Latest from IPE Magazine – Page 268

-

Features

How we run our money: KZVK-VKPB

The two schemes are separate legal entities but are managed through a single fund and investment team, led by CIO Wolfram Gerdes

-

Country Report

Pensions in Central & Eastern Europe: In search of size and scale

Rachel Fixsen speaks to the CEOs of two of Latvia’s open pension funds about strategy, consolidation and communication

-

Special Report

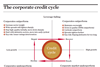

Special ReportSpecial Report, The M&A Cycle: Credit over-reaching

Joseph Mayo advises bond investors on what to look out for during the ‘reach’ phase of the credit cycle – and what to do about it

-

Features

Investment Briefing: Sayonara, keiretsu

Abenomics may not be the only reason to take another look at Japanese equities. David Turner uncovers a sudden conversion to the shareholder-friendly religion

-

Features

Cash is king

There is a reason why business people judge their success by money in the bank. Alistair Wittet asks why equity investors focus more on accounting values that obscure this crucial number

-

Features

FeaturesPortfolio Risk Management Commentary: Diversifying fat tails away

Peter Meier, Jann Stoz and Marc Weibel explore the effects of optimising for tail risk rather than volatility, in portfolios with and without hedge funds

-

Features

ESG Interview - Jeanett Bergan, KLP: Divestment is only the start

When should asset owners concede defeat and divest from a troublesome company? Jonathan Williams talks to Jeanett Bergan of Norway’s KLP about engagement, divesting, and how exclusion can be the first part of a longer dialogue

-

Interviews

InterviewsStrategically speaking: Aberdeen Asset Management

The timing of Aberdeen Asset Management’s £600m (€757m) acquisition of Scottish Widows Investment Partnership (SWIP) at the start of 2014 could not have been better.

-

Features

Asset Allocation - Fixed Income, Rates, Currencies: The big picture

The new year will surely see the US Federal Reserve finally raise target rates. When it does, it will be for the first time in six years – which is nearly a record

-

Features

Ahead of the Curve: An era of diminished expectations

Peter Perkins runs through some basic asset and regional allocation strategies to meet the probable economic scenarios of the next decade

-

Features

FeaturesFocus Group Small isn’t necessarily beautiful

If IPE’s Focus Group is anything like a representative sample, European institutional investors do not allocate much to smaller companies. Only about half invest in listed small-caps, and those allocate 5% or less of their assets. About two-thirds invest via private equity but, again, most allocate in single digits.

-

Interviews

On the Record: Do you invest in long-term, illiquid assets?

Matching long-term cash flow to liabilities

-

Features

FeaturesInterview: Yngve Slyngstad, NBIM, Master of the universe

Yngve Slyngstad is one of the most influential asset owners in the world. As chief executive of Norges Bank Investment Management (NBIM), he oversees the day-to-day affairs of the Government Pension Fund Global, the sovereign wealth fund that claims ownership of 1% of all equities worldwide – and 2.5% of those listed on European exchanges.

-

Opinion Pieces

Letter from the US: Data managers

Technological tools, data management, attention to governance and transparency are the most important issues for pension fund CIOs right now.

-

Opinion Pieces

Guest viewpoint: Con Keating - BrightonRock Group

With 78% of pension funds considering themselves long-term investors in an IPE Focus Group survey, it would be tempting to believe that dramatic progress had been made towards achieving the objectives of the Kay Review on UK equity markets.

-

Features

Vive la répartition

While she might have abolished peculiarities such as yellow car headlights and the old-style caps of the gendarmerie, France’s pension system, based on répartition (redistribution), remains as distinct as ever.

-

Features

I need a dollar

Risk assets had a terrible time early in October. What was all the fuss about? Soft US retail sales data? Hardly. The geopolitical background? Unlikely. Weak numbers out of Germany and a lack of faith in the ECB? Jitteriness at the prospect of the Fed packing up QE? Quite possibly.

-

Opinion Pieces

Every lesson helps

Here are 12 things arising from the Tesco accounting debacle that pension funds could deploy which would help prevent, or at least mitigate, similar implosions.

-

Features

Interview, Gabriel Bernardino: We are listening

Gabriel Bernadino, chairman of EIOPA, tells Taha Lokhandwala why his organisation wants stakeholders to challenge the ideas in its consultation on regulatory frameworks

-

Interviews

On The Record: CERN Pension Fund Switzerland, Théodore Economou, CEO

As an investor, I focus on managing risk as well as return. Going forward, simply beating the index will no longer be enough, and that is why they will have to focus on risk-management in portfolio construction. At the same time, I believe it is important to look at the long-term cycle, as there is value added in identifying long-term risks and trends.