All articles by Martin Steward – Page 2

-

News

ECB quantitative easing: Question everything

IPE’s Martin Steward analyses today’s long-awaited European Central Bank announcement

-

News

ECB's larger-than-expected QE programme welcomed by markets

Asset manager to Europe’s largest pension fund says announcement meets expectations, will not impact asset allocation

-

News

NewsAQR launches research institute with London Business School

US-based asset manager sees 10-year partnership as part of commitment to EMEA region

-

Interviews

InterviewsStrategically speaking: Aberdeen Asset Management

The timing of Aberdeen Asset Management’s £600m (€757m) acquisition of Scottish Widows Investment Partnership (SWIP) at the start of 2014 could not have been better.

-

Special Report

Special ReportSpecial Report, The M&A Cycle: When CEOs go shopping

The charts on this page, which you will find illustrating articles elsewhere in the January 2015 issue of IPE, tell of the M&A cycle that we explore in this month’s special report.

-

Special Report

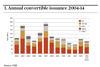

Special ReportSpecial Report, The M&A Cycle: Turning the ratchet

Convertible bonds are not only a good way for fixed-income investors to protect themselves against the ravages of M&A. Martin Steward and Anthony Harrington find that they are a great risk-managed way to exploit the cycle, too

-

Features

A divergent opinion

If there is one big idea running markets around the world at the moment, it’s the ‘great policy divergence’. I’ve articulated the idea more than once: just last month I suggested it would take a “brave, brave soul to bet against the dollar”.

-

Asset Class Reports

Investing In Small & Mid-Cap Equities: Focus from diversity

Rummaging through successful small-caps portfolios reveals a diversity of opportunity, finds Martin Steward. This diversity enables portfolio managers to express very well-defined styles in their portfolio risk

-

News

Private equity to woo DC pension funds, says Coller Capital survey

Quarterly Barometer of institutional LPs also signals appetite for direct investing, buy-and-build and credit

-

News

Bradesco AM offers Latin American smart beta, appoints new CEO [updated]

Brazilian giant works with FTSE to launch smart-beta index, SICAV as it begins search for Joaquim Levy replacement

-

News

Rosy economic forecast has 'hidden sting in tail' for UK DB schemes

UK official forecasts point to £500bn linker shortfall

-

Special Report

Special Report – Outlook 2015: Political & Geopolitical Risk

It’s 2014, and geopolitical risk is back. It’s not as if nothing happened since the Berlin Wall came down, but the sudden confluence of a US government shutdown, Russia’s annexation of Crimea, the march of Islamic State and the polling successes of anti-EU parties, not to mention the threatened break-up of the UK, has concentrated minds. Citigroup research confirms there have indeed been more frequent elections and public protests since 2011 than in the preceding decade.

-

Interviews

Strategically speaking: Assicurazioni Generali

It has been just over two years since Generali CEO Mario Greco took the reins of a company whose governance was in disarray, and whose performance was reflected in a loss of almost 75% of its stock-market value. His appointment immediately stemmed those losses, and the market has since been proved right.

-

Interviews

Strategically speaking: Grandmaster Capital Management

“Under no circumstances should you play fast if you have a winning position,” advised Hungarian chess Grandmaster Pal Benko. “Use all your time and make good moves.”

-

Features

FeaturesInterview, John Corrigan, CEO, NTMA: Europe’s comeback kid

John Corrigan must have known he was not taking on the world’s easiest job when he became CEO of Ireland’s National Treasury Management Agency (NTMA) in November 2009. The National Asset Management Agency (NAMA) ‘bad bank’ had been set up to recapitalise the country’s ruined financial institutions, and plans were afoot to carve out a chunk of the National Pension Reserve Fund (NPRF) for the same purpose.

-

Features

I need a dollar

Risk assets had a terrible time early in October. What was all the fuss about? Soft US retail sales data? Hardly. The geopolitical background? Unlikely. Weak numbers out of Germany and a lack of faith in the ECB? Jitteriness at the prospect of the Fed packing up QE? Quite possibly.

-

Features

That’s about the size of it

In late September, one of the world’s largest pension funds ditched its hedge funds, and one of the world’s largest mutual funds lost its manager. One decision made sense, but not for the reasons most commentators put forward. The other made sense, despite all the focus on the nonsense surrounding it.

-

Special Report

Active Management: Alpha? Bravo!

One of the interviewees who contributed to this month’s special report recalls meeting someone with an unusual business card. Instead of a run-of-the-mill job title – ‘Managing Director’, say – this person styled himself ‘Alpha Generator’.

-

Special Report

Active Management: Feast and famine

The ability to generate alpha might be a skill, but the amount of alpha available from the market is not a constant. Martin Steward asks how we might measure the alpha opportunity and whether investors should vary the risk budget they allocate to active management as a result

-

Special Report

Active Management: Diluting by concentrating

Concentrated portfolios can look like a proxy for high-conviction and high-alpha portfolios. Martin Steward asks if the two things necessarily follow one another