Latest from IPE Magazine – Page 69

-

Asset Class Reports

Asset Class ReportsEmerging markets: Global or local?

For emerging market strategies, it is difficult to establish a clear link between performance and local presence

-

Interviews

InterviewsOn the record: Impact through corporate engagement

Investors are aiming to maximise the impact of their investment strategies by engaging with investee companies

-

Asset Class Reports

Asset Class ReportsEmerging markets: Investors stay positive on Chinese investments

Many Western investors are staying put in China. But Russia’s invasion of Ukraine has given them pause over what might change their stance

-

Interviews

InterviewsIlmarinen: The making of a Finnish pensions legend

Mikko Mursula (pictured), CIO of Finland’s Ilmarinen, talks to Carlo Svaluto Moreolo about equities and the organisation’s 2035 net-zero commitment

-

Opinion Pieces

Opinion PiecesGuest viewpoint: How can DC schemes build a more sustainable future?

The UK government’s Build Back Better growth plan paves the way for significant investment in infrastructure, which could be attractive for defined contribution schemes. How might they take advantage of opportunities to improve outcomes for savers?

-

Opinion Pieces

Opinion PiecesNotes from the Nordics: Finland on the frontier

Fear and uncertainty are rattling markets, but financial concerns are dwarfed by the human suffering caused by the war in Ukraine. In Finland, people have particular reason to worry due to the country’s long land border with Russia.

-

Opinion Pieces

Opinion PiecesAustralia: A new sense of unity over superannuation funds

Australia’s leading political parties appear to have called a truce over often-politicised issues in the superannuation sector in the lead-up to this May’s Federal election.

-

Opinion Pieces

Opinion PiecesUS: The SEC’s new climate disclosure rule is a watershed

Most investors, asset managers and consultants look like they are in favour.

-

Interviews

InterviewsStrategically speaking interview: Sandro Pierri, BNP Paribas Asset Management

Like many of his counterparts at large asset management firms, Sandro Pierri is mindful of how global trends are influencing his clients and the best ways for his firm to address them.

-

Features

FeaturesAccounting: IASB shortlist of projects hits a snag

The best laid plans of mice and men often go awry. Or so they say. March was supposed to be the month when the International Accounting Standards Board (IASB) whittled down its shortlist of potential standard-setting projects for a final vote in April. But nothing ever goes to plan.

-

Features

FeaturesDerivatives: countdown to mandatory margin

From 1 September, a large number of pension funds and clients of asset managers will be required to start posting initial margin on their non-cleared derivatives exposures, a change that will have a big impact on how they conduct business. The problem is that many institutions may not be fully aware of the implications or what they need to do to prepare – and time is running out.

-

Features

FeaturesFixed income, rates & currency: Markets grapple with inflation and slowdown

The global outlook for economic growth is deteriorating, with repeatedly revised economic forecasts pointing to ever-higher inflation and lower GDP growth. The far-reaching impacts of the Russia-Ukraine war, moving principally through energy and commodity channels, have exacerbated so many of the world’s existing pandemic-related supply-side bottlenecks, which had been gradually easing in the weeks and months before Russia invaded.

-

Features

FeaturesAhead of the curve: China treads a careful path

Since the Tiananmen Square protests in 1989 the Chinese Communist Party has not put a foot wrong domestically. It has pursued economic growth alongside social cohesion, entrenching its prime objective of staying in power.

-

Features

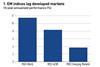

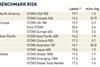

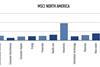

FeaturesQontigo Riskwatch - May 2022

* Data as of 31 March 2022. Forecast risk estimate for each index measured by the respective US, World and Emerging Markets Qontigo model variants

-

-

Features

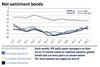

FeaturesIPE Quest Expectations Indicator commentary May 2022

Ukraine is slowly gaining the upper hand, while Russia is still unwilling to make concessions. Putin is trying to play his nuclear card, a dangerous move, making himself the major obstacle to stopping the appalling Russian losses in people and equipment. Meanwhile, Zelensky lost points by creating an issue with Germany when he can’t afford to lose points.

-

Asset Class Reports

Asset Class ReportsCredit: Investors cautious over Ukraine war

Despite geopolitical tensions, inflation and rising costs, private debt market remains optimistic after a record 2021

-

Country Report

Country ReportCountry Report – Pensions in Germany & Austria (April 2022)

It took just over 100 days in office before Germany’s new coalition government announced a €500bn budget to first pillar pension financing, setting in motion an agreed reform process that would create a partially funded state pension system.

-

Special Report

Special ReportSpecial Report – Manager selection

With COVID-19 now under control, the business of selecting managers no longer has to deal with severe restrictions on travel and face-to-face interactions. However, the pandemic has taught investors and manager selection advisers some important lessons.

-

Country Report

Country ReportGermany: New government seeds new ideas on pensions

Germany’s traffic-light coalition aims to stabilise pensions and contribution rates as it seeks to endow a €10bn state global equity fund