Latest from IPE Magazine – Page 26

-

Features

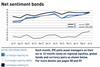

FeaturesIPE Quest Expectations Indicator - June 2024

Trump and Biden are both losing to undecided voters, a group that is now unusually large and may be sensitive to Trump’s legal troubles. Biden’s approval rate is below his score in presidential polls, while Trump’s score is the same in presidential polls and those measuring voters’ opinion of him. In the UK, the Conservatives took another drubbing in the local elections.

-

Opinion Pieces

Opinion PiecesWhat happens if we burn all the carbon?

As someone who started his career working for Shell International (albeit four decades ago when fossil-fuel-induced global warming was not an issue that we were aware of), I do not believe that oil companies are inherently evil.

-

Opinion Pieces

Opinion PiecesDisagreements between Germany's coalition partners cloud occupational pensions reform

Pension reforms have taken centre stage in the latest row among the coalition partners in the German government.

-

Opinion Pieces

Opinion PiecesWhy Norway's rebuff to oil fund over private equity is all about pay and equality

It would be hard to argue that Norway’s sovereign wealth fund is not diversified, but its range of permitted asset classes is narrower than that of peers.

-

Opinion Pieces

Opinion PiecesHow AI is making inroads in America's retirement industry

Artificial intelligence (AI) is starting to gain traction in the retirement industry, even if it is still early days.

-

Opinion Pieces

Opinion PiecesAustralian super funds push back on lacklustre energy transition proposals by corporates

Australian and global pension funds orchestrated an unusually vocal tactical campaign against the climate-transition action plan of Woodside Energy, a global oil and gas producer, in the lead-up to its 70th annual general meeting in late April.

-

Special Report

Special ReportRoundtable: PensionsEurope & IAPF - Jerry Moriarty

To strengthen European pensions, the European Commission must prioritise increasing pension coverage, closing existing gaps and ensuring favourable outcomes through funded pensions.

-

Special Report

Special ReportRoundtable: BVI - Thomas Richter

It is good to see the topics of the Capital Markets Union and improvements in old-age provision gaining momentum at the European level. The next European Commission should focus on reforming the PEPP.

-

Special Report

Special ReportRoundtable: APG Asset Management - Onno Steenbeek

Regarding the prioritisation of policies by the next European Commission to strengthen European pensions, it is clear that addressing the challenges presented by an ageing population and ensuring sustainable, adequate pension systems must be a priority.

-

Special Report

Special ReportRoundtable: EIOPA - Petra Hielkema

There are there are several countries where many people are saving through occupational pensions but often this is the outcome of decades of dialogue in society between employers, employees, unions, and citizens.

-

Special Report

Special ReportPension funds should seriously consider venture capital

To fulfil their role, pension funds would be well-advised to invest more in European private equity and venture capital

-

Asset Class Reports

Asset Class ReportsFixed income: European high yield stands its ground

Investors flocked to the European junk bond market last year and despite a strong US economy, there is still appetite for European issuers

-

Country Report

Country ReportUK Country Report 2024: Is buyout still the gold standard for pension funds?

Improved funding positions mean more DB schemes are considering run-on rather than off-loading their liabilities

-

Country Report

Country ReportProgress report on the UK’s Mansion House capital market reforms

Details of potential changes to the UK’s pension landscape have been thin on the ground

-

Asset Class Reports

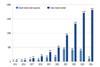

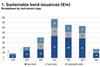

Asset Class ReportsGreen bonds reach escape velocity

The green bond market looks set to grow further, despite pressure from many sides and key questions over their function

-

Country Report

Country ReportHow consolidation might affect the UK’s local government pension sector

There is political consensus on the need for local government pension schemes to merge, but the question of in-house asset management is less straightforward

-

Asset Class Reports

Asset Class ReportsThe quest for innovation in sustainable fixed income

Japan’s climate transition bond is the latest in a string of innovative developments in sustainable fixed income

-

Asset Class Reports

Asset Class ReportsClosing the data gap in green, social and sustainability-linked bonds

Luxembourg’s bourse has capitalised on its experience as a green bond hub

-

Country Report

Country ReportSolvency UK: tweaks likely to bring only marginal gains

The UK’s reforms of the Solvency II framework are unlikely to be enough to usher in a big wave of investment in domestic productive assets by insurers

-

Country Report

Country ReportBridging the stewardship gap between companies and investors

Findings of research into how well corporates and investors communicate