Latest from IPE Magazine – Page 266

-

Asset Class Reports

Investing In Small & Mid-Cap Equities: Starved of capital

Central bank policies are heading for divergent paths. Joseph Mariathasan looks into the likely impact on small and mid-sized stocks, where valuations are already exhibiting marked differentiation

-

Country Report

Pensions In Central & Eastern Europe: Around the region

A Central & Eastern Europe roundup with Carlo svaluto moreolo

-

Special Report

Special ReportSpecial Report, The M&A Cycle: Big deals

Global M&A activity is increasing and mega-deals are leading the way. At a time when growth is sluggish and cash is piling up on balance sheets, Charlotte Moore looks at the trends in terms of regions, sectors and financing

-

Asset Class Reports

Investing In Small & Mid-Cap Equities: New book claims that 'The Future is Small'

‘The Future is Small’ (Harriman House, 2014), a newly-published book from Miton Asset Management’s Gervais Williams, contends that while returns from large-cap stocks will remain low in an environment without decent economic growth, we are at the early stages of a multi-decade period of small-company outperformance.

-

Country Report

Pensions In Central & Eastern Europe: The freeze continues

Regulatory uncertainty is clouding the Russian second pillar system. The market outlook following international sanctions over Ukraine and a drastically lower oil price is almost certain to hit returns, finds Krystyna Krzyzak

-

Special Report

Special Report, The M&A Cycle: Commodity bust signals M&A wave in mining – for the right assets

Lower Chinese demand for raw materials and sluggish growth in most industrialised economies have forced mining companies into extensive repair work to bring capital structures and spending plans in line at the end of the ‘commodities supercycle’.

-

Asset Class Reports

Investing In Small & Mid-Cap Equities: Keeping it in the family

Germany’s Mittelstand shows why mom-and-pop shops, despite the risks, can create superior success from local networks and a longer-term view of their businesses. Joseph Mariathasan investigates

-

Country Report

Pensions In Central & Eastern Europe: Azerbaijan seeks Latvian and German expertise

In 2013, Azerbaijan and the European Union signed agreements for a twinning project, funded by the EU, which seeks to establish a funded non-state second pillar. Azerbaijan manages assets of over €27bn in its State Oil Fund.

-

Country Report

Pensions In Central & Eastern Europe: A closing chapter

Pension fund reforms launched in 2013 by the government of Petr Nečas have fallen flat. The voluntary second pillar is to be abolished as of January 2016, while many of the third pillar funds will have to be merged to meet capital requirements.

-

Special Report

Special Report, The M&A Cycle: Will it be different this time?

In the past, studies have questioned whether M&A adds long-term value and there is plenty of academic and anecdotal evidence of badly-botched integrations. “There are plenty of train wrecks out there,” as Steve Allan, M&A practice leader at Towers Watson, puts it.

-

Asset Class Reports

Investing In Small & Mid-Cap Equities: Northern exposure

While the Swedish stock market in general can be rather volatile, this goes to an even greater extent for Swedish small-caps. But as Caroline Liinanki finds, for those able to handle the short-term market movements investing in smaller Swedish companies has been a very profitable move

-

Country Report

Pensions in Central & Eastern Europe: Growing pains

Carlo Svaluto Moreolo assesses Croatia’s mandatory pension system as it digests new rules creating lifestyle strategies and loosening restrictions on domestic equity and foreign investments

-

Asset Class Reports

Investing In Small & Mid-Cap Equities: Focus from diversity

Rummaging through successful small-caps portfolios reveals a diversity of opportunity, finds Martin Steward. This diversity enables portfolio managers to express very well-defined styles in their portfolio risk

-

Special Report

Special Report, The M&A Cycle: The M&A premium

There is no doubt that when M&A picks up, potential acquisition targets attract inflated bids. But Christopher O’Dea finds little evidence of a market-wide M&A premium, and even sectors that are usually targets are seeing prices driven much more by other factors

-

Country Report

Pensions in Central & Eastern Europe: The ‘living organism’ of Macedonian pensions a decade after reforms

Macedonia was one of the latest countries in Eastern Europe to restructure its pension system, having implemented a major reform in 2005.

-

Special Report

Special Report, The M&A Cycle: Feeding frenzy

While European valuations have dipped recently thanks to growth fears, cash and equity-rich trade buyers are still competing for assets against the private equity titans like never before, finds Lynn Strongin-Dodds

-

Asset Class Reports

Investing In Small & Mid-Cap Equities: Taking small-caps global

Brandes Investment Partners has been managing global small caps since 1997. “It’s a big pond with a lot of fish but very few anglers,” as director of investments Luiz Sauerbronn puts it.

-

Country Report

Pension in Central & Eastern Europe: Rumours of nationalisation persist in Bulgaria’s second-pillar system

The Bulgarian press was full of speculation last November about the nationalisation of second-pillar assets. When the Hungarian government froze all contributions to the second pillar in 2010 and appropriated most of the assets, pension industries in the region, including Bulgaria, have lived in fear of similar attempts.

-

Asset Class Reports

Investing In Small & Mid-Cap Equities: The M&A effect

The M&A theme tends to be big in small-caps: these companies are growing, often via their own acquisitions; and becoming assets coveted by both LBO from below and large-caps from above. Our featured strategies feel its effects as both a blessing and a curse.

-

Special Report

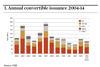

Special ReportSpecial Report, The M&A Cycle: Turning the ratchet

Convertible bonds are not only a good way for fixed-income investors to protect themselves against the ravages of M&A. Martin Steward and Anthony Harrington find that they are a great risk-managed way to exploit the cycle, too