All Local Government Pension Scheme (LGPS) articles – Page 7

-

News

LGPS pushes for reporting consistency as pooling increases

Pooled vehicles now account for two thirds of local authority pension assets, according to the scheme’s latest annual report

-

News

NewsScotland’s Falkirk and Lothian pension funds target merger

Background work has determined that a merger would be viable and beneficial, the local authority pension funds said

-

News

NewsBorder to Coast to tender £1bn in EM equity alpha fund

Up to two EM equity managers can be hired to manage around £650m of the fund, joining two China specialist managers already appointed

-

Country Report

Country ReportCountry Report – Pensions in the UK (May 2022)

The 80-plus local government pension funds in England and Wales have been on course to consolidate into eight asset pools for the last six years, with a target of €1-2bn in cost savings by 2033.

-

Country Report

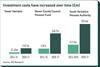

Country ReportUK: Behind the pooling figures for local government pensions

Comparing the cost savings of the eight local government pension scheme pools is a complex exercise

-

News

More LGPS heavyweights back VC clean tech fund

Merseyside, South Yorkshire and Strathclyde have now all committed to the Clean Growth Fund

-

News

LGPS pool Brunel now ‘breaking even’

From vantage point of cost savings, ’pooling seems to be working’

-

News

NewsInvestment pool duo launches new funds claiming £4.6bn in LGPS assets

Border to Coast launches £1.4bn listed alternatives fund, while ACCESS adds £3.2bn to the LGPS pool

-

News

London CIV sets 70% target for pooled assets

‘Our big gap in terms of the fund range is property,’ says O’Donnell

-

Opinion Pieces

Opinion Pieces‘Levelling up’ white paper targets LGPS funds to support local areas

The UK government’s long-awaited ‘Levelling Up the United Kingdom’ white paper, published last month, includes several bold missions to help achieve greater equality. One is to call on Local Government Pension Scheme (LGPS) funds to publish plans for increasing local investment.

-

News

Worcestershire scheme backs Gresham forestry carbon credits strategy [updated]

Investors receive distributions in the form of verified carbon credits

-

News

NewsLPP LGPS pool claims £74m saved for clients since launch

And forecasts £468m in cost savings by 2035

-

News

Border to Coast set to launch £1.3bn listed alternatives fund

New fund scheduled to launch in early 2022

-

News

Avon shifts £780m into Paris-Aligned Benchmark, cuts EM

Local authority pension fund aiming to reduce absolute emissions in equity portfolios by 43% by 2025

-

News

Asset pooling can deliver additional value to LGPS funds – study

Governance is critical to any well-run pension scheme

-

News

NewsLGPS pools secure £45m Haringey investment for London Fund

London CIV and LPPI CEOs see investment as ‘really positive moment’

-

News

UK government urged to consult LGPS pools for domestic infra boost bid

‘Onus on government to invite leading UK pension funds to the consultation table,’ says Brunel CIO

-

News

NewsBrunel picks trio for £2.1bn multi-asset credit fund

Managers grilled about approach to alignment with Paris Agreement and carbon data challenges

-

News

NewsLGPS pool finds five more takers for renewable infra fund

Renewable fund is one of London CIV’s most successful fund launches to date

-

News

NewsESG roundup: Border to Coast to launch dedicated climate change policy

LGPS pool says carbon reduction targets ‘remain actively under review’