The majority of assets held by the England and Wales Local Government Pension Scheme (LGPS) system are now held within pooled vehicles, according to the scheme’s latest annual report.

Two thirds (66%) of the system’s £342bn (€397bn) assets were in pooled funds as of the end of March 2021. This included those operated by the LGPS’s eight asset pooling companies, reflecting the effect of the drive to combine assets in place since 2016.

Between the 2015-16 financial year and the 2020-21 financial year, assets held in pooled vehicles increased from 43.6% to 66.2%, data from annual reports show.

However, the actual amount held by the pooling companies was not reflected in the annual report, published today by the LGPS Scheme Advisory Board. This is due to inconsistencies related to reporting of asset allocations by the 86 underlying funds operated by local authorities in England and Wales.

According to the Scheme Advisory Board, 14% of the LGPS’s total assets were invested in public equities, 5% in bonds, and 2% in direct property.

Nearly 9% of the LGPS’s total assets were defined as “other” investments, such as private markets and infrastructure. The UK government recently issued a call for the LGPS to invest as much as 5% of its total assets into UK infrastructure as part of its ‘Levelling Up’ agenda to increase capital spend outside of London and the southeast of England.

To inform the discussion around this point, Councillor Roger Phillips, chair of the Scheme Advisory Board, said it was important that the LGPS system developed a more consistent and clear approach to reporting assets.

Speaking at the Pensions and Lifetime Savings Association’s annual LGPS conference today, Phillips said: “We need to understand better how [assets] are defined within individual funds. None of us have a problem with investing in the UK, providing that we recognise that we are a pension, not a grant giver – we need to have a return.”

“We need to understand better how [assets] are defined within individual funds.”

Councillor Roger Phillips, chair of the Scheme Advisory Board

He added: “We need to make very clear the definition of [infrastructure] and whether we are properly capturing it – and, indeed, how much UK infrastructure we are already delivering. That would be a very powerful piece of information.”

The Scheme Advisory Board will work with pooling companies and individual funds to improve consistency and transparency of asset allocations, Phillips added.

He also explained that such an improved reporting approach would also help understand the LGPS’s overall investments in environmental, social and governance-themed strategies.

The system receives many requests for information about these kinds of investments from members, campaign groups and the media, meaning a clearer and more consistent approach to reporting assets would make responding to these requests easier.

The LGPS’s annual report also revealed that total assets held by funds in England and Wales increased by 24% from March 2020 to hit £342bn as of 31 March 2021.

Investment returns amounted to 21%, and the system remained cashflow positive. However, Phillips warned that local authorities would have to monitor their funds’ cash positions as the number of retired members increased and they became more dependent on investment income to pay benefits.

“We are a maturing scheme, [but] we knew this and we have been planning for this,” he said. “All contributions plus investment income are now required to pay pensions. Managing cashflow is a useful phrase but we need to understand what exactly it means.”

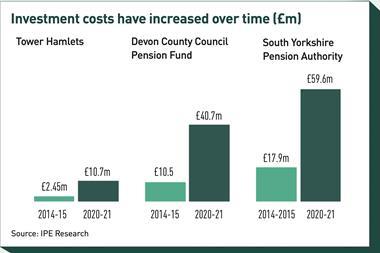

Management costs rose by £196m across the system, which Phillips said reflected the increase in scheme assets and a rise in allocations to more expensive asset classes such as private markets.