European investors are much more sceptical about the future role of artificial intelligence (AI) in investment analysis than their counterparts in North America and Asia-Pacific (APAC), according to a study by asset manager Invesco.

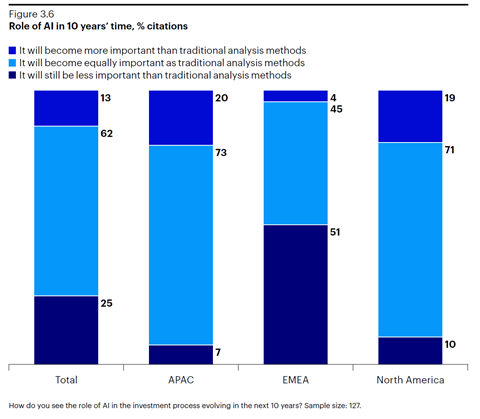

Some 51% of European institutional investor respondents to the Invesco Global Systematic Investing Study believe traditional methods of investment analysis will continue to be dominant, even 10 years from now.

The contrast with North American and APAC AI optimists is stark: in both of these continents, a large majority of respondents believe that AI will be at least equally important in influencing investment decisions as traditional methods.

Only 10% of North Americans and 7% of Asia-Pacific investors think traditional methods will continue to dominate.

Overall, 10% of institutional investors are now using AI ‘extensively’ in their investment process while another 35% use it to a limited extent. Unsurprisingly, North American and especially APAC investors are more likely to have adopted AI than European investors.

“Asia is leading when it comes to applying AI. This is mostly due to the presence of sovereign wealth funds there,” said Bernhard Langer, chief investment officer, quantitative strategies, at Invesco.

He added: “These guys are very much on the forefront. Europeans are still a little bit behind, and are more conservative in using AI.”

Factor investors can, for example, use AI to predict certain macroeconomic trends and feed these into a model that will constantly change factor weightings based on the direction of these trends, said Langer.

Besides forecasting, investors can also use AI to optimise portfolio allocations and for risk management. AI is still being used less frequently for real-time trading and monitoring.

Also, when it comes to the use of natural language processing (NLP) through programmes such as ChatGPT, the divide between especially Asia and Europe is stark. Only 17% of European investors use NLP for sentiment analysis, for example by analysing news articles and social media posts, or to translate documents, while a large majority of Asian investors have embraced such tools.

Conservative pension funds

Langer noted that sovereign wealth funds, which are predominantly based in Asia, have fewer constraints in experimenting with AI than, for example, European pension funds.

“Sovereign wealth funds are very curious about AI, and are asking us for use cases, and nobody stops them from adopting it as they are not bound by regulation. Pension funds in Europe are also curious to learn about AI, but it usually stops there,” he said.

Langer is not sure if this will ever change. “European pension funds across the board are conservative,” he said.

Invesco’s survey indeed shows that some 42% of institutional investors considers a lack of understanding or buy-in from stakeholders a major barrier for the adoption of AI models. As this figure includes sovereign wealth funds, this is likely to be considerably higher for pension funds.

By contrast, only some 20% of wholesale investors is concerned about stakeholder support.

“For investors such as pension funds, the obligation to explain the methods and mechanisms behind an AI model’s decisions to stakeholders has made them wary of ‘black box’ solutions,” Langer noted.

Indeed, by far the largest concern about AI among survey respondents is the complexity and interpretability of AI models, followed by insufficient data quality.

Read more

The latest digital edition of IPE’s magazine is now available