All LDI crisis articles

-

Analysis

AnalysisRising Gilt yields trigger déjà vu for UK DB industry

Three years after the LDI crisis, are UK DB pension funds are equipped to deal with rising Gilt yields?

-

News

NewsEIOPA launches liquidity stress test of European pension funds

Fifth stress test exercise focuses on liquidity in light of recent market episodes like the LDI crisis in the UK in 2022

-

News

NewsBoE launches repo facility to help tackle severe Gilt market dysfunction

The CNRF will lend to participating insurance companies, pension schemes and LDI funds to help maintain financial stability

-

News

NewsUK investment industry rules out LDI Crisis 2.0 as bond yields soar

UK 10-year Gilt yield rose to 4.93% today following increased borrowing costs from government

-

News

NewsFiduciary managers evolve capabilities to meet changing needs of UK DB schemes

While more large schemes are now adopting fiduciary management, the market remains dominated by smaller schemes, says IC Select survey

-

News

NewsCBI, CSSF finalise yield buffer rules for sterling LDI funds

Measures complement guidance issued by UK regulators in wake of UK LDI crisis

-

News

NewsDutch pension funds’ bond sales push down prices, study shows

The extra price drops are only visible for short-duration bonds that pension funds use most to meet margin calls for their interest rate hedges

-

News

NewsDutch pension funds well prepared for liquidity crunch, say regulators

The switch to obligatory central clearing will increase liquidity needs while the transition to DC will likely have the reverse effect, according to regulators DNB and AFM

-

News

NewsFiduciary managers’ mandates fall for the first time, says Isio

Isio’s Paula Champion expects fiduciary managers to look for other pools of assets as the ‘DB world is declining’

-

News

NewsFiduciary management market faced 24% fall in asset value in 2022

Client growth also stalled in 2022 as scheme buyouts and transfers to PPF offset new funds moving to fiduciary management

-

News

NewsValue of UK defined benefit schemes falls by £626bn in 2023

ONS data indicates that the total value of DB pension schemes decreased from over £2trn at the start of 2022 to less than £1.4trn by the end of March

-

News

NewsInvestor group rejects basis for UK government delay of net zero policies

‘Staying the course not incompatible with addressing immediate cost of living concerns’

-

Opinion Pieces

Opinion PiecesViewpoint: How to prepare your scheme for the buyout backlog

Schemes must proactively prepare for major delays in risk transfers

-

News

NewsWTW recommends policy changes to fuel UK economic growth

Plus: ABI calls on industry to put savers at the heart of plans to boost pension investment

-

News

NewsUK pensions regulator in hot seat over lax governance of LDI

The Pensions Regulator was not able to monitor whether its LDI guidance on managing risk was being followed, Work and Pensions Select Committee finds

-

News

NewsUK’s pensions regulator to gather feedback on LDI guidance

The Regulator placed ‘huge emphasis’ on operational processes

-

News

NewsBank of England calls on pensions industry for financial stability responsibility

‘Central banks cannot be a substitute for the primary obligation of LDI funds to manage their own risk,’ says BoE

-

Opinion Pieces

Opinion PiecesViewpoint: Fee transparency – it’s good for managers too, but they probably won’t believe it

Asset managers are still not properly able to represent the true and comparative value-for-money they provide

-

Country Report

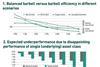

Country ReportUK: to barbell or not to barbell?

In the new world of lower LDI leverage, trustees must choose between maintaining hedging or diversification

-

Opinion Pieces

Opinion PiecesBlame will not solve the issues raised by the LDI crisis

The chain of events that led to the UK’s liability-driven investment (LDI) crisis, a high-profile inquiry by the UK Parliament, and a time of anxiety and introspection in the country’s pension industry, started well before then prime minister Liz Truss’s government and its somewhat reckless ‘growth plan’.