Nick Reeve

Contact info

- Email:

- nick.reeve@ipe.com

Special Report

Special ReportAP7 notches up legal success against Kraft Heinz

In May 2023, Sweden’s AP7 fund recorded a significant victory for Swedish and other investors when US food giant Kraft Heinz agreed to settle a class action lawsuit for $450m (€421m).

Special Report

Special ReportCase study: How CalSTRS uses ETFs to support the energy transition

The California State Teachers’ Retirement System (CalSTRS) manages US$315.6bn (€294.3bn) on behalf of teachers and education staff in the state of California. Environmental considerations and the transition to a low-carbon economy are high priorities for the pension fund, which is one of the biggest public sector funds in the US.

Special Report

Special ReportCase study: Varma - A bespoke approach to ETFs

Varma, the €57.4bn Finnish pension insurer, has been at the forefront of sustainable investing for several years and has used exchange-traded funds to get there.

Special Report

Special ReportCase study: Ilmarinen - Building a climate-focused future

Finland’s second-biggest pension provider is a keen investor in exchange-traded funds (ETFs), having allocated more than €6bn to a range of equity vehicles in recent years.

- Special Report

Case study: MHPF - Searching for greater transparency

Transparency is one of the most important elements of exchange-traded funds (ETFs) for many investors. For some, however, there is always room for improvement.

News

NewsInsurers ‘stretched’ as UK pension de-risking demand rises

More than £12bn worth of bulk annuity transactions were reported in the first half of 2022, according to EY Parthenon

News

NewsUK DB pension scheme funding proposal ‘risks corporate insolvencies, asset fire sales’

Consultants warn on ‘dramatic’ impact of new UK DB pension scheme funding rules as DWP proposal raises insolvency risks

- News

LGPS: Government reform aims to boost global role

The LGPS is facing reforms aimed at enhancing its role as a powerful investor at home and abroad

News

NewsUK looks to accelerate local authority asset pooling project

Ministers are reportedly growing impatient with progress on pooling the assets of the LGPS

- News

LGPS climate reporting rules expected in autumn

Chair of the LGPS Scheme Advisory Board expresses disappointment at delay to TCFD-aligned reporting

- News

LGPS pushes for reporting consistency as pooling increases

Pooled vehicles now account for two thirds of local authority pension assets, according to the scheme’s latest annual report

Country Report

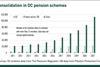

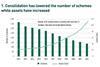

Country ReportUK: The long and winding road to consolidation

Brexit, COVID and other factors delay regulation that would enable commercial DB scheme consolidators to operate

Country Report

Country ReportUK: Auto-enrolment after a decade: broadening the scope

The UK is exploring how to bring younger, part-time, and lower paid workers into the scope of its successful auto-enrolment regime

- Features

Briefing – ESG data: material innovations

As environmental, social and governance (ESG) considerations have risen in importance among investors in recent years, so the subject of data quality has become an essential issue.

Features

FeaturesBriefing: Unfinished business on IORP II

Almost three years on from the effective date for the implementation of IORP II, the directive is still being worked on, amended and adapted by Europe’s regulators. What will 2022 bring for the regulation of the EU’s pension funds?

- News

UK to review DC charge cap to boost illiquid investment

Chancellor Rishi Sunak also tweaks tax regime to address ‘net pay anomaly’

News

NewsUK seeks to boost DB consolidation options

The ‘self-certification’ regime for DB master trusts is aimed at standardising key information and making it easier for trustees to assess their options.

Special Report

Special ReportBonds, boutiques and Bitcoin: ETF trends in 2021

The extreme events of 2020 sent ripples through the exchange-traded fund (ETF) market. Highly volatile markets in the first quarter gave way to a huge rally later in the year, with thematic products in particular reaping the benefits of significant inflows.

Special Report

Special ReportIreland: Counting the cost of new rules

Ireland has finally transposed the European Union’s IORP II directive – but there is a long and potentially expensive path ahead to full implementation

Country Report

Country ReportM&A: Regulator set to scrutinise more deals

New tools granted to the Pensions Regulator could see it play a more prominent role in corporate activity such as mergers and acquisitions (M&A)