Latest from IPE Magazine – Page 27

-

Country Report

Country ReportMercer’s upbeat vision for UK pension funds and their investment advisers

James Lewis, UK CIO at Mercer, is optimistic about the future of the UK’s DB and DC industries

-

Opinion Pieces

Opinion PiecesBond markets look set to become the new stewardship powerbroking arena

Investors in bond markets are starting to assume a more powerful position than equity investors to influence companies and countries. Innovation is sweeping through bond markets with the introduction of specific ‘use of proceeds’ bonds and sustainability-linked bonds.

-

Book Review

Book ReviewThe importance of board decisions in an uncertain world

In the foreword to this new book, the CIO of CERN Pension Fund, Dr Elena Manola-Bonthond, says that, in her experience, investment alpha is scarce and very often difficult to access. It can be costly and its persistence is sometimes questionable. But there are other types of alpha that are more accessible and governance alpha is definitely one of them.

-

Opinion Pieces

Opinion PiecesStriking the right balance on pension funds and fiduciary duty

Pension fund investment principles, strategies and decision-making have all become more complex in the wake of the growth of sustainability factors in general and climate change in particular. This has made the interpretation and practice of trustee ‘fiduciary duties’ more vexed and challenging than ever. A recent review of fiduciary duties in the UK by the Financial Markets Law Committee (FMLC) put it this way: “It is sometimes easier to state the duties than it is to apply them.”

-

Interviews

InterviewsMerseyside pension fund dials down domestic bias

Scheme’s strategic ambition is to move closer to the MSCI World index weightings

-

Features

FeaturesUK creates social factors template for pension investors

Environmental and governance risks receive much attention, but UK and other European institutional investors have focused less on social factors and their complexities.

-

Features

FeaturesPrivate credit secondaries come of age

Since the secondaries market came into existence, private equity has been the dominant asset class, but the tide is turning. It is finally time for private equity’s more youthful counterpart, private credit, to receive more of our attention. The private credit secondaries market borrows various elements from its older sibling, including best practices and deal structures, and it is now demanding the spotlight as awareness of the asset class increases.

-

Features

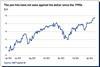

FeaturesUS economy continues to surprise

The resilience of the US economy continues to confound observers. The Federal Reserve’s 11 hikes in interest rates over the course of 2022 and 2023 were implemented to rein in economic strength and to stifle inflation. Scroll forward to the second quarter of 2024 and both inflation and economic activity are still higher than expected.

-

Analysis

AnalysisYoung pension employees clamour for learning and interaction

Many young professionals are deterred from pursuing careers in pensions due to insufficient knowledge and a perceived lack of career progression

-

Interviews

InterviewsSweden’s AP3 pension fund and its quest for alpha

Jonas Thulin, recently appointed CIO of Sweden’s Tredje AP-Fonden (AP3), talks to Carlo Svaluto Moreolo about his approach to asset allocation and portfolio management

-

Opinion Pieces

Opinion PiecesEnrico Letta’s European 401(k) policy is ambitious but necessary

Enrico Letta’s long-awaited review of the EU single market (Much More than a Market), reached inboxes last month. Among a sweeping range of measures, Letta advocates an ambitious system, akin to the 401(k) in the US, with an EU-wide auto-enrolment long-term savings policy as part of a proposed Savings and Investment Union.

-

Features

FeaturesModelling shows net-zero investing can be profitable

Since the acceptance of the Paris Agreement in 2015, which bound nations to a legal commitment to reduce global temperatures, there has been a clear shift towards net-zero investing. While socially responsible investments are crucial for the mitigation of climate change, recent calls to row back on ESG funds suggest some hesitation.

-

Opinion Pieces

Opinion PiecesDefence is the new ESG question

Earlier this year, the European Commission launched its ambitious European Defence Industrial Strategy (EDIS). The main goals of the strategy are reducing fragmentation within the €70bn European defence industry and lowering weapons imports, thus increasing the EU’s military readiness. The success of the strategy would also contribute to economic growth.

-

Features

FeaturesIPE Quest Expectations Indicator - May 2024

EU parliamentary elections are approaching fast. Current polls predict a shift to the right, with the current centrist parties remaining dominant and the extremist right overtaking the Eurosceptics. US President Donald Trump is still liable to be convicted in a criminal case, but his poll figures are rising.

-

Opinion Pieces

Opinion PiecesTime is running out for Germany's planned pension reforms

The German government is in the final stretches of an ambitious but tortuous journey to reform the three pillars of the pension system.

-

Opinion Pieces

Opinion PiecesUS public pension funds focus on labour practices in private equity

Private equity has become dependent on public pension funds, which represent almost one-third of all investors in the asset class. These schemes invested 13% of their assets – over $620bn (€580bn) in 2022 – up from 3.5% in 2001 and 8.3% in 2011, according to data from public pension research non-profit Equable Institute.

-

Opinion Pieces

Opinion PiecesSmall island states turn to institutional investors to protect oceans

Small island developing states may have a total population of only around 65 million, but through their exclusive economic zones they control about 30% of oceans and seas, according to the International Institute for Sustainable Development (IISD).

-

Interviews

InterviewsThematics Asset Management’s CIO on themes and investment challenges

Out of the 19 boutiques businesses belonging to the Natixis Investment Management franchise, Thematics Asset Management is by no means the smallest, but it is not exactly a juggernaut, managing €3.3bn of assets at the end of last year. Yet, it is actively contributing to what could be a crucial evolutionary step for global investors.

-

Opinion Pieces

Opinion PiecesAustralia faces up to the cost of pandemic pension early release

Four years after Australians were allowed to withdraw superannuation savings to deal with the economic shock of the COVID-19 pandemic, they now know emergency measures will cost the nation A$85bn (€51bn) in future pension payments.

-

Special Report

Special ReportManager selection: Solving the pension liquidity puzzle

Advisers and fiduciary managers are working as hard as ever to meet the liquidity needs of pension funds