Latest analysis – Page 41

-

Features

ESG: PGGM gets serious on carbon reduction

PGGM, asset manager for the €172bn Dutch healthcare pension fund PFZW, is to divest the scheme’s stakes in more than 200 mining, steel and energy companies in a bid to halve its investment portfolio’s carbon footprint.

-

Features

Norwegian Government Pension Fund Global: Changes at the margins for oil giant

Falling inflows from oil revenue to Norway’s leviathan Government Pension Fund Global (GPFG) will not change the NOK7.1trn (€762bn) sovereign wealth fund’s investment strategy or its need for diversification, according to the fund’s second in command.

-

Features

UK Pensions Regulator: TPR bares its teeth

Since UK retailer BHS entered administration in April, leaving its two pension funds with a combined deficit of £571m (€743m) on a buyout basis, questions have been raised about the ability of the UK Pensions Regulator (TPR) to hold the industry to account.

-

Features

Interview: Chinelo Anohu-Amazu, National Pension Commission of Nigeria

Chinelo Anohu-Amazu, the head of Nigeria’s National Pension Commission tells Carlo Svaluto Moreolo about plans to extend pension provision in Africa’s most populous country

-

Features

Research: An inventive retirement solution

Governments should issue bonds that encompass both the accumulation and decumulation phases for defined contribution participants, argues Arun Muralidhar

-

Features

Research: Driving an energy transition

Jane Ambachtsheer discusses the outcome of an initiative to raise investor awareness of climate change and focus efforts on clean energy investment

-

Features

BlackRock dominates as LGIM joins 10 largest managers

BlackRock continues to dominate the asset management world, managing a third more in assets than Vanguard, the second largest manager (€4.398trn to €3.091trn), according to the 2016 IPE Top 400 Asset Managers survey.

-

Opinion Pieces

Letter from Brussels: Tax targeting continues

Pressure to clean up the financial sector has led to copious legislation from Brussels.

-

Opinion Pieces

Letter from the US: No clarity on hedgies

Not all pension funds are abandoning hedge funds. And the ones that are could be making the same mistake that investors often make – basing decisions on the past.

-

Features

From Our Perspective: France rallies to the cause

Opposition to funded pensions has long been popular in France. Trade unions suspect that they will act as a Trojan horse for Anglo-Saxon capitalism and social welfare policy, which would undermine the country’s solidarity-based pension system. Politicians shy away from using terms like ‘pension funds’.

-

Features

British Steel Pension Scheme: Steeling for a battle over pensions

As the UK faces the prospect of its steel industry winding down, attention has focused not only on the possibility of a temporary nationalisation of some of the assets owned by Tata Steel but also on the fate of the British Steel Pension Scheme

-

Opinion Pieces

Letter from Brussels: Ethical pressures mount

There are plenty of indicators of rising pressure to advance ethical standards across the financial sector. One outcome takes the form of mountains of clean-up legislation, including from Brussels.

-

Opinion Pieces

Letter from the US: The robo-race starts

Robo-advisers are gaining ground in the US retirement industry. Their success will have an impact on the market, accelerating the shift of assets out of actively managed funds and into index funds

-

Analysis

AnalysisAnalysis: Petro-dollar crunch hits GCC sovereign wealth funds

Cyril Widdershoven looks at the unique problems facing the sovereign wealth funds of the Gulf Cooperation Council

-

Opinion Pieces

Letter from Brussels: Beefing up the CMU

Inadequacy of European national court systems in the financial sphere is due for overhaul. Upgrade is necessary if the EU’s capital markets union programme (CMU) is going to get anywhere, according to a high-status paper

-

Opinion Pieces

Letter from the US: The Yale effect

Good things come in small packages. It sounds so true reading the latest annual National Association of College and University Business Officers (NACUBO) Commonfund study of endowment performance.

-

Features

FeaturesBanks and LDI

The rise of liability-driven investments (LDI), pairing cashflow-matching assets with forecast liability streams, has developed in tandem with a broad, overall maturing of the liabilities of the European occupational pension sector

-

Features

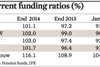

FeaturesDutch Funding: Facing a painful squeeze

Dutch pension funds’ nose-diving coverage ratios underline just how futile various measure have been in improving funding and minimise rights cuts

-

Features

FeaturesUK Local Government Pensions: Choose your partner

After years of debate, concrete details regarding the future of the UK local authority pensions sector are emerging

-

Features

PLSA Investment Conference: Industry embraces FCA asset management review

The question of whether the asset management market is working for pension funds and other investors, as the UK Financial Conduct Authority (FCA) is asking, was a theme at the UK pension fund association’s conference in Edinburgh.