Latest from IPE Magazine – Page 50

-

Special Report

Special ReportNatural capital: Investors press for impact

The focus is starting to shift from pure risk reporting to ensure that investments have a positive effect on declining biodiversity

-

Asset Class Reports

Private debt: European markets try to power ahead

Private debt in Europe is still feeling the impact of the war in Ukraine and the surge in inflation, but there are reasons for optimism

-

Country Report

Country ReportGermany: Viewpoints on corporate pension proposals

IPE asked leading practitioners for a progress report on company pensions

-

Asset Class Reports

Asset Class ReportsPrivate debt: Sustainable lending set for comeback

Issuance of sustainability-linked paper took a hit in 2022, but managers are now introducing ESG KPIs to incentivise borrowers

-

Special Report

Special ReportNatural capital: Asset owners start to engage

Two new global initiatives are under way to help investors focus on issues such as deforestation, while some managers have been on track for a while

-

Country Report

Country ReportGermany: Financing the Energiewende

German professional pension funds like ÄVWL and BVK are keen to support the energy transition process

-

Special Report

Special ReportNatural capital: KLP hopes for a nature-positive economy

The asset manager’s head of responsible investments speaks to Sophie Robinson-Tillett about her optimism that the COP15 agreement will lead to regulatory change

-

Asset Class Reports

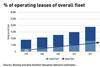

Asset Class ReportsPrivate debt: Leases make plane sense after COVID

With plenty of pent-up demand for air travel, aeroplane operating leases may be an attractive investment option

-

Country Report

Country ReportGermany: Clash of views on private pension reform

Discussions on third-pillar reforms have begun but views differ, particularly about setting up a public fund

-

Special Report

Special ReportNatural capital: New nature fund aims to halt loss of flora and fauna

Global Biodiversity Framework fund is targeting $200bn per year by 2030, but there is uncertainty about private sector participation

-

Special Report

Natural capital: First nature benchmark shows the time to act is now

Investors can contribute to a nature-positive world now by understanding their portfolio company impacts on nature and prioritising action

-

Opinion Pieces

Opinion PiecesMight Ukraine’s distressed assets one day look attractive to pension funds?

Russia’s invasion of Ukraine in February 2022 has tested Europe’s political and economic resolve. But where Vladimir Putin attempted to sow discord, he instead has failed to divide the West.

-

Opinion Pieces

Opinion PiecesHow to define natural capital and greenwashing

Last month, I wrote about recent challenges that have arisen from the terminology of sustainable finance – the legal and political consequences of the sometimes careless ways that terms like ESG, ethics, risks and impact have been interchanged depending on audience and public mood.

-

Opinion Pieces

Opinion PiecesGermany's gamble with sweeping pension reforms

This is without a doubt an interesting time for pension reforms in Germany, given the inevitable associated risks of failure.

-

Opinion Pieces

The cost of gender equality in pensions

The gender pension gap continues to be a significant issue in the European labour market, where women are at a disadvantage compared to men in terms of retirement income.

-

Features

FeaturesCentral banks and the weaponisation of finance

The US has been a global power since the second world war. But it was during the interval between the collapse of the USSR in 1991 and the rise of China in the 21st century that the US was perhaps the single global hegemon.

-

Features

FeaturesAccounting: The line between transparency and confidentiality

It was inevitable that the push by the International Sustainability Standards Board (ISSB) to redefine non-financial reporting would collide with the question of just how much transparency is too much. We had something of an answer on 18 January when the board explored disclosures about the risks and opportunities that arise from climate change.

-

Features

FeaturesAustralia: Regulator targets greenwashing

Vanguard, one of the world’s largest investment managers, suffered the indignity in December of being the second company in Australia to receive an infringement notice for alleged greenwashing.

-

Features

FeaturesUS: SECURE 2.0 means the hard work ahead for pension plan sponsors

On one thing pretty much everyone agrees: the new SECURE 2.0 Act is very broad, complex, and will create a lot of work for US plan sponsors and retirement providers. In fact, the Setting Every Community Up for Retirement Enhancement law includes over 90 different provisions.

-

Features

FeaturesTCFD reporting for pension funds in the UK: a progress report

Some 18 months from the introduction of mandatory reporting of climate data by large UK pension funds, evidence shows that the policy has not brought about greater orientation towards green investments