirit of holding myself to account, it’s time to see how they panned out

-

Features

FeaturesDutch reform: ‘Complexity and stubbornness killing world’s best pensions system’

Despite ranking as the world’s best in the Melbourne Mercer Global Pension index, the Netherlands’ pensions system is being hit by too much complexity and ineffective regulation

-

Features

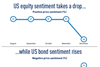

FeaturesIPE Expectations Indicator: December 2018

At times we aim to find the mountains within the molehills of manager expectation shifts. In our defence, any curvature is worthy of recognition. Sometimes, changes (or lack thereof) come along that are worth diving into. In the prior survey, it was the four-month lack of change within the high sentiment toward US equity markets to rise that was significant. During the current period, hyperbole aside, change has come.

-

Opinion Pieces

Letter from the US: REITS a good long-term bet, says study

Investors have lost some of their enthusiasm for US REITs – real-estate investment trusts – after their poor performance in the third quarter. From July to September, the FTSE Nareit All Equity REITs index gained 0.5%, compared with a 7.6% return for S&P 500 over the same period. The return of the REITs index has trailed behind S&P 500 by more than seven percentage points for the first three quarters of the year.