Latest from IPE Magazine – Page 29

-

Opinion Pieces

Opinion PiecesUS pension plans wrestle with China private market exposure

After a horrible 2023, Chinese stocks look cheap and attractive. But most US pension funds do not seem interested in investing in the Chinese stock market. On the contrary, they have reduced their holdings since 2020 and some are exiting entirely, according to Bloomberg analysis.

-

Features

FeaturesMeasuring the impact of non financial factors on GDP growth

In their paper entitled Modeling the Links Between Economic Growth, Socio-economic Dynamics and Environmental Dimensions: a Panel VAR Approach, the authors attempt to quantify direct and indirect causalities between economic growth and extra-financial dimensions, including demographics, biodiversity, climate change, political stability, inequalities and economic growth.

-

Features

FeaturesAn inflection point for India bonds

The impending inclusion of Indian government bonds (IGBs) in JP Morgan’s widely tracked $240bn (€220bn) Govern ment Bond Index-Emerging Markets (GBI-EM) index is seen as a milestone. However, while some asset managers hope it is the beginning of a more open investment culture, others are more circumspect.

-

Interviews

InterviewsAhold Delhaize pension fund on climate transition and system change

Eric Huizing, chief investment officer at Ahold Delhaize Pensioen, explains to Tjibbe Hoekstra how the pension fund is progressing not only with its climate-focused investments but also the change in the Dutch pension system

-

Opinion Pieces

Opinion PiecesAustralia connects retirement income sources

Australia, a country with the world’s fourth-largest pool of retirement savings, is caught in a curious bind. At issue is how to transition Australians from saving to spending.

-

Special Report

Special ReportNatural capital special report: Getting to grips with the TNFD

More than 100 financial institutions have formally committed to adopting the recommendations of the Taskforce on Nature-related Financial Disclosures. Here’s how some of them are getting on so far

-

Country Report

Country ReportGermany Country Report 2024: Unions take a more active role in pensions

Unions have a new role in determining the shape of occupational pensions but are mindful of their duty to protect workers

-

Asset Class Reports

Asset Class ReportsPrivate debt: Private lending shows signs of recovery

Private credit is showing signs of recovery, but investors are focusing on defensive sectors

-

Asset Class Reports

Asset Class ReportsLegal systems key in emerging market private credit

In the legally complex world of emerging markets, private credit investors naturally favour those with cleaner legal systems

-

Country Report

German employers use pensions to tackle skills shortage

German companies are reworking HR policies in a changing labour market as they hunt for skilled workers and seek to retain experienced employees

-

Special Report

Special ReportAGM season preview: nature at the ballot box

Despite the backlash against ESG, biodiversity risks will be on the agenda during the next round of shareholder meetings

-

Country Report

Country ReportGermany turns its back on sustainability

A recent rightwards pivot has softened Germany’s ambition on ESG both at home and in Brussels

-

Special Report

Special ReportInvestors engage with corporates on nature issues

Shareholders are ramping up their stewardship efforts on key topics like deforestation and biodiversity

-

Country Report

Country ReportCommentary: Pension funding options for German employers

Pension schemes have a choice of ways in which they can exercise their funding obligations

-

Special Report

Special ReportBiodiversity: bridging policy and finance

Governments and pension funds can leverage new capital markets instruments to meet the twin challenges of biodiversity loss and climate change

-

Country Report

Germany’s pension buyout market shows signs of life

Companies are increasingly looking to offload their pension liabilities

-

Special Report

Special ReportNew regulations tackle water insecurity

The new European Sustainability Reporting Standards’ E3 tackles the complex and diverse realm of water insecurity

-

Country Report

Country ReportGerman pension reforms remain controversial

The governing coalition is running out of time to overhaul the three-pillar retirement system

-

Interviews

InterviewsERAFP: France’s public sector pension scheme and its key priorities

Susanna Rust talks to Catherine Vialonga, CIO of ERAFP, France’s mandatory additional pension scheme for civil servants, and CEO Régis Pelissier about the fund’s priorities and tactical asset allocation adjustments

-

Features

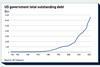

FeaturesContrasting global economic growth fortunes

Economic growth patterns across the world paint a picture of contrasts, ranging from surprisingly robust in the US to soft and struggling in China, with the stagnant euro area narrowly avoiding a technical recession after posting zero GDP growth in the fourth quarter of 2023, following a 0.1% decline the previous quarter.