Latest from IPE Magazine – Page 67

-

Opinion Pieces

Opinion PiecesFiduciary managers must do better on ESG transparency

What sets one fiduciary manager apart from another? These days, it is increasingly hard to tell between the leaders. As a fiduciary manager myself, this view may seem counterintuitive but it seems to me that this part of the investment world is getting less distinct in its capabilities, resources and even its messaging.

-

Interviews

InterviewsOpenbare Apothekers Pension Fund: Preparing for change

Ronald Heijn and Maarten Thomassen of the Netherland’s Pensioenfonds Openbare Apothekers tell Tjibbe Hoekstra about the impact of the Dutch pension reform on their fund

-

Interviews

InterviewsStrategically speaking interview: Edwin Conway, BlackRock Alternative Investors

Many asset owners focus on the return streams available from private markets investments and the diversification effect of private equity, debt or any of the other flavours available in this sector of the market.

-

Asset Class Reports

Asset Class ReportsQuant managers: back with new weapons

As investors show renewed interest in value strategies, quant managers look for better uses of alternative data

-

Asset Class Reports

Quant managers: Quoniam’s Nigel Cresswell

Liam Kennedy spoke to Quoniam Asset Management’s CEO about the challenges and opportunities faced by a quant boutique

-

Features

FeaturesAhead of the curve: tie executive pay to climate targets

AllianzGI and Cevian Capital take very different approaches to how we manage equity portfolios, but we are both long-term and active owners of companies. Following a series of conversations about how to best implement ESG criteria in our portfolios, we have found a common perspective.

-

Features

FeaturesAI could help triple Europe’s private debt market

Investors seeking higher yield have driven the growth of the private debt market. European private debt, though still much smaller than the US market, has also been growing rapidly. European lenders managed assets of $350bn as of June last year, according to Preqin, in a total market of $1.19trn. This is more than double the level in December 2016.

-

Interviews

InterviewsPension funds on the record: Seeking protection in private markets

Unlisted assets are the safe haven for investors searching for safety in choppy markets

-

Opinion Pieces

Opinion PiecesUS: Fidelity’s retirement account crypto move raises concerns

Even six months ago it looked like crypto investing was not going to become mainstream any time soon in 401(k) plans – and since then Bitcoin has halved in value. But the market’s sentiment and trend are changing very quickly. So much so that Fidelity Investments has now become the first major retirement-plan provider to allow investors to add a Bitcoin account to their 401(k). The move was announced in late April.

-

Features

FeaturesUK DB schemes in a risk transfer sweet spot

Pension funds are in a good position for buyouts, but is there enough capacity in the market and will DB superfunds provide a genuine alternative?

-

Features

FeaturesEmissions reporting: taking stock of indirect emissions in Scope 3

Disclosure proposals by the US Securities and Exchange Commission (SEC) in March could guide the regulatory searchlight beyond companies’ direct and indirect C02 emissions (Scope 1 and 2) and towards upstream and downstream (Scope 3) emissions.

-

Features

FeaturesYen’s swift dive surprises market

For several decades, the Japanese yen has not been in the limelight too often. However, earlier this year it became headline news as the currency began to depreciate rapidly against the US dollar. Although investors were not overly surprised that the yen would weaken, the speed of its decline was certainly startling. Over the course of about 15 months, between the start of 2021 to early April 2022, the yen has lost about 25% of its value against the dollar, with nearly half the move occurring in that final month.

-

Features

FeaturesUK venture: new kids on the block

Google the venture firm 2150 and you won’t find an investment strategy but a manifesto.

-

Features

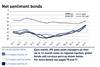

FeaturesFixed income, rates & currency: disappearing safe havens

Risk markets have been having a torrid time of late. ‘Risk-free’ government bond markets are not providing any safe havens in these storms, with curves steepening and considerable volatility in longer rates.

-

Features

FeaturesIPE-Quest Expectations Indicator commentary June 2022

The longer Russia refuses to make concessions, the more it loses, both in territory and in ‘face’. The Russian army has suffered even more loss of face than the Russian government. Analysts believe Europe and the UK now run the most risk. Perhaps, but in a post-war environment, they stand to gain most from reconstruction works in the Ukraine as well as the energy transition speeding up at home.

-

Features

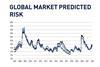

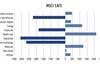

FeaturesQontigo Riskwatch - June 2022

* Data as of 29 April 2022. Forecast risk estimate for each index measured by the respective US, World and Emerging Markets Qontigo model variants

-

-

Opinion Pieces

Opinion PiecesAustralia: Political risk on the agenda for super funds

Australia’s cash-rich super funds allocate more to international equities than to their domestic counterparts. International equities are the largest single allocation.

-

Special Report

Special ReportDriving change as the debate on impact evolves

It’s hard to believe, but this is IPE’s fifth annual special report dedicated to investing for impact: our first impact investing report was in 2018. What has changed since then? In some ways not much. We still have a debate about the credibility of claiming impact in public markets, where the narrative is all about stewardship in the form of engagement and voting, and we discuss the effectiveness of engagement versus divestment.

-

Country Report

Country ReportCountry Report – Pensions in the UK (May 2022)

The 80-plus local government pension funds in England and Wales have been on course to consolidate into eight asset pools for the last six years, with a target of €1-2bn in cost savings by 2033.